Following are financial statements and additional information for Alef, Beal & Clarke LLP: Southwestern Enterprises (a limited

Question:

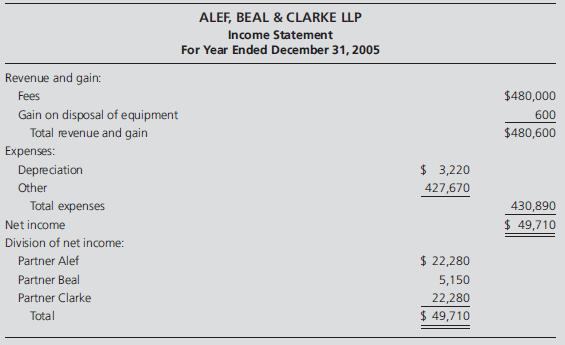

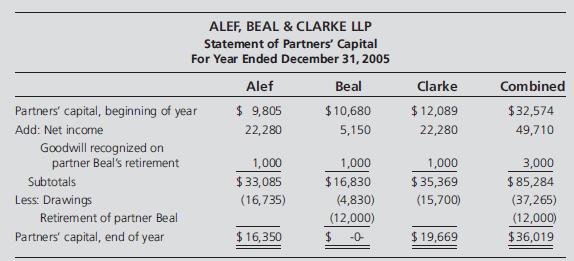

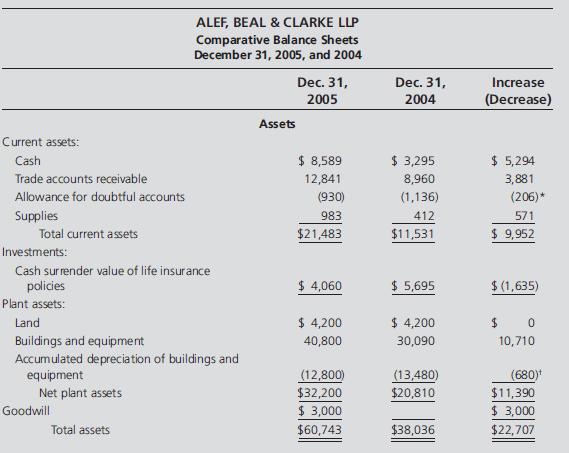

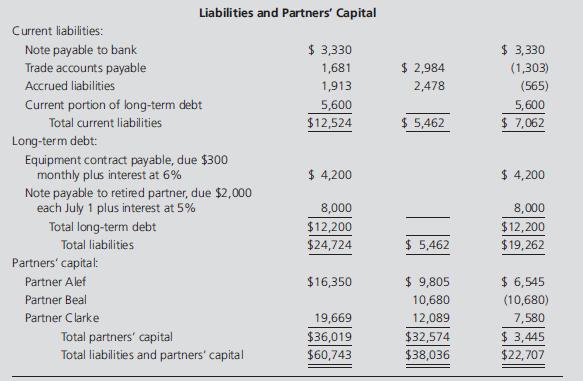

Following are financial statements and additional information for Alef, Beal & Clarke LLP:

Southwestern Enterprises (a limited partnership) was formed on January 2, 2005, with the issuance of 1,200 units, $1,000 each, as follows:

Southwestern Enterprises (a limited partnership) was formed on January 2, 2005, with the issuance of 1,200 units, $1,000 each, as follows:

The trial balance of Southwestern Enterprises on December 31, 2005, the end of its first year of operations, is as follows:

SOUTHWESTERN ENTERPRISES (a limited partnership)

Trial Balance December 31, 2005 Debit Credit Cash $ 20,000 Trade accounts receivable 90,000 Allowance for doubtful accounts $ 10,000 Inventories 100,000 Plant assets 1,500,000 Accumulated depreciation of plant assets 100,000 Note payable to bank 20,000 Trade accounts payable 50,000 Accrued liabilities 30,000 Laurence Douglas, capital 400,000 Laurence Douglas, drawings 0 Limited partners, capital 800,000 Limited partners, redemptions 260,000 Net sales 1,400,000 Cost of goods sold 700,000 Operating expenses 140,000 Totals $2,810,000 $2,810,000 Additional Information 1. The Limited Partners, Capital and Limited Partners, Redemptions ledger accounts are controlling accounts supported by subsidiary ledgers.

2. The certificate for Southwestern Enterprises provides that general partner Laurence Douglas may withdraw cash each December 31 to the extent of his unit participation in the net income of the limited partnership. Douglas had no drawings for 2005. The certificate also provides that limited partners may withdraw their net equity only on June 30 or December 31 of each year. Two limited partners, each owning 100 units in Southwestern Enterprises, withdrew cash for their equity during 2005, as shown by the following Limited Partners, Redemptions ledger account:

Limited Partners, Redemptions Six months ended June 30, 2005 $120,000 Six months ended Dec. 31, 2005 440,000 Net income, year ended Dec. 31, 2005 $560,000 Date Explanation Debit Credit Balance 2005 June 30 100 units @ $1,100 110,000 110,000 dr Dec. 31 100 units @ $1,500 150,000 260,000 dr 3. Net income of Southwestern Enterprises for the year ended December 31, 2005, was subdivided as follows:

4. The 10%, six-month bank loan had been received on December 31, 2005.

5. There were no disposals of plant assets during 2005.

Instructions Prepare an income statement, a statement of partners’ capital, a balance sheet, and a statement of cash flows (indirect method) for Southwestern Enterprises (a limited partnership)

for the year ended December 31, 2005. Show net income per weighted-average unit separately for the general partner and the limited partners in the income statement, and show partners’ capital per unit in the balance sheet. A working paper is not required for the statement of cash flows.

Step by Step Answer: