Josh Miller is chief financial officer of a medium-sized Seattle-based medical device manufacturer. The company's annual sales

Question:

Josh Miller is chief financial officer of a medium-sized Seattle-based medical device manufacturer. The company's annual sales of \(\$ 40\) million have been growing rapidly, and working capital financing is a common source of concern. He has recently been approached by one of his major Japanese customers, Yokasa, with a new payment proposal.

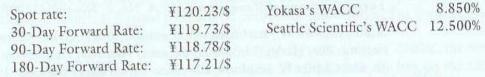

Yokasa typically orders \(¥ 12,500,000\) in product every other month and pays in Japanese yen. The current payment terms extended by Seattle Scientific are 30 days, with no discounts given for early or cash payment. Yokasa has suggested that it would be willing to pay in cash (Japanese yen) if it was given a \(4.50 \%\) discount on the purchase price. Josh Miller gathered the following quotes from his bank on current spot and forward exchange rates, and estimated Yokasa's cost of capital.

a. What is Seattle Scientific's "cost of hedging" the yen receivable?

b. How much in U.S. dollars will Seattle Scientific receive (1) with the discount, and (2) with no discount but fully covered with a forward contract?

c. If Josh were to compare the results of part

(b) in present value terms, which appears to be preferable?

d. What discount rate would Josh Miller probably try to negotiate with Yokasa?

Step by Step Answer:

Multinational Business Finance

ISBN: 9780201635386

9th Edition

Authors: David K. Eiteman, Michael H. Moffett, Arthur I. Stonehill, Denise Clinton