Answered step by step

Verified Expert Solution

Question

1 Approved Answer

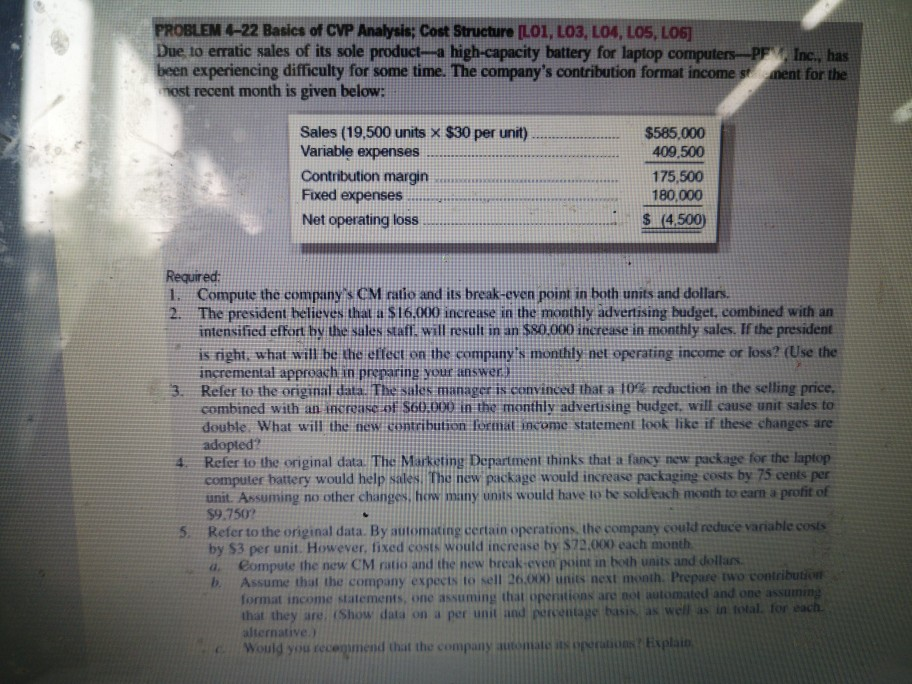

managerial accounting PROBLEM -22 Basics of CVP Analysis: Cost Structure ILO1, LO3, LO4, LOS, LO6] to erratic sales of its sole product-a high-capacity battery for

managerial accounting

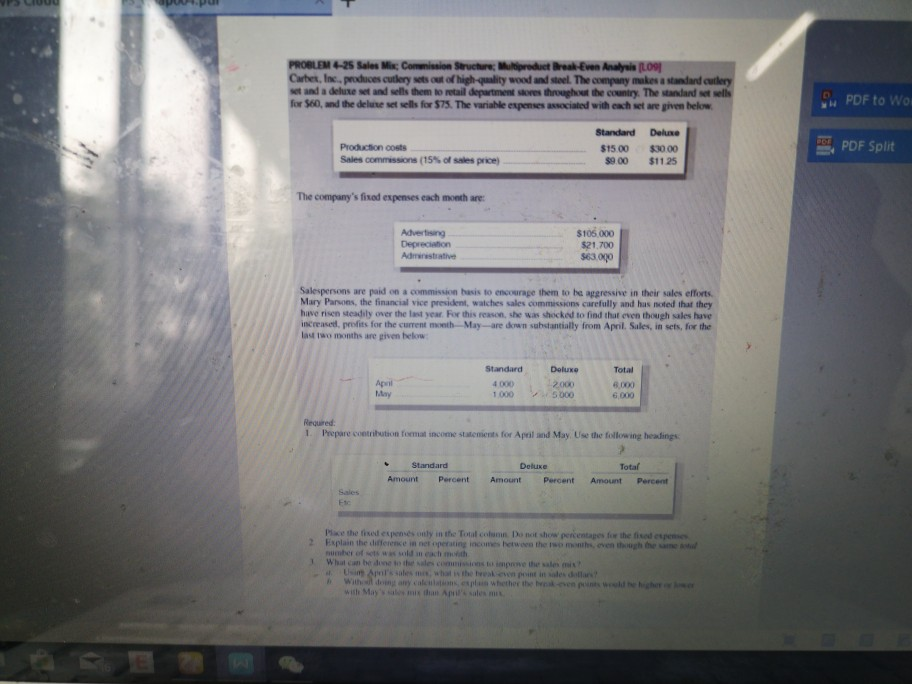

PROBLEM -22 Basics of CVP Analysis: Cost Structure ILO1, LO3, LO4, LOS, LO6] to erratic sales of its sole product-a high-capacity battery for laptop experiencing difficulty for some time. The company's contribution format income st Inc, has t for the ost recent month is given below: Sales (19,500 units x $30 per unit)... Variable expenses $585,000 Contribution margin Fixed expenses 175,500 180,000 Net operating lossm Required: 1. Compute the company s CI ratlio and its break-even point in both units and dollars 2. The president believes that a $16.000 increase in the monthly advertising budget, combined with an intensified efort by the sales staff will result in an $80.000 increase in monthly sales. If the president is right, what will be the effect on the company's monthly net operating income or loss? (Use the incremental approach in peparing your answer Refer to the original data. The sales manager n convinced that a 10% reduction in the selling price. combined with an increascof So0:000 n the monthly advertising budget, will cause unit sales to double. What will the new contrihution Format ncome statement look like if these changes are adopted? E . 4 Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would help sales The new package would increase packaging costs by 75 cents per unit Assuming no other changes, how many units would have to be soldleach month to earn a profit of $9.750? 5. Refer to the original data. By automaring certain operations, the company could reduce variable by $3 per unit. However, fixed costs would increase by $72.000 each month a. Compute the new CM ratio and the new break even point in both units and dollars. b. Assume that the company expects to sell 26.0ND unts next mooth. Prepare two contribu format income statements, one assuming that operations are not automated and one assum that they are, (Show data on a per unit and percentage basis as well mend that the compan t PROBLEM 4-25 Sales Mix Commission Structure: Multiproduct Break-Even Analyis t09 Cartes, Inc.pndaces culory sm cut ofhighqulity woodandstoel Thecompany makes a 1udiliry set and a deluxe set and sells them to retail department stoves throughout the country. The standlard set sells for 560, and the deluse set sells for $75. The variable expenses associated with each set are given below PDF to Wo Standard Delxe Production costs Sales on mssors (15% of sales price, $1500 $3000 $900 $11.25 PDF Split The company's fixed expenses each month are $105.000 $21,700 Salespersons are paid on a commission basis to encourage them to be aggressive in their sales effiorts Mary Panons, the financial vice president, walches sales commissions carefully and has noted that they huve risen steadly over the last year For this reason, she wastocked to find ihr even though sales have increased. profits for the current month-May-are down substantially from Apnil. Sales, in sets, for the las two months are given below Standard Deluxe 2.000 1000 5 000 Doluxe Apnil hMay Total 6 000 6,000 4 000 1. Prepare coetribution foemat income statemients for Apeil and May Use the following headings Standard Deluxe Total Amount PercentAmountPercent AmountPercent Sales Piace the fised espenses only in the Total column Do not show percentages for the fisd espenses nurmber of sets was sold in each mokth 1 What can be done to the sales commistons to impove the sales mis? s sales mis. what is the freak -even peint in sales dellarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started