Question

While FF was started 40 years ago, its common stock has been publicly traded for the past 25 years. The returns on its equity are

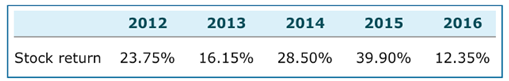

While FF was started 40 years ago, its common stock has been publicly traded for the past 25 years. The returns on its equity are calculated as arithmetic returns. The historical returns for FF for 2012 to 2016 are:

1- Given the preceding data, the average realized return on FF's stock is .........

2, The preceding data series represents ................... of FF?s historical returns. Based on this conclusion, the standard deviation of FF?s historical returns is ..............

3. If investors expect the average realized return from 2012 to 2016 on FF?s stock to continue into the future, its coefficient of variation (CV) will be .................2012 2014 2015 2016 2013 Stock return 23.75% 16.15% 28.50% 39.90% 12.35%

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Average return 24 1615 29 3990 12355 2413 2 Given BLM has been traded fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J Wild, Ken Shaw

24th edition

1259916960, 978-1259916960

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App