Question: We consider the following portfolio optimization problem: where C is the empirical covariance matrix, A > 0 is a risk parameter and r is the

We consider the following portfolio optimization problem:

![]()

where C is the empirical covariance matrix, A > 0 is a risk parameter and r̂ is the time-average return for each asset for the given period. Here, the constraint set X is determined by the following conditions.

• No shorting is allowed.

• There is a budget constraint Xi + • • • + xn = 1.

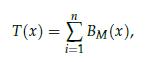

In the above, the function T represents transaction costs and market impact, c ≥ 0 is a parameter that controls the size of these costs, while x° ∈ Rn is the vector of initial positions. The function T has the form

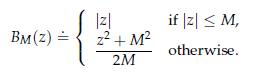

where the function BM is piece-wise linear for small x, and quadratic for large x; that way we seek to capture the fact that transaction costs are dominant for smaller trades, while market impact kicks in for larger ones. Precisely, we define BM to be the so-called "reverse Huber" function with cut-off parameter M: for a scalar z, the function value is

The scalar M > 0 describes where the transition from a linearly shaped to a quadratically shaped penalty takes place.

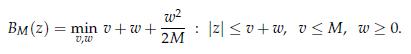

1. Show that BM can be expressed as the solution to an optimization problem:

Explain why the above representation proves that BM is convex.

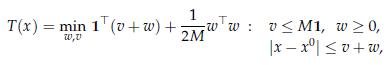

2. Show that, for given x ∈ Rn:

where, in the above, ν,ω are now n-dimensional vector variables, 1 is the vector of ones, and the inequalities are component-wise.

3. Formulate the optimization problem (14.40) in convex format. Does the problem fall into one of the categories (LP, QP, SOCP, etc) seen in Chapter 8?

max Tx - AxTCx-c-T(x-x): x 0, x= x,

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

To show that BM can be expressed as the solution to an optimization problem we can rewrite BM as BMz ... View full answer

Get step-by-step solutions from verified subject matter experts