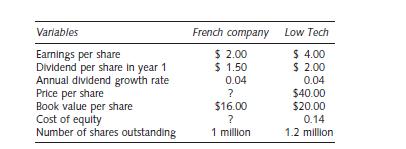

We will assume that IBM is analyzing the acquisition of a privately held French company. The French

Question:

We will assume that IBM is analyzing the acquisition of a privately held French company.

The French company is more similar to Low Tech (LT) than any other company whose stock is traded in the public market. To establish a fair market price for the French company, IBM has compiled the statistics presented in the following table. Estimate the market value of the French company (FM) in the following three ways:

(a) the price–earnings ratio, (b)

market value/book value, and

(c) the dividend growth model.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim

Question Posted: