LMN Company has a June 30 year-end and maintains three bank accounts: City Bank?Regular, City Bank?Payroll, and

Question:

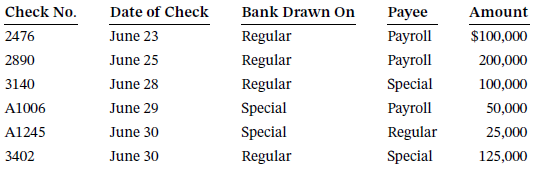

LMN Company has a June 30 year-end and maintains three bank accounts: City Bank?Regular, City Bank?Payroll, and Metro Bank?Special. Your analysis of cash disbursements records for the period June 23 to July 6 reveals the following bank transfers:

You determine the following facts about each of the first five checks: (1) the date of the cash disbursements journal entry is the same as the date of the check, (2) the payee receives the check two days later, (3) the payee records and deposits the check on the day it is received, and (4) it takes five days for a deposited check to clear banking channels and be paid by the bank on which it is drawn. Check 3402 was not recorded as a disbursement until July 1. This check was picked up by the payee on the date it was issued, and it was included in the payee?s after-hours bank deposit on June 30.

Required

a. What are the purposes of the audit of bank transfers?

b. Prepare a bank transfer schedule as of June 30 using the format shown in Illustration 13.3.

c. Prepare separate adjusting entries for any checks that require adjustment.

d. In the reconciliation for the three bank accounts, indicate the check numbers that should appear as (1) an outstanding check or (2) a deposit in transit.

e. Which check(s) may be indicative of kiting?

Step by Step Answer:

Auditing A Practical Approach with Data Analytics

ISBN: 978-1119401742

1st edition

Authors: Raymond N. Johnson, Laura Davis Wiley, Robyn Moroney, Fiona Campbell, Jane Hamilton