1.

2.

3.

.

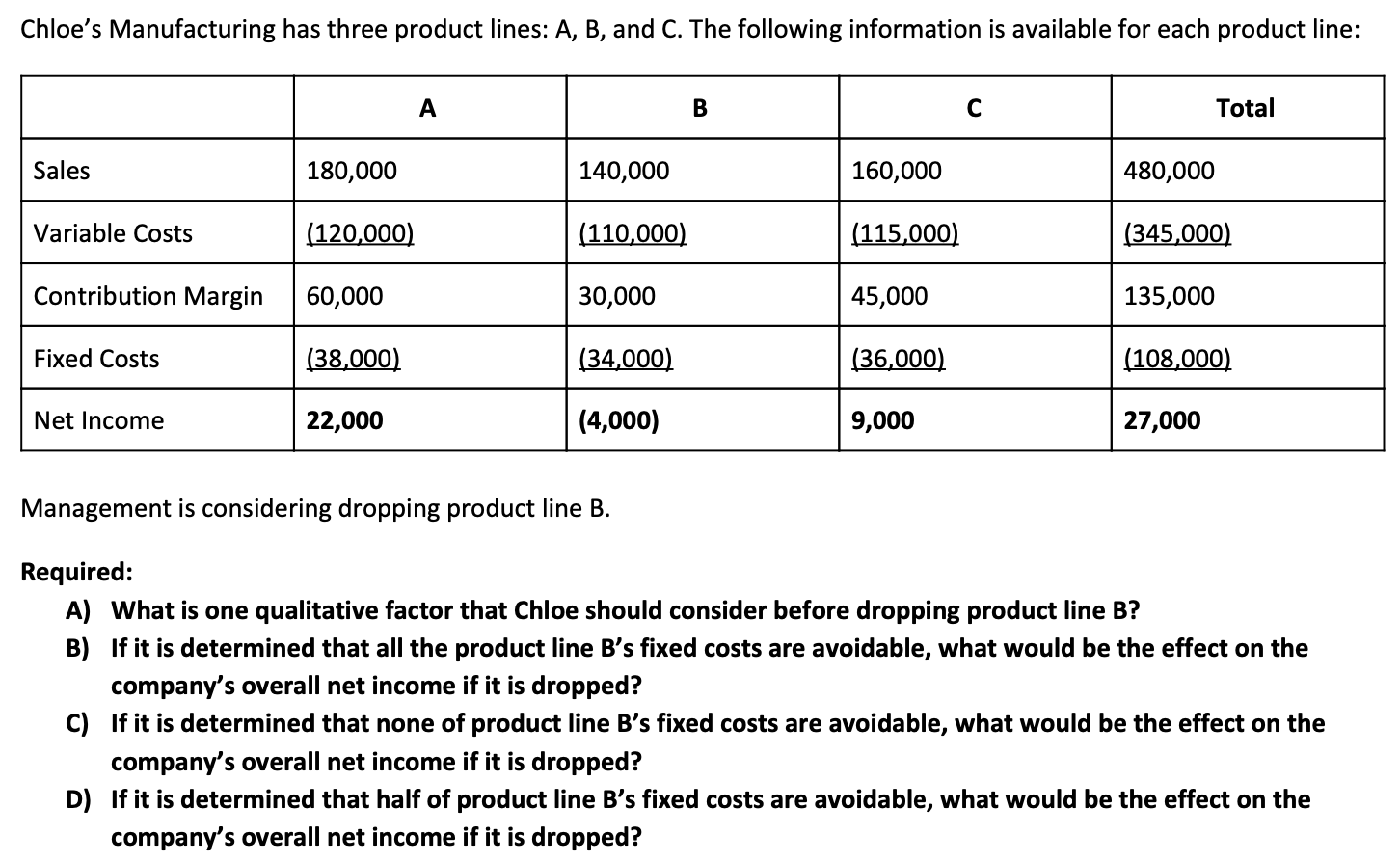

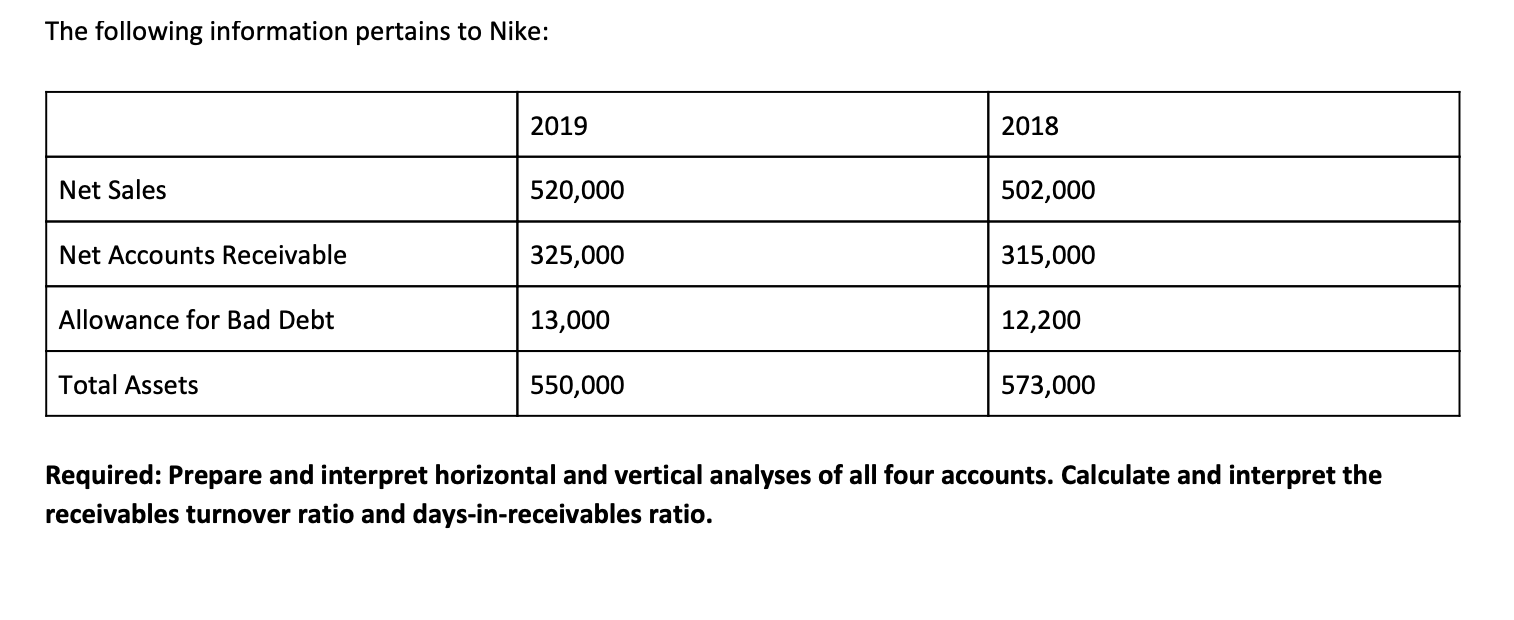

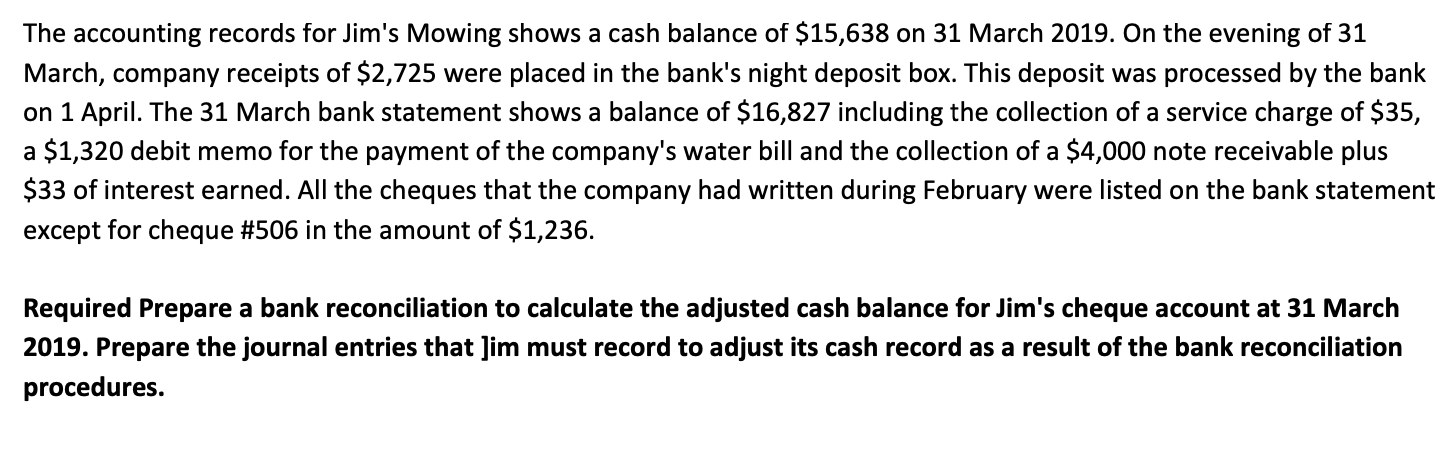

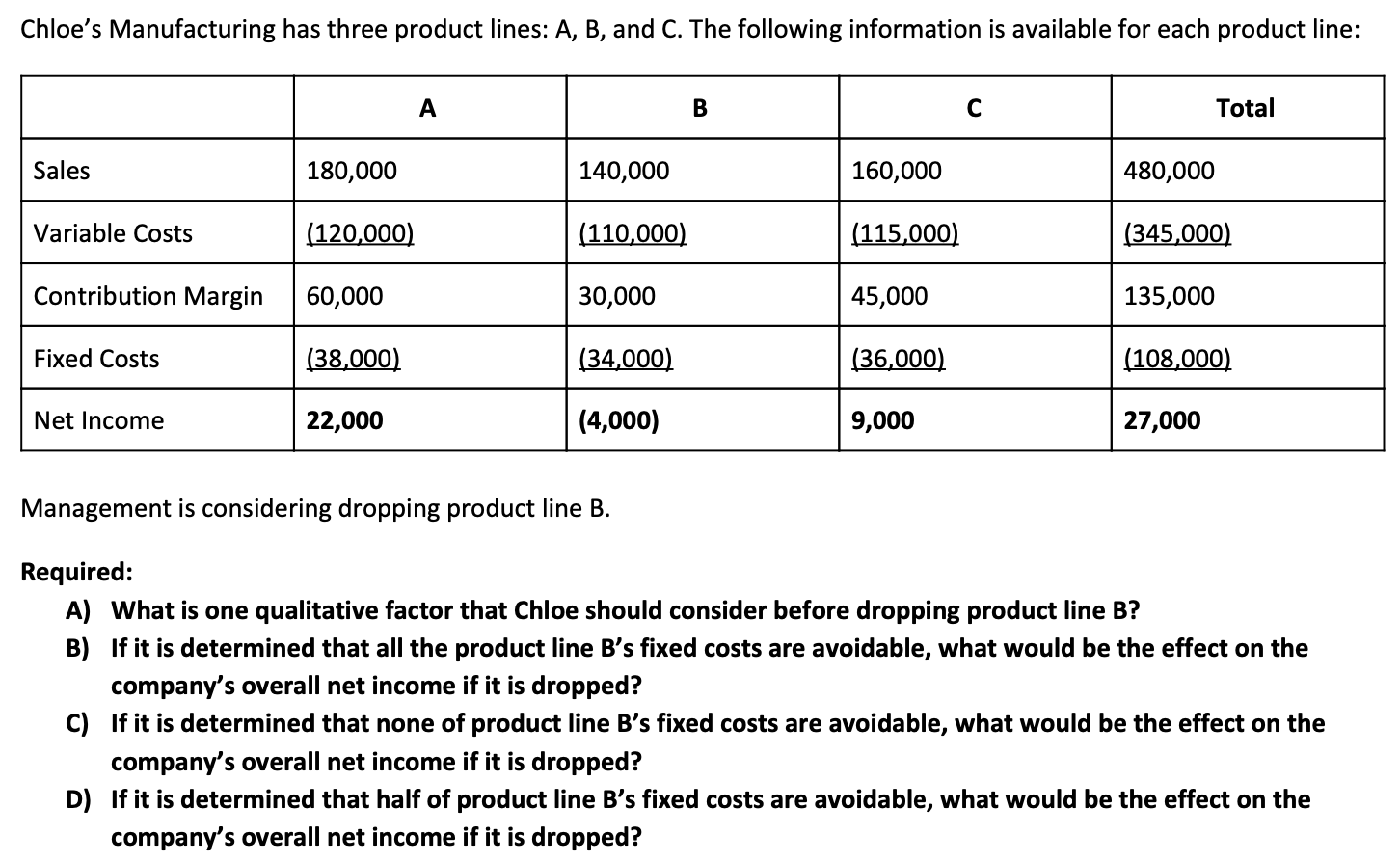

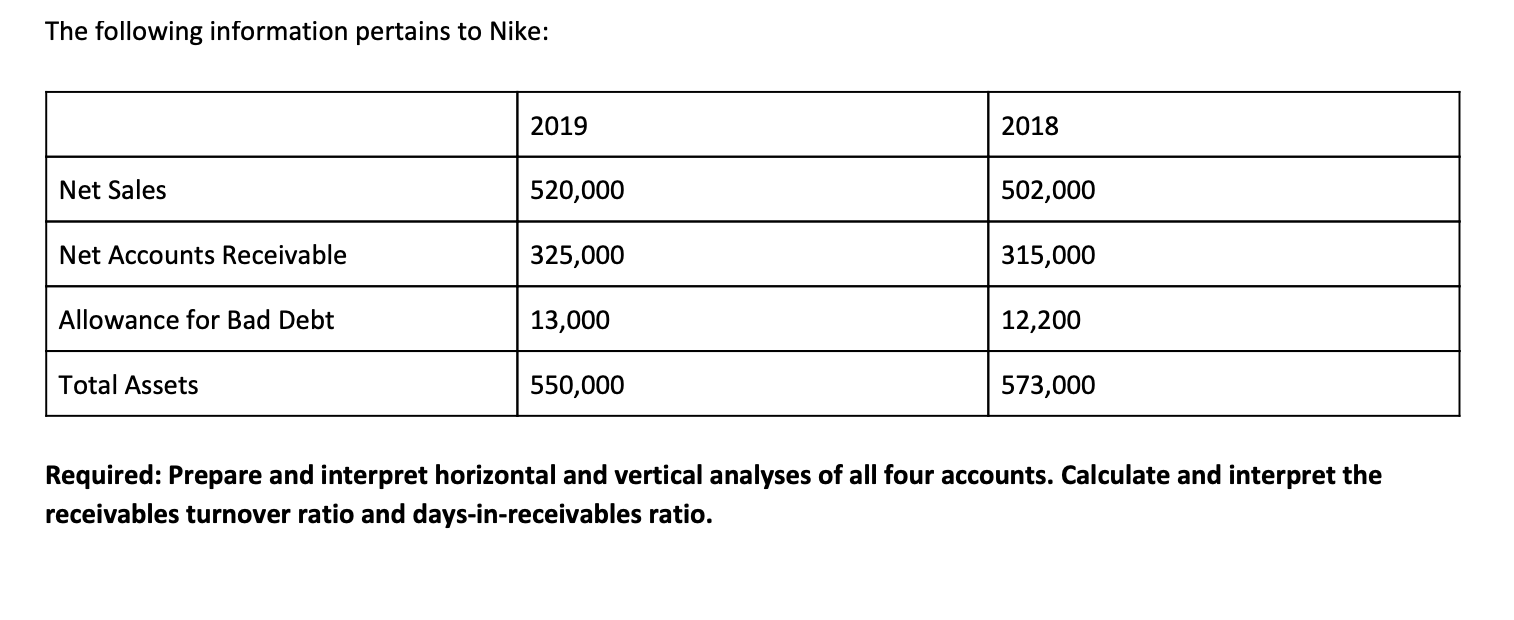

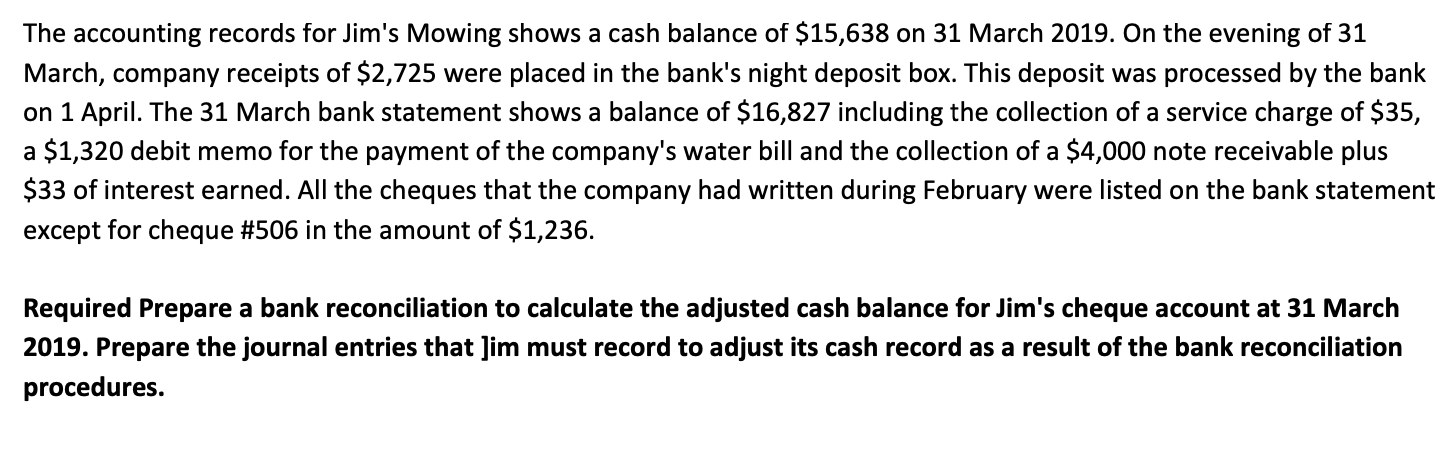

Chloe's Manufacturing has three product lines: A, B, and C. The following information is available for each product line: A B C Total Sales 180,000 140,000 160,000 480,000 Variable Costs (120,000) (110,000) (115,000) (345,000) Contribution Margin 60,000 30,000 45,000 135,000 Fixed Costs (38,000) (34,000) (36,000) (108,000) Net Income 22,000 (4,000) 9,000 27,000 Management is considering dropping product line B. Required: A) What is one qualitative factor that Chloe should consider before dropping product line B? B) If it is determined that all the product line B's fixed costs are avoidable, what would be the effect on the company's overall net income if it is dropped? C) If it is determined that none of product line B's fixed costs are avoidable, what would be the effect on the company's overall net income if it is dropped? D) If it is determined that half of product line B's fixed costs are avoidable, what would be the effect on the company's overall net income if it is dropped? The following information pertains to Nike: 2019 2018 Net Sales 520,000 502,000 Net Accounts Receivable 325,000 315,000 Allowance for Bad Debt 13,000 12,200 Total Assets 550,000 573,000 Required: Prepare and interpret horizontal and vertical analyses of all four accounts. Calculate and interpret the receivables turnover ratio and days-in-receivables ratio. The accounting records for Jim's Mowing shows a cash balance of $15,638 on 31 March 2019. On the evening of 31 March, company receipts of $2,725 were placed in the bank's night deposit box. This deposit was processed by the bank on 1 April. The 31 March bank statement shows a balance of $16,827 including the collection of a service charge of $35, a $1,320 debit memo for the payment of the company's water bill and the collection of a $4,000 note receivable plus $33 of interest earned. All the cheques that the company had written during February were listed on the bank statement except for cheque #506 in the amount of $1,236. Required Prepare a bank reconciliation to calculate the adjusted cash balance for Jim's cheque account at 31 March 2019. Prepare the journal entries that Jim must record to adjust its cash record as a result of the bank reconciliation procedures