Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. One of your portfolio managers, Rajesh Gupta, has recently complained that by measuring risk-adjusted returns using the Sharpe ratio, he is

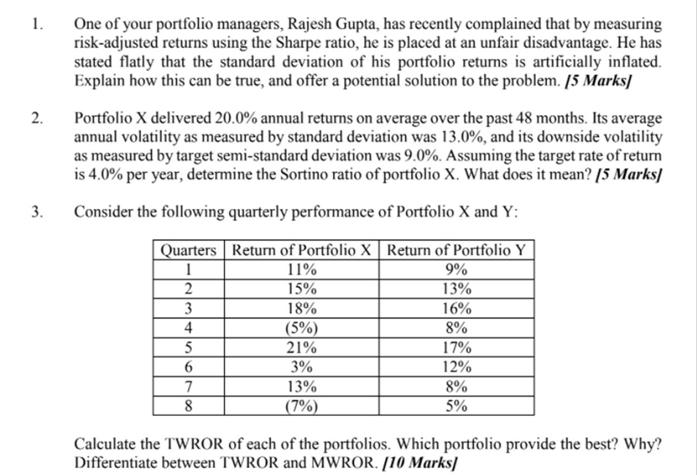

1. 2. 3. One of your portfolio managers, Rajesh Gupta, has recently complained that by measuring risk-adjusted returns using the Sharpe ratio, he is placed at an unfair disadvantage. He has stated flatly that the standard deviation of his portfolio returns is artificially inflated. Explain how this can be true, and offer a potential solution to the problem. [5 Marks] Portfolio X delivered 20.0% annual returns on average over the past 48 months. Its average annual volatility as measured by standard deviation was 13.0%, and its downside volatility as measured by target semi-standard deviation was 9.0%. Assuming the target rate of return is 4.0% per year, determine the Sortino ratio of portfolio X. What does it mean? [5 Marks] Consider the following quarterly performance of Portfolio X and Y: Quarters Return of Portfolio X Return of Portfolio Y 1 11% 9% 2 15% 13% 3 18% 16% 4 (5%) 8% 5 21% 17% 6 3% 12% 7 13% 8% 8 (7%) 5% Calculate the TWROR of each of the portfolios. Which portfolio provide the best? Why? Differentiate between TWROR and MWROR. [10 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Sharpe Ratio and Rajesh Guptas Disadvantage 15 Marks Rajesh Gupta might be right about the Sharpe ratio inflating his portfolios risk Heres why Sharpe Ratio uses Standard Deviation Standard dev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started