Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the income statement in this step, and then identify and enter the applicable EPS amounts in the following step Choose from any list or

Complete the income statement in this step, and then identify and enter the applicable EPS amounts in the following step

Choose from any list or enter any number in the input nears and then click Check Answer.

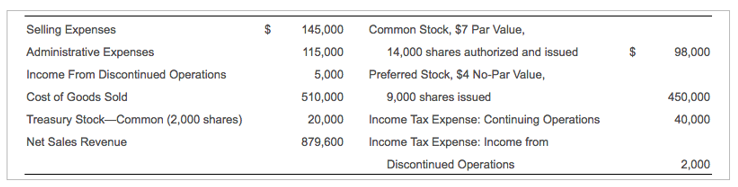

Selling Expenses Administrative Expenses Income From Discontinued Operations Cost of Goods Sold Treasury Stock-Common (2,000 shares) Net Sales Revenue $ 145,000 115,000 5,000 510,000 20,000 879,600 Common Stock, $7 Par Value, 14,000 shares authorized and issued Preferred Stock, $4 No-Par Value, 9,000 shares issued Income Tax Expense: Continuing Operations Income Tax Expense: Income from Discontinued Operations 98,000 450,000 40,000 2,000 Income Tax Expense Income From Continuing Operations Discontinued Operations (less applicable tax) Net Income Earnings per Share of Common Stock (12,000 shares issued): Earnings per Share of Common Stock (12,000 shares outstanding): Earnings per Share of Common Stock (14,000 shares issued): Earnings per Share of Common Stock (14,000 shares outstanding): 40,000 69,600 3,000 $ 72,600

Step by Step Solution

★★★★★

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Amount in Net Sales Revenue 879600 Le...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started