Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. PLEASE Show steps of answering questions thank you! Current Attempt in Progress Liam Company signed a lease for an office building for

1.

2.

3.

PLEASE Show steps of answering questions thank you!

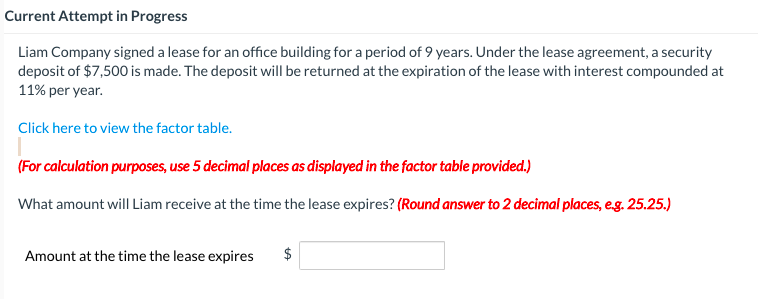

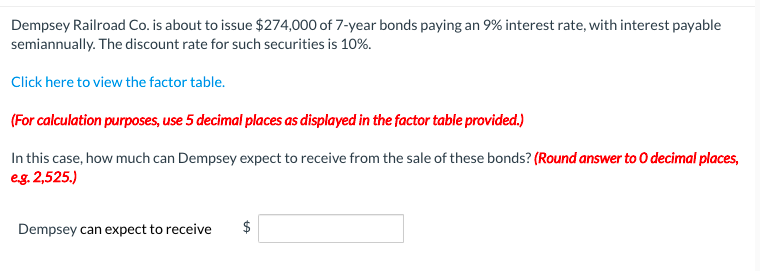

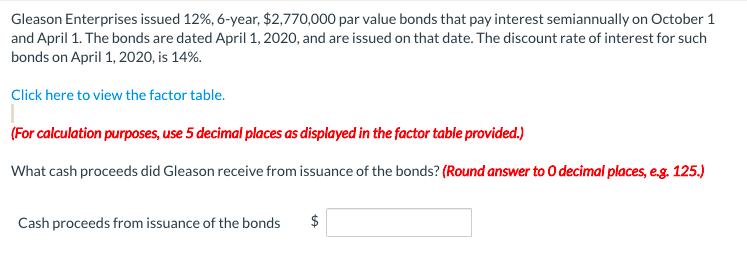

Current Attempt in Progress Liam Company signed a lease for an office building for a period of 9 years. Under the lease agreement, a security deposit of $7,500 is made. The deposit will be returned at the expiration of the lease with interest compounded at 11% per year. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What amount will Liam receive at the time the lease expires? (Round answer to 2 decimal places, eg, 25.25.) Amount at the time the lease expires $ Dempsey Railroad Co. is about to issue $274,000 of 7-year bonds paying an 9% interest rate, with interest payable semiannually. The discount rate for such securities is 10%. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) In this case, how much can Dempsey expect to receive from the sale of these bonds? (Round answer to decimal places, eg. 2,525.) Dempsey can expect to receive $ Gleason Enterprises issued 12%, 6-year, $2,770,000 par value bonds that pay interest semiannually on October 1 and April 1. The bonds are dated April 1, 2020, and are issued on that date. The discount rate of interest for such bonds on April 1, 2020, is 14%. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What cash proceeds did Gleason receive from issuance of the bonds? (Round answer to O decimal places, e.g. 125.) Cash proceeds from issuance of the bonds $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started