1. This case illustrates an example of the fact that sometimes the best alternative is the one...

Question:

2. Given the fact that, ultimately, the government found that phthalates were not harmful, was Gerber€™s decision to respond proactively a good one or a bad one? Why? Can an organization afford to wait until full information is available about potential health risks?

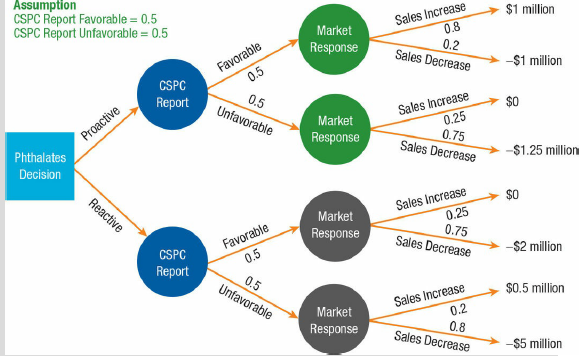

In dealing with the phthalates issue, Gerber€™s managers had to evaluate all of the information it had, determine its various options, weigh the consequences of each action, and decide on the best one. The firm knew that all scientific evidence indicates that phthalates are completely safe. Nevertheless, in the wake of the Greenpeace announcement, the Consumer Product Safety Commission (CPSC) decided to issue its own press release expressing doubts about phthalates. A month before Christmas, the commission informed Gerber it intended to issue a press release advising parents of the potential dangers of phthalates, specifically naming Gerber as one of the biggest companies making products containing phthalates.

Gerber was faced with two choices, both of which had significant drawbacks. The firm could (1) proactively address the problem by removing phthalates from its products regardless of the public€™s response to the Greenpeace report, or (2) it could wait for the CPSC€™s announcement and monitor public response before deciding on a course of action. The CSPC€™s report suggested the agency either was likely to issue a recall of all products containing phthalates or it would merely post a notification expressing concern about phthalates; in which case, the public€™s reaction could be minimal. Given these two initial alternatives, Gerber came up with eight possible outcomes on its decision tree.

Respond Proactively. If Gerber reacted proactively by discontinuing use of all phthalates, and the report simply issued a warning, there was an 80% chance that the public would react favorably to Gerber€™s responsiveness, causing sales to jump relative to competing firms that responded more slowly. A possible revenue increase of $l million was therefore entered into the decision tree. With a proactive response and a favorable CSPC report, Gerber also predicted there would be a 20% chance its sales would decline by $1 million because of the nature of the press coverage.

If the report were more strongly negative, resulting in a recall, and Gerber responded proactively, the company believed that there was a 25% probability it could preserve its current sales and a 75% probability that sales would fall by $1.25 million.

Respond Reactively. Four more alternatives were judged possible in the event that Gerber decided to wait for the press release before taking action. With a favorable report and a delayed response, the firm figured there would be a 25% chance that sales would remain flat and a 75% chance that sales would decline by $2 million.

The worst-case scenario was if Gerber were to remain nonresponsive, and the CSPC issued a recall. In that case, Gerber predicted there was a 20% probability that it could still increase its sales by approximately $.5 million at the expense of companies that were less prepared for the report. Nevertheless, Gerber predicated there was an 80% probability it would lose a significant amount of sales (approximately $5 million) by remaining passive. Gerber€™s decision tree is shown in Figure F.12.

The EV calculations for the tree are as follows:

1. Respond Proactively

(1) Favorable report, sales increase: $1 million

(2) Favorable report, and sales decline: €“$1 million

EV1 = ($1 million × 0.8) + (€“$1 million × 0.2) = $600,000

(3) Unfavorable report, sales increase: $0

(4) Unfavorable report, sales decline: €“$1.25 million

Figure F.12

EV2 = ($0 × 0.25) + (€“$1.25 million × 0.75) = €“$937,500

EVrespond proactively = (EV1 × 0.5) + (EV2 × 0.5)

= ($600,000 × 0.5) + (€“$937,500 × 0.5)

= €“$168,750

2. Respond Reactively

(5) Favorable report, sales increase: $0

(6) Favorable report, sales decline: €“$2 million

EV1 = ($0 × 0.25) + (€“$2 million × 0.75) = €“$1.5 million

(7). Unfavorable report, sales increase: $0.5 million

(8) Unfavorable report, sales decline: €“$5 million

EV2 = ($0.5 million × 0.2) + (€“$5 million × 0.8) = €“ $3,900,000

EVrespond reactively = (EV1 × 0.5) + (EV2 × 0.5)

= (€“$1,500,000 × 0.5) + (€“$3,900,000 × 0.5) = €“$2,600,000

Based on the decision tree and the expected values of the alternatives it calculated, Gerber concluded that its best option was to respond proactively without waiting for the CPSC€™s report. Then, Gerber hoped for a favorable report. This would give the company a strategic advantage over its competitors that had failed to take action. Nevertheless, the CPSC, U.S. Food & Drug Administration, and American Council on Science and Health (ACSH) ultimately approved phthalates for use in toys and other products. In fact, an ACSH panel of scientists and physicians reinforced the benefits of using phthalates in medical applications. Nonetheless, Gerber€™s decision to respond proactively was based on a rational decision-making process and the best information the firm had. Because it is impossible to accurately predict outcomes, often the best choices still cost money.

Step by Step Answer:

Operations Management Managing Global Supply Chains

ISBN: 978-1506302935

1st edition

Authors: Ray R. Venkataraman, Jeffrey K. Pinto