Answered step by step

Verified Expert Solution

Question

1 Approved Answer

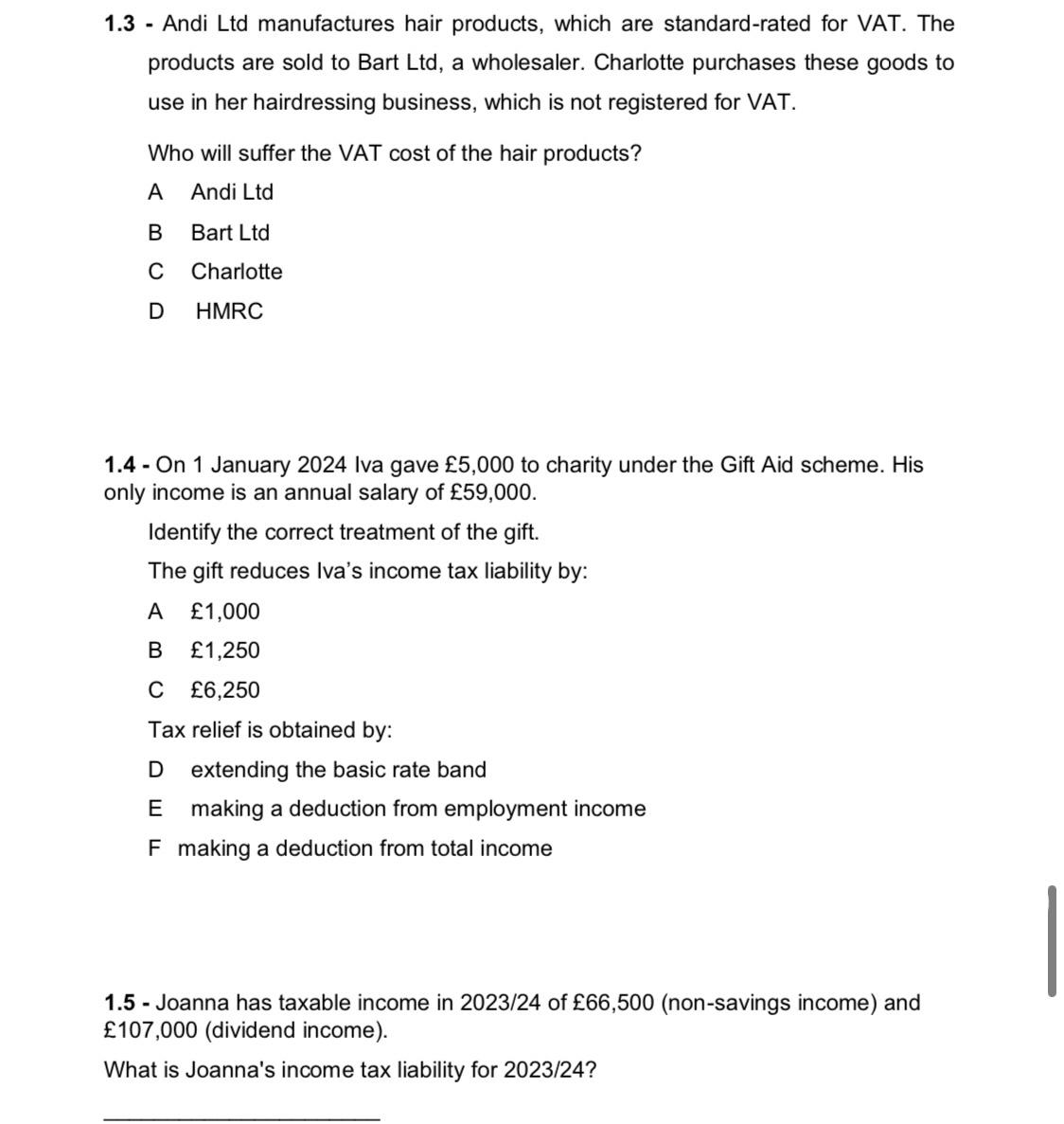

1 . 3 - Andi Ltd manufactures hair products, which are standard - rated for VAT. The products are sold to Bart Ltd , a

Andi Ltd manufactures hair products, which are standardrated for VAT. The products are sold to Bart Ltd a wholesaler. Charlotte purchases these goods to use in her hairdressing business, which is not registered for VAT.

Who will suffer the VAT cost of the hair products?

A Andi Ltd

B Bart Ltd

C Charlotte

D HMRC

On January Iva gave to charity under the Gift Aid scheme. His only income is an annual salary of

Identify the correct treatment of the gift.

The gift reduces Iva's income tax liability by:

A

B

C

Tax relief is obtained by:

D extending the basic rate band

E making a deduction from employment income

F making a deduction from total income

Joanna has taxable income in of nonsavings income and dividend income

What is Joanna's income tax liability for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started