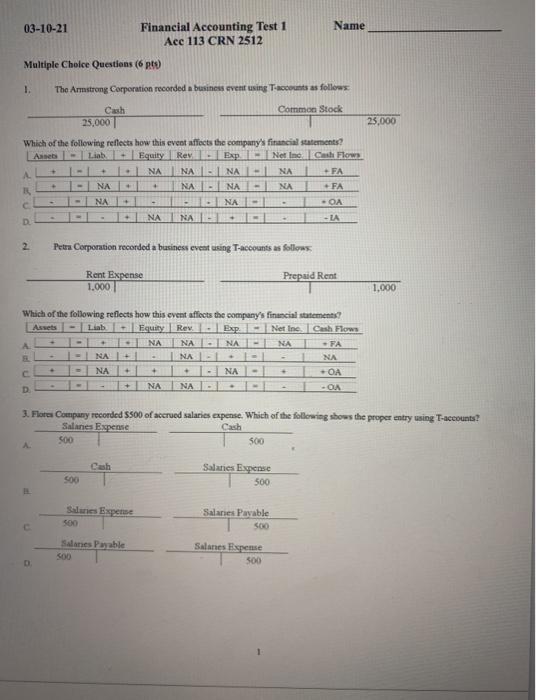

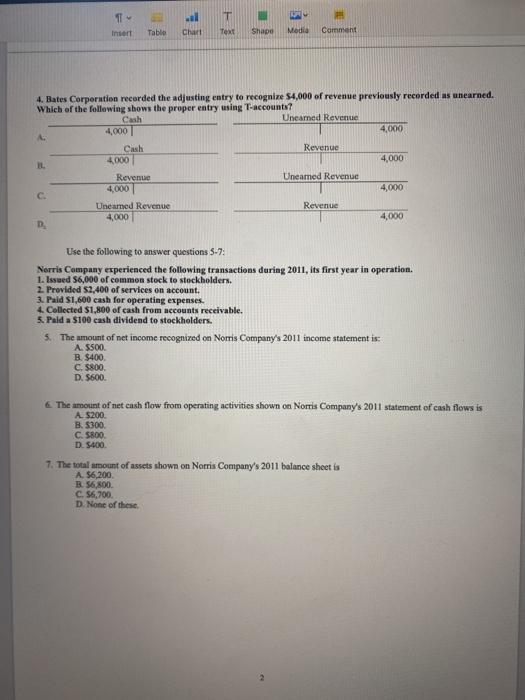

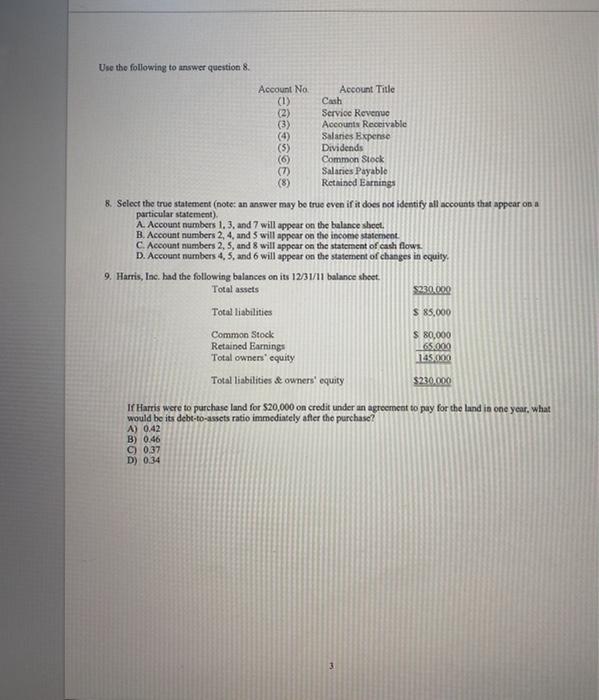

03-10-21 Name Financial Accounting Test 1 Ace 113 CRN 2512 Multiple Choice Questions (6 pto 1. The Armstrong Corporation recorded a business event using accounts as follows: 25,000 Cash Common Stock 25,000 Which of the following reflects how this event affects the company's financial statements? Annet Linh + Equity Rey - Fap Net ne I Cash Flow I NA NA - NA NA FA NA - NA - NA NA - FA - NA NA -OA D NA NA + + + - Petra Corporation recorded a business event using Taccounts as follows Rent Expense 1.000 Prepaid Rent 1.000 . Which of the following reflects how this event affects the company's financial statements? Assets Liab - Equity RevExp. Net Inc Cash Flows A NA NA NA NA - FA NA NA NA + + . - NA - + NANA -OA D NA 3. Flores Company recorded SS00 of accrued salaries expense. Which of the following shows the proper entry using T-accounts! Salines Expense Cash 500 500 Salaries Expense 500 Salines Expense 500 Salaries Payable SO Salones Payable 500 Salanes Expense 500 AR T Text Intert Table Modia Charl Shape Comment 4. Bates Corporation recorded the adjusting entry to recognize 54,000 of revenue previously recorded as unearned. Which of the following shows the proper entry using T-accounts Cash Uneamed Revenue 4,000 4,000 Revenue 4,000 IL Uneamed Revenue Cash 4,000 Revenue 4,000 Uneamed Revenue 4000 4,000 c Revenue 4,000 D. Use the following to answer questions 5-7: Norris Company experienced the following transactions during 2011, its first year in operation. 1. Issued 6,000 of common stock to stockholders. 2. Provided 52,400 of services on account. 3. Pald S1,600 cash for operating expenses. 4. Collected $1.800 of cash from accounts receivable. 5. Pald a $100 cash dividend to stockholders. 5. The amount of net income recognized on Norris Company's 2011 income statement is: A. 5500 B. $400. C. 5800 D. 5600 6. The amount of net cash flow from operating activities shown on Norris Company's 2011 statement of cash flows is A $200 B. $300 C. 5800 D. 5400 7. The total amount of assets shown on Norris Company's 2011 balance sheet is A $6,200 B. 56,800 C. 56,700, D. None of these SOSOBE Use the following to answer question 8 Account No Account Title (1 Cash Service Revenue Accounts Receivable Salaries Expense Dividends (6 Common Stock () Salaries Payable (8) Retained Earnings 8. Select the true statement (note: an answer may be true even if it does not identify all accounts that appear on a particular statement) A. Account numbers 1.3, and 7 will appear on the balance sheet. B, Account numbers 2, 4, and will appear on the income statement C. Account numbers 2. 5, and 8 will appear on the statement of cash flows D. Account numbers 4, 5, and 6 will appear on the statement of changes in equity, 9. Harris, Inc. had the following balances on its 12/31/11 balance sheet. Total assets Total liabilities $ 85,000 Common Stock $ 80,000 Retained Earnings 65.000 Total owners' equity 145.000 Total liabilities & owners' equity $230.000 If Harris were to purchase land for $20,000 on credit under an agreement to pay for the land in one year, what would be its debt-to-assets ratio immediately after the purchase? A) 0.42 B) 0.46 C) 0.37 D) 0.34 1