Stable Nuclear Plant Corporation has estimated the cash flows over the 5-year lives for two projects, A

Question:

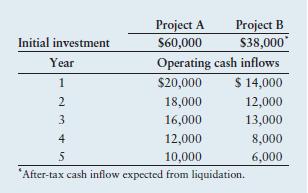

Stable Nuclear Plant Corporation has estimated the cash flows over the 5-year lives for two projects, A and B. These cash flows are summarized in the table below.

a. If project A were actually a replacement for project B and the $38,000 initial investment shown for project B were the after-tax cash inflow expected from liquidating it, what would be the relevant cash flows for this replacement decision?

b. How can an expansion decision such as project A be viewed as a special form of a replacement decision? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted: