On January 1, 2024, Platform Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of

Question:

On January 1, 2024, Platform Company exchanged $1,000,000 for 40 percent of the outstanding voting stock of Vector Company. Especially attractive to Platform was a research project underway at Vector that would enhance both the speed and quantity of client-accessible data. Although not recorded in Vector’s financial records, the fair value of the research project was considered to be $1,960,000. Also Vector possessed unpatented technology with a fair value of $376,000.

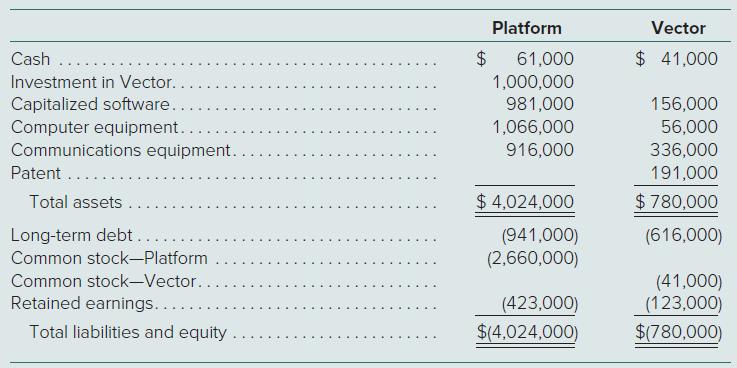

In contractual agreements with the sole owner of the remaining 60 percent of Vector, Platform was granted (1) various decision-making rights over Vector’s operating decisions and (2) special service purchase provisions at below-market rates. As a result of these contractual agreements, Platform established itself as the primary beneficiary of Vector. Immediately after the purchase, Platform and Vector presented the following balance sheets:

Each of the above amounts represents a fair value at January 1, 2024. The fair value of the 60 percent of Vector shares not owned by Platform was estimated at $1,500,000.

Prepare an acquisition-date consolidation worksheet for Platform and its variable interest entity.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik