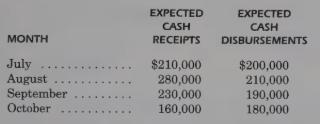

SHORT-TERM INVESTMENTS, SHORT-TERM DEBT, AND CASH REQUIREMENTS. Arens Corporation has the following schedule for expected cash receipts

Question:

SHORT-TERM INVESTMENTS, SHORT-TERM DEBT, AND CASH REQUIREMENTS. Arens Corporation has the following schedule for expected cash receipts and cash disbursements:

Arens begins July with a cash balance of $20,000, $15,000 of short-term debt, and no short-term investments. Arens uses the following cash management policy:

a) End-of-month cash should equal $20,000 plus the excess of disbursements over receipts for the next month.

b) If receipts are expected to exceed disbursements in the next month, the currentmonth ending cash balance should be $20,000.

c) Excess funds should be invested in short-term instruments unless there is shortterm debt, in which case excess funds should be used to reduce short-term debt.

d) Fund deficiencies are met first by liquidating short-term investments and, if additional funds are required, by incurring short-term debt.

REQUIRED:

1. Calculate the acquisition or liquidation of short-term investments or the incurrence or repayment of short-term debt at the end of July, August, and September.

2. Discuss the general considerations that help accountants develop a cash management policy.

Step by Step Answer: