Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. ($52.50 - $50.00 - $47.50 - $42.50 - $40.00) 2. ($50.97 - $45.05 - $42.79 - $41.26 - $38.83) please answer both thanks! 25

1. ($52.50 - $50.00 - $47.50 - $42.50 - $40.00)

2. ($50.97 - $45.05 - $42.79 - $41.26 - $38.83)

please answer both thanks!

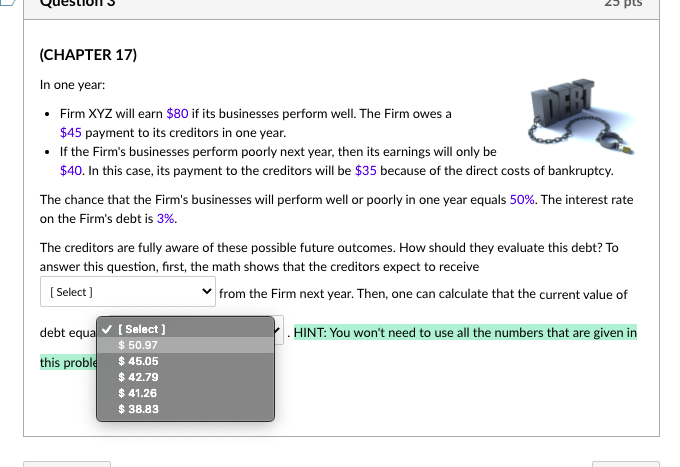

25 (CHAPTER 17) In one year: Firm XYZ will earn $80 if its businesses perform well. The Firm owes a $45 payment to its creditors in one year. If the Firm's businesses perform poorly next year, then its earnings will only be $40. In this case, its payment to the creditors will be $35 because of the direct costs of bankruptcy. The chance that the Firm's businesses will perform well or poorly in one year equals 50%. The interest rate on the Firm's debt is 3%. The creditors are fully aware of these possible future outcomes. How should they evaluate this debt? To answer this question, first, the math shows that the creditors expect to receive [Select) from the Firm next year. Then, one can calculate that the current value of . HINT: You won't need to use all the numbers that are given in debt equa Select $ 50.97 this proble $ 45.05 $ 42.79 $ 41.26 $ 38.83Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started