The trial balance of Southwestern Enterprises on December 31,The partners of Noble & Roland LLP have asked

Question:

The trial balance of Southwestern Enterprises on December 31,The partners of Noble & Roland LLP have asked you to review the following balance sheet

(AICPA Professional Standards, vol. 2, “Compilation and Review of Financial Statements,”

sec. AR100.04 defines review as follows:

Review of financial statements. Performing inquiry and analytical procedures that provide the accountant with a reasonable basis for expressing limited assurance that there are no material modifications that should be made to the statements in order for them to be in conformity with generally accepted accounting principles or, if applicable, with another comprehensive basis of accounting.

Also, sec. AR100.35 states: “Each page of the financial statements reviewed by the accountant should include a reference such as ‘See Accountant’s Review Report.’ ”)

NOBLE & ROLAND LLP Balance Sheet June 30, 2005 Assets Current assets:

Cash and cash equivalents $ 3,000 Short-term investments in marketable equity securities, at cost 10,000 10% note receivable, due on demand 20,000 Trade accounts receivable 40,000 Short-term prepayments 1,000 Total current assets $ 74,000 Equipment, net of accumulated depreciation $4,000 50,000 Total assets $124,000 Liabilities and Partners’ Capital Current liabilities:

Trade accounts payable $ 15,000 Accrued liabilities 2,000 Total current liabilities $ 17,000 Long-term debt:

8% note payable, due June 30, 2009 5,000 Total liabilities $ 22,000 Partners’ capital:

Partner Anne Noble $62,000 Partner Janice Roland 40,000 Total partners’ capital 102,000 Total liabilities and partners’ capital $124,000 Your review of the foregoing balance sheet disclosed the following:

1. The partners had requested your review because the bank considering their application for a 30-day, 12%, unsecured loan of $5,000 had requested a review because of concern about the partnership’s high current ratio of $4.35 to $1 ($74,000 $17,000 $4.35 to $1).

2. The short-term investments, properly classified as available for sale, had a current fair value of $6,000. Because of the substantial unrealized loss on the investments, the partnership had no present plans to dispose of them in the near future.

3. The note receivable had been executed by partner Janice Roland two years ago; because interest had been paid to June 30, 2005, the partnership had no present plans to demand payment of the principal.

4. Trade accounts receivable totaling $5,000 are estimated to be doubtful of collection.

5. Payee of the note payable was partner Anne Noble.

6. Interest rates on the note receivable and note payable, and depreciation of the equipment, appeared appropriate.

Instructions

a. Prepare journal entries to correct the accounting records of Noble & Roland LLP as of June 30, 2005. Allocate all entries affecting income statement accounts to the partners’

capital accounts in their income-sharing ratio: Noble, 60%; Roland, 40%.

b. Prepare a corrected balance sheet for Noble & Roland LLP as of June 30, 2005.

1. Some branches maintain complete accounting records and prepare financial statements much the same as an autonomous business enterprise. Other branches perform only limited accounting functions, with most accounting activity concentrated in the home office. Assuming that a branch has a complete set of accounting records, what criterion or principle would you suggest be used in deciding whether various types of expenses applicable to the branch should be recognized by the home office or by the branch?

2. Explain the use of reciprocal ledger accounts in home office and branch accounting systems in conjunction with the periodic inventory system.

3. The president of Sandra Company informs you that a branch is being opened and requests your advice: “I have been told that we may bill merchandise shipped to the branch at cost, at branch retail selling prices, or anywhere in between. Do certified public accountants really have that much latitude in the application of generally accepted accounting principles?”

4. Jesse Corporation operates 10 branches in addition to its home office and bills merchandise shipped by the home office to the branches at 10% above home office cost. All plant assets are carried in the home office accounting records. The home office also conducts an advertising program that benefits all branches. Each branch maintains its own accounting records and prepares separate financial statements. In the home office, the accounting department prepares financial statements for the home office and combined financial statements for the enterprise as a whole.

Explain the purpose of the financial statements prepared by the branches, the home office financial statements, and the combined financial statements.

5. The accounting policies of Armenia Company provide that equipment used by its branches is to be carried in the accounting records of the home office. Acquisitions of new equipment may be made either by the home office or by the branches with the approval of the home office. Slauson Branch, with the approval of the home office, acquired equipment at a cost of $17,000. Describe the journal entries for the Slauson Branch and the home office to record the acquisition of the equipment.

6. Explain the use of and journal entries for a home office’s Allowance for Overvaluation of Inventories: Branch ledger account.

7. The reciprocal ledger account balances of Meadow Company’s branch and home office are not in agreement at year-end. What factors might have caused this?

8. Ralph Company operates a number of branches but centralizes its accounting records in the home office and maintains control of branch operations. The home office found that Ford Branch had an ample supply of a certain item of merchandise but that Gates Branch was almost out of the item. Therefore, the home office instructed Ford Branch to ship merchandise with a cost of $5,000 to Gates Branch. What journal entry should Ford Branch make, and what principle should guide the treatment of freight costs? (Assume that Ford Branch uses the perpetual inventory system.)

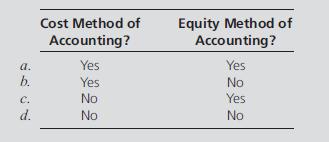

1. May the Investment in Branch ledger account of a home office be accounted for by the:

2. Which of the following generally is not a method of billing merchandise shipments by a home office to a branch?

a. Billing at cost.

b. Billing at a percentage below cost.

c. Billing at a percentage above cost.

d. Billing at retail selling prices.

3. A branch journal entry debiting Home Office and crediting Cash may be prepared for:

a. The branch’s transmittal of cash to the home office only.

b. The branch’s acquisition for cash of plant assets to be carried in the home office accounting records only.

c. Either a or b.

d. Neither a nor b.

4. A home office’s Allowance for Overvaluation of Inventories: Branch ledger account, which has a credit balance, is:

a. An asset valuation account.

b. A liability account.

c. An equity account.

d. A revenue account.

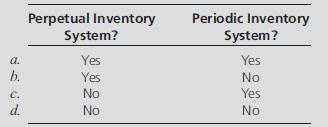

5. Does a branch use a Shipments from Home Office ledger account under the:

6. A journal entry debiting Cash in Transit and crediting Investment in Branch is required for:

a. The home office to record the mailing of a check to the branch early in the accounting period.

b. The branch to record the mailing of a check to the home office early in the accounting period.

c. The home office to record the mailing of a check by the branch on the last day of the accounting period.

d. The branch to record the mailing of a check to the home office on the last day of the accounting period.

7. For a home office that uses the periodic inventory system of accounting for shipments of merchandise to the branch, the credit balance of the Shipments to Branch ledger account is displayed in the home office’s separate:

a. Income statement as an offset to Purchases.

b. Balance sheet as an offset to Investment in Branch.

c. Balance sheet as an offset to Inventories.

d. Income statement as revenue.

8. If the home office maintains accounts in its general ledger for a branch’s plant assets, the branch debits its acquisition of office equipment to:

a. Home Office.

b. Office Equipment.

c. Payable to Home Office.

d. Office Equipment Carried by Home Office.

9. In a working paper for combined financial statements of the home office and the branch of a business enterprise, an elimination that debits Shipments to Branch and credits Shipments from Home Office is required under:

a. The periodic inventory system only.

b. The perpetual inventory system only.

c. Both the periodic inventory system and the perpetual inventory system.

d. Neither the periodic inventory system nor the perpetual inventory system.

10. The appropriate journal entry (explanation omitted) for the home office to recognize the branch’s expenditure of $1,000 for equipment to be carried in the home office accounting records is:

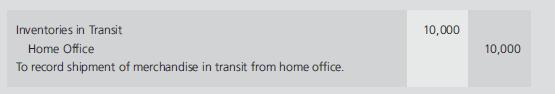

11. On January 31, 2005, East Branch of Lyle Company, which uses the perpetual inventory system, prepared the following journal entry:

When the merchandise is received on February 4, 2005, East Branch should:

a. Prepare no journal entry.

b. Debit Inventories and credit Home Office, $10,000.

c. Debit Home Office and credit Inventories in Transit, $10,000.

d. Debit Inventories and credit Inventories in Transit, $10,000.

12. If a home office bills merchandise shipments to the branch at a markup of 20% on cost, the markup on billed price is:

a. 162⁄3%

b. 20%

c. 25%

d. Some other percentage 13. The appropriate journal entry (explanation omitted) in the accounting records of the home office to record a $10,000 cash remittance in transit from the branch at the end of an accounting period is:

Step by Step Answer: