Yee & Zane LLP has maintained its accounting records on the accrual basis of accounting, except for

Question:

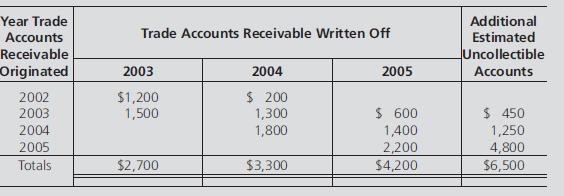

Yee & Zane LLP has maintained its accounting records on the accrual basis of accounting, except for the method of handling uncollectible account losses. Doubtful accounts expense has been recognized only when specific trade accounts receivable were determined to be uncollectible.

The partners of Yee & Zane LLP are anticipating the admission of Arne to the firm on December 31, 2005, and they retain you to review the partnership accounting records before this action is taken. You suggest that the firm change retroactively to the allowance method of accounting for doubtful accounts receivable so that the planning for admission of Arne may be based on the accrual basis of accounting. The following information is available:

The partners shared net income and losses equally through 2004. In 2005 the incomesharing plan was changed as follows: salaries of $8,000 and $6,000 to Yee and Zane, respectively, to be expensed by the partnership; the resultant net income or loss to be divided 60% to Yee and 40% to Zane. Income of Yee & Zane LLP for 2005 was $52,000 before partners’ salaries expense.

The partners shared net income and losses equally through 2004. In 2005 the incomesharing plan was changed as follows: salaries of $8,000 and $6,000 to Yee and Zane, respectively, to be expensed by the partnership; the resultant net income or loss to be divided 60% to Yee and 40% to Zane. Income of Yee & Zane LLP for 2005 was $52,000 before partners’ salaries expense.

Instructions

a. Prepare a journal entry for Yee & Zane LLP on December 31, 2005, giving effect to the change in accounting method for doubtful accounts expense. Support the entry with an exhibit showing changes in doubtful accounts expense for the year ended December 31, 2005.

b. Assume that after you prepared the journal entry in a above, Yee’s capital account balance was $48,000, Zane’s capital account balance was $22,000, and Arne invested $30,000 for a 20% interest in net assets of Yee, Zane & Arne LLP and a 25% share in net income or losses. Prepare a journal entry for Yee, Zane & Arne LLP to record the admission of Arne on December 31, 2005, by the bonus method.

Step by Step Answer: