Answered step by step

Verified Expert Solution

Question

1 Approved Answer

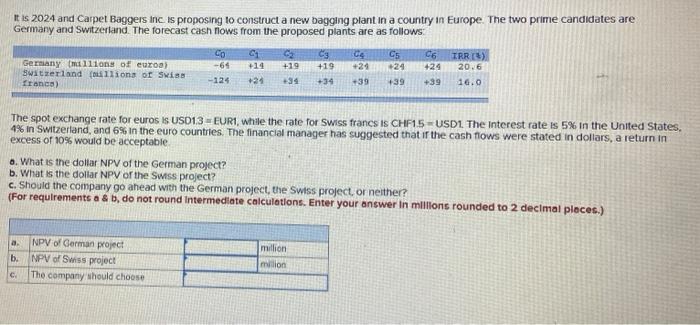

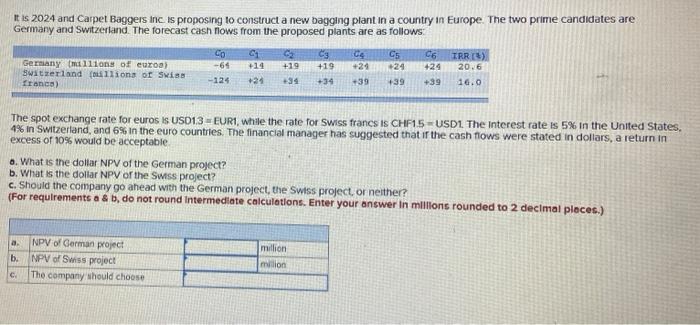

1. 2. It is 2024 and Carpet Baggers Inc is proposing to construct a new bagging plant in a country in Europe The two prime

1.

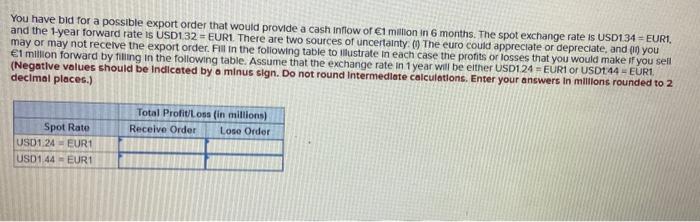

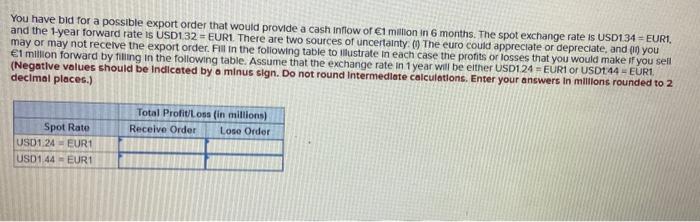

It is 2024 and Carpet Baggers Inc is proposing to construct a new bagging plant in a country in Europe The two prime candidates are Germany and Switzerland. The forecast cash flows from the proposed plants are as follows: Co 21 Cs CA C5 C6 TRR) Gerniany 1110ns of euroa) -64 +14 +19 +19 +21 +24 424 Switzerland (llions of Swiss 20.6 France) -124 24 +34 +34 +39 +39 +39 16.0 The spot exchange rate for euros Is USD13 - EUR1, while the rate for Swiss francs is CHF15 - USD1. The Interest rate is 5% in the United States, 4% in Switzerland, and 6% in the euro countries. The financial manager has suggested that if the cash flows were stated in dollars, a return in excess of 10% would be acceptable a. What is the dollar NPV of the German project? b. What is the dollar NPV of the Swiss project? c. Should the company go ahead with the German project, the Swiss project, or neither? (For requirements a & b, do not round Intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) a. b. NPV of German project NPV Swiss project The company should choose million million C You have bid for a possible export order that would provide a cash inflow of 1 million in 6 months. The spot exchange rate is USD134 = EUR1. and the 1-year forward rate is USD132 = EUR1. There are two sources of uncertainty The euro could appreciate or depreciate, and on you may or may not receive the export order. Fill in the following table to illustrate in each case the profits or losses that you would make if you sell 1 million forward by filling in the following table. Assume that the exchange rate in 1 year will be either USD124 =EUR Or USD144 - EUR1. (Negative values should be indicated by a minus sign. Do not round Intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Total Profit Loss (in millions) Receive Order Lose Order Spot Rate USD 1.24 EUR1 USD144 - EUR1

2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started