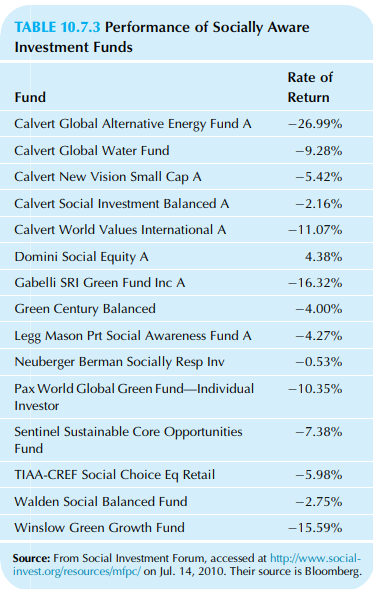

Selected mutual funds that practice socially aware investing, with year-to-date rates of return, are shown in Table

Question:

Selected mutual funds that practice socially aware investing, with year-to-date rates of return, are shown in Table 10.7.3. On average, these funds lost value in the first half of 2010, in the sense that their average rate of return was negative. However, the Standard & Poor’s 500 stock market index lost 9.03% of its value during the same period, so this was a difficult time for the market in general.

a. On average, as a group, did socially aware mutual funds lose significantly more than the market index? Please use the market index as the reference value.

b. Find the p-value for this test (as either p>0.05, p<0.05, p<0.01, or p<0.001). In particular, is it highly significant?

c. Identify the underlying hypotheses and assumptions involved in part a.

d. Under these assumptions, the hypothesis test makes a clear and correct statement. However, are the assumptions realistic? Be sure to address independence (note that some of these funds are part of the same group).

e. Why is a two-sided test appropriate in this case?

Mutual funds are like a pool of funds gathered by different small investors that have simalar investment perspective about returns on their investments. These funds are managed by professional investment managers who act smartly on behalf of the...

Step by Step Answer: