Assume that all of the facts in Problem 3 remain unchanged except that Green paid $211,800 for

Question:

Assume that all of the facts in Problem 3 remain unchanged except that Green paid $211,800 for 60% of the voting shares of Mansford.

Required:

(a) Prepare a consolidated balance sheet at January 1, Year 5.

(b) Calculate goodwill and non-controlling interest under parent company extension theory.

(c) Explain how the definition of a liability supports the recognition of a deferred income tax liability when a parent purchases shares in a subsidiary and the fair values of the subsidiary's identifiable net assets are greater than their carrying amounts.

Problem 3:

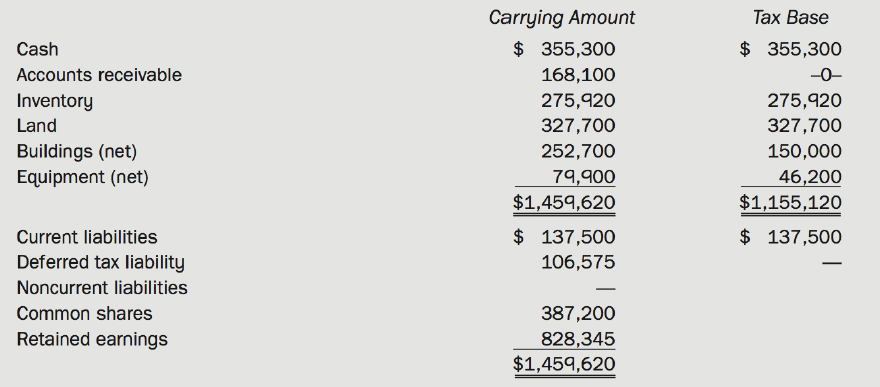

On January 1, Year 5, Green Inc. purchased 100% of the common shares of Mansford Corp. for $353,000. Green's balance sheet data on this date just prior to this acquisition were as follows:

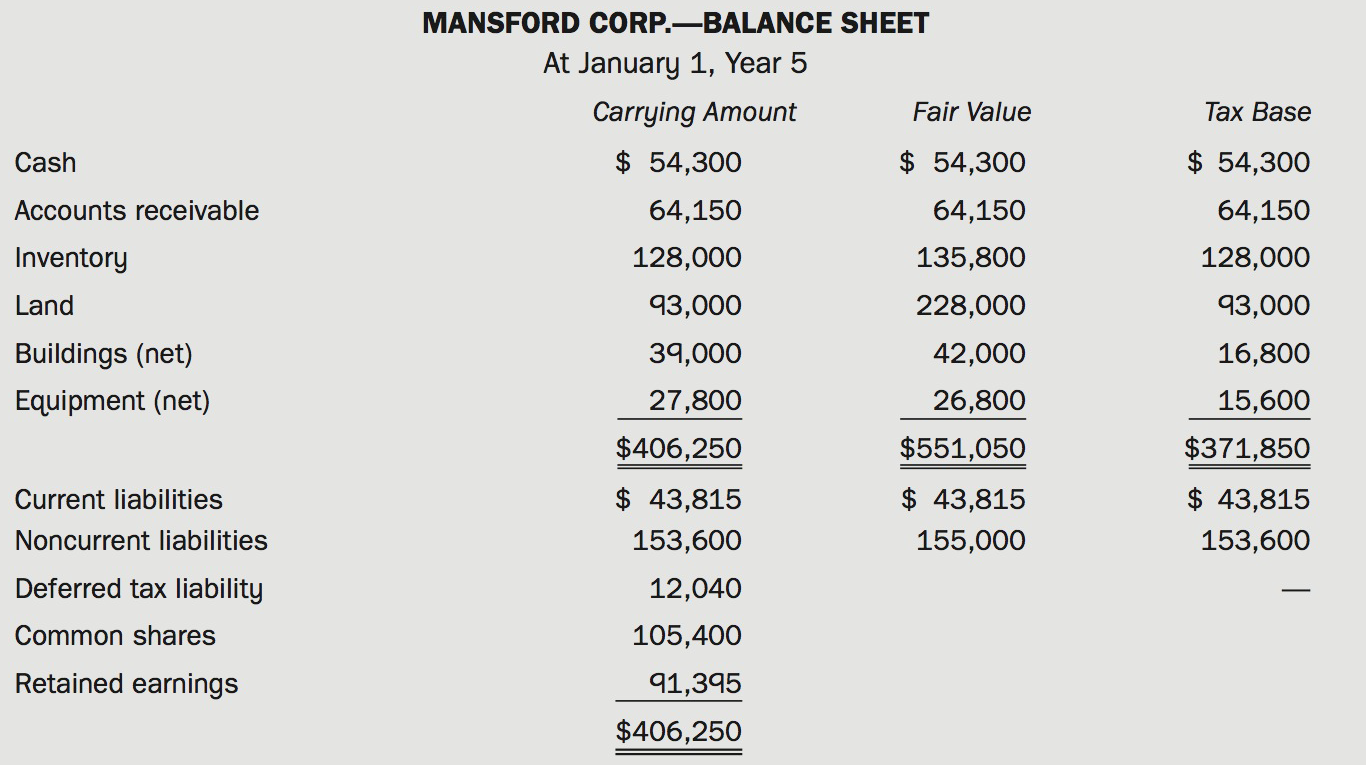

The balance sheet and other related data for Mansford are as follows:

Additional Information:

• As at January 1, Year 5, the estimated useful lives of the building and equipment were 15 years and 4 years, respectively, and the term to maturity was 10 years for the noncurrent liabilities.

• There has been no goodwill impairment since the date of acquisition.

• For both companies, the income tax rate is 35%. Deferred income taxes are recognized on the consolidated financial statement pertaining to the temporary differences arising from the acquisition differential.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell