Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firms financial

Question:

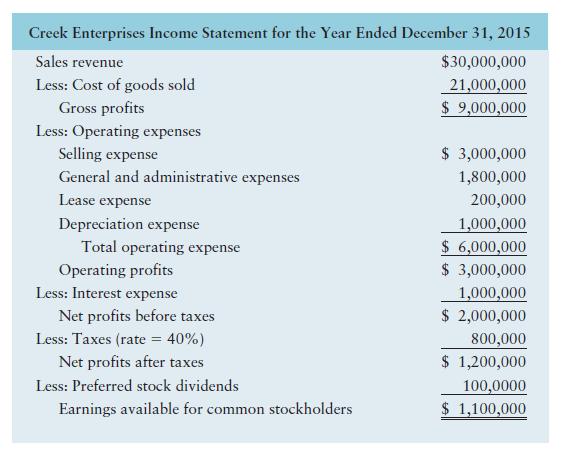

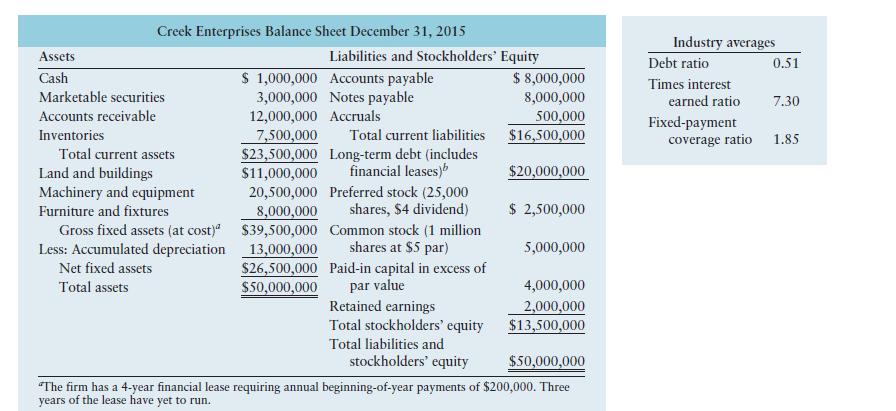

Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm’s financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry averages and Creek’s recent financial statements (following), evaluate and recommend appropriate action on the loan request.

Transcribed Image Text:

Creek Enterprises Income Statement for the Year Ended December 31, 2015 $30,000,000 21,000,000 $ 9,000,000 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders $ 3,000,000 1,800,000 200,000 1,000,000 $ 6,000,000 $ 3,000,000 1,000,000 $ 2,000,000 800,000 $ 1,200,000 100,0000 $ 1,100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 20% (5 reviews)

To evaluate Creek Enterprises financial leverage and financial risk we will need to assess various financial ratios and compare them to industry avera...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Business questions

-

Springfield Bank is evaluating Creek Enterprises, which has requested a $3,910,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along...

-

As Director of Clinical Services at People First San Diego, you normally have a budget of $300,000 to fund the Therapy Services department. This money pays for salaries, training, and supplies....

-

Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along...

-

Determine one positive and one negative coterminal angle for each angle given. 173

-

A farsighted person can read printing as close as 25.0 cm when she wears contacts that have a focal length of 45.4 cm. One day, she forgets her contacts and uses a magnifying glass, as in Figure (b)....

-

Monson Medical Clinic offers a number of specialized medical services, one of which is cancer care. Because of the reputation the clinics physicians (oncologists) have developed over the years,...

-

10. Suppose call and put prices are given by Strike 50 55 60 Call premium 18 14 9.50 Put premium 7 10.75 14.45 Find the convexity violations. What spread would you use to effect arbitrage?...

-

You bought a share of 4 percent preferred stock for $94.89 last year. The market price for your stock is now $96.12. What was your total return for last year?

-

specify the category and the applicable division of the Fringe Benefits Tax Assessment Act 1986 (FBTAA); provide section references of the FBTAA for each part of your calculation; and indicate...

-

Complete Form 941 for the 4th quarter for TCLH Industries (which is located at 202 Whitmore Avenue, Durham, NC 27701; Employer Identification #44-4444444). Assume that all necessary deposits were...

-

A common-size income statement for Creek Enterprises 2014 operations follows. Using the firms 2015 income statement presented in Problem 318 develop the 2015 common-size income statement and compare...

-

Speedy Manufacturing Companys end-of-year accounts receivable balance consists of amounts originating in the months indicated below. The company had annual sales of $3.2 million. The company extends...

-

The first-order reaction A B with k = 0.8 min1 is carried out in a real reactor with the following RTD function: The Hemi or half circle curve is drawn touching the horizontal axis between the...

-

a) Describe the following concepts in the context of organizational development. b) Discuss how these concepts interrelate and support each other within an organizational framework

-

Q2. a) Analyze the importance of communication in the change management process. b) Suggests strategies that a Disaster Management Organization can employ to ensure effective communication during...

-

Q3. a) Explain the following Change Management Models

-

Q3. b) Discuss how each model can be applied in real-world organizational change scenarios.

-

In this question, you will work step-by-step through an optimization problem. A craftsman wants to make a cylindrical jewelry box that has volume, V, equal to 55 cubic inches. He will make the base...

-

Drummond Services Ltd. acquired 25% of the common shares of Bella Roma Ltd. on January 1, 2018, by paying $3.6 million for 200,000 shares. Bella Roma declared a $0.50-per-share cash dividend in each...

-

What are the typical record-at-a-time operations for accessing a file? Which of these depend on the current file record?

-

How is the current rate (translation) method used to consolidate a firms foreign and domestic financial statements?

-

With regard to financial ratio analysis, how do the viewpoints held by the firms present and prospective shareholders, creditors, and management differ?

-

What is the difference between cross-sectional and time-series ratio analysis? What is benchmarking?

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App