Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A bond has a coupon rate of 8 percent and has 12 years to maturity. This bond has a face value of $1000

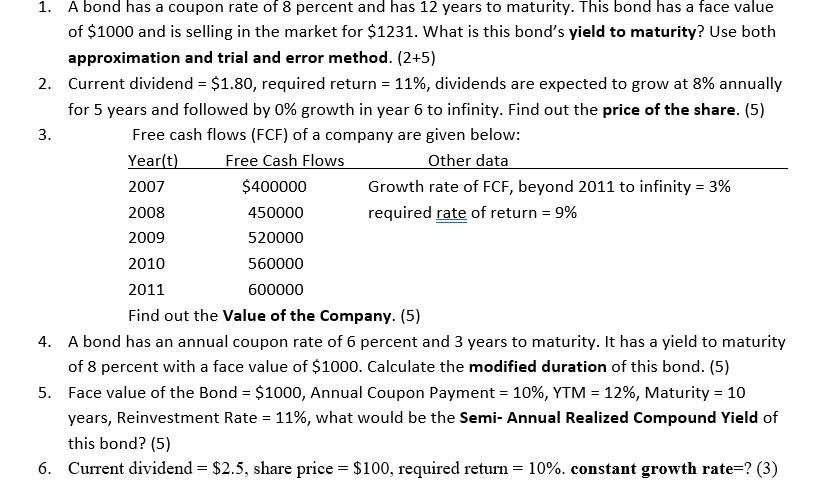

1. A bond has a coupon rate of 8 percent and has 12 years to maturity. This bond has a face value of $1000 and is selling in the market for $1231. What is this bond's yield to maturity? Use both approximation and trial and error method. (2+5) 2. Current dividend = $1.80, required return = 11%, dividends are expected to grow at 8% annually for 5 years and followed by 0% growth in year 6 to infinity. Find out the price of the share. (5) Free cash flows (FCF) of a company are given below: Year(t) Free Cash Flows Other data 2007 $400000 2008 450000 2009 520000 2010 560000 2011 600000 Find out the Value of the Company. (5) 4. A bond has an annual coupon rate of 6 percent and 3 years to maturity. It has a yield to maturity of 8 percent with a face value of $1000. Calculate the modified duration of this bond. (5) 5. Face value of the Bond = $1000, Annual Coupon Payment = 10%, YTM = 12%, Maturity = 10 years, Reinvestment Rate = 11%, what would be the Semi- Annual Realized Compound Yield of this bond? (5) 6. Current dividend = $2.5, share price = $100, required return = 10%. constant growth rate=? (3) 3. Growth rate of FCF, beyond 2011 to infinity = 3% required rate of return = 9%

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The image contains a list of finance and investment questions related to bonds shares free cash flows and company valuation Ill address each of these numerically corresponding with the list in the ima...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started