Answered step by step

Verified Expert Solution

Question

1 Approved Answer

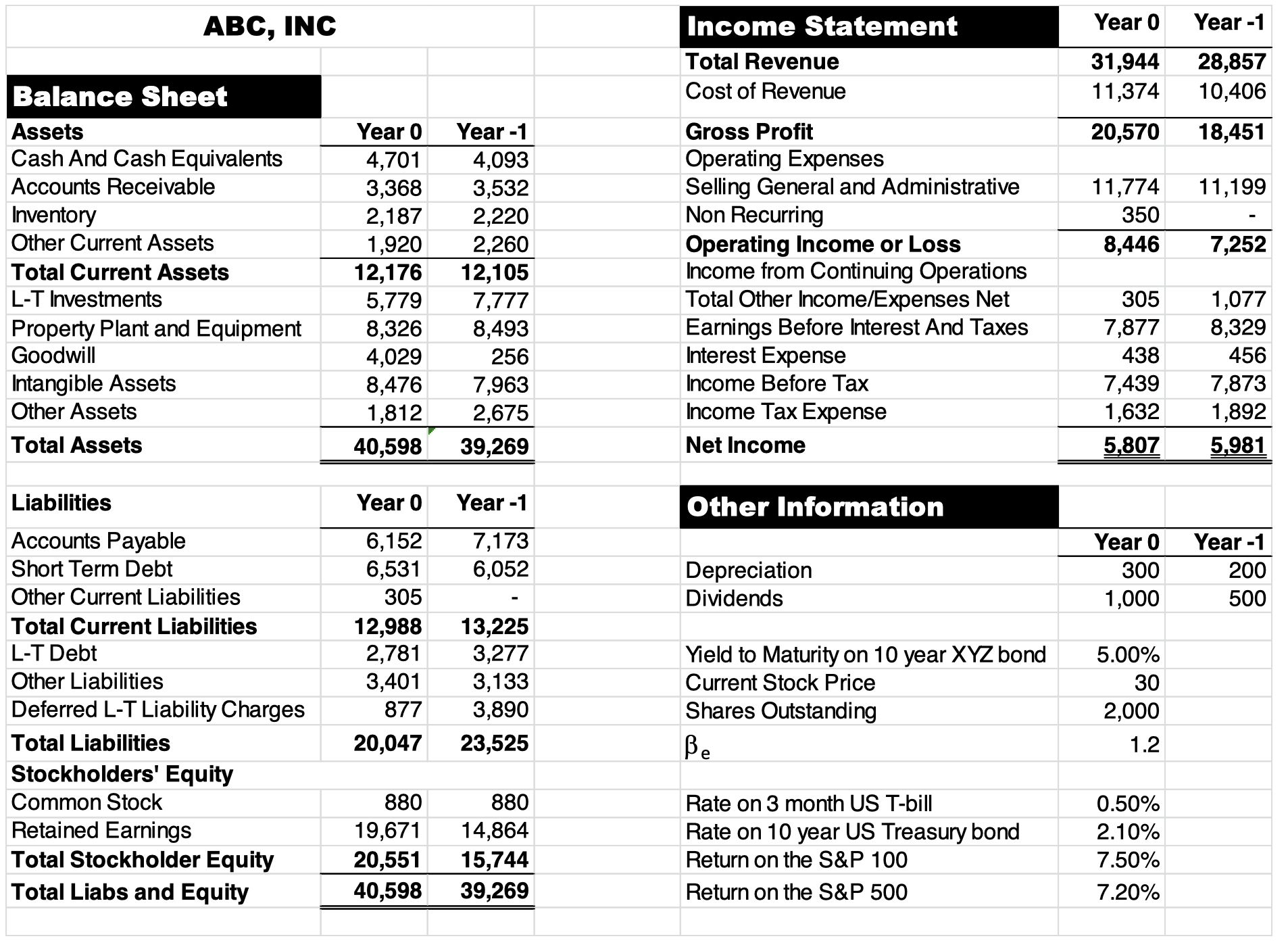

1.What is the cost of equity for firm ABC? 2.What is the cost of capital for firm ABC? 3.What is the cost of assets, rA

1.What is the cost of equity for firm ABC?

2.What is the cost of capital for firm ABC?

3.What is the cost of assets, rA for firm ABC?

ABC, INC Income Statement Year 0 Year -1 Total Revenue 31,944 28,857 Balance Sheet Cost of Revenue 11,374 10,406 Assets Year 0 Year -1 Gross Profit 20,570 18,451 Cash And Cash Equivalents 4,701 4,093 Operating Expenses Accounts Receivable 3,368 3,532 Selling General and Administrative 11,774 11,199 Inventory 2,187 2,220 Non Recurring 350 Other Current Assets 1,920 2,260 Total Current Assets 12,176 12,105 L-T Investments 5,779 7,777 Property Plant and Equipment 8,326 8,493 Goodwill 4,029 256 Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense 8,446 7,252 305 1,077 7,877 8,329 438 456 Intangible Assets 8,476 7,963 Income Before Tax 7,439 7,873 Other Assets 1,812 2,675 Income Tax Expense 1,632 1,892 Total Assets Liabilities 40,598 39,269 Net Income 5,807 5,981 Year 0 Year -1 Other Information Accounts Payable 6,152 7,173 Year 0 Year -1 Short Term Debt 6,531 6,052 Depreciation 300 200 Other Current Liabilities 305 Dividends 1,000 500 Total Current Liabilities 12,988 13,225 L-T Debt 2,781 3,277 Yield to Maturity on 10 year XYZ bond 5.00% Other Liabilities 3,401 3,133 Current Stock Price 30 Deferred L-T Liability Charges 877 3,890 Shares Outstanding 2,000 Total Liabilities 20,047 23,525 Be 1.2 Stockholders' Equity Common Stock Retained Earnings 880 19,671 880 Rate on 3 month US T-bill 0.50% 14,864 Rate on 10 year US Treasury bond 2.10% Total Stockholder Equity 20,551 15,744 Return on the S&P 100 7.50% Total Liabs and Equity 40,598 39,269 Return on the S&P 500 7.20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Based on the information provided we can calculate the cost of equity for firm ABC using th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started