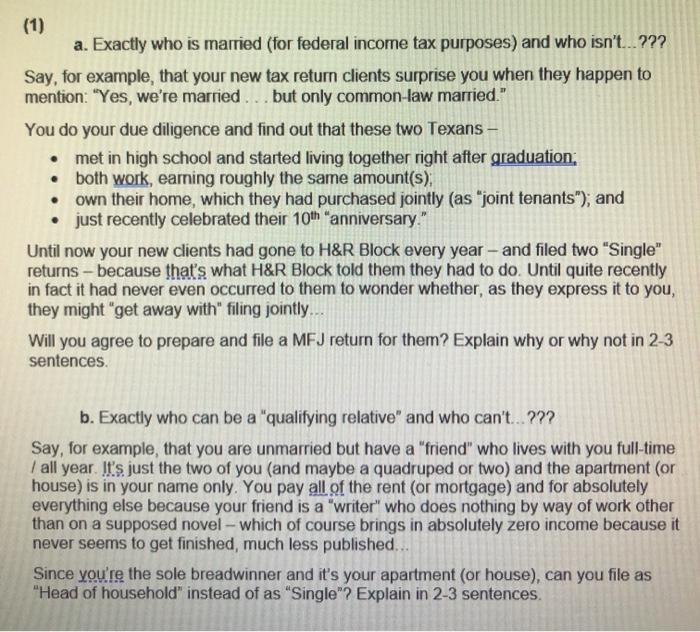

. (1) a. Exactly who is married (for federal income tax purposes) and who isn't...??? Say, for example, that your new tax return clients surprise you when they happen to mention: "Yes, we're married. but only common-law married." You do your due diligence and find out that these two Texans - met in high school and started living together right after graduation, both work, earning roughly the same amount(s); own their home, which they had purchased jointly (as "joint tenants"); and just recently celebrated their 10th anniversary." Until now your new clients had gone to H&R Block every year - and filed two "Single" returns - because that's what H&R Block told them they had to do. Until quite recently in fact it had never even occurred to them to wonder whether, as they express it to you, they might "get away with" filing jointly... Will you agree to prepare and file a MFJ return for them? Explain why or why not in 2-3 sentences b. Exactly who can be a "qualifying relative" and who can't..??? Say, for example, that you are unmarried but have a "friend" who lives with you full-time | all year. It's just the two of you (and maybe a quadruped or two) and the apartment (or house) is in your name only. You pay all of the rent (or mortgage) and for absolutely everything else because your friend is a "writer" who does nothing by way of work other than on a supposed novel - which of course brings in absolutely zero income because it never seems to get finished, much less published... Since you're the sole breadwinner and it's your apartment (or house), can you file as "Head of household" instead of as "Single"? Explain in 2-3 sentences. . (1) a. Exactly who is married (for federal income tax purposes) and who isn't...??? Say, for example, that your new tax return clients surprise you when they happen to mention: "Yes, we're married. but only common-law married." You do your due diligence and find out that these two Texans - met in high school and started living together right after graduation, both work, earning roughly the same amount(s); own their home, which they had purchased jointly (as "joint tenants"); and just recently celebrated their 10th anniversary." Until now your new clients had gone to H&R Block every year - and filed two "Single" returns - because that's what H&R Block told them they had to do. Until quite recently in fact it had never even occurred to them to wonder whether, as they express it to you, they might "get away with" filing jointly... Will you agree to prepare and file a MFJ return for them? Explain why or why not in 2-3 sentences b. Exactly who can be a "qualifying relative" and who can't..??? Say, for example, that you are unmarried but have a "friend" who lives with you full-time | all year. It's just the two of you (and maybe a quadruped or two) and the apartment (or house) is in your name only. You pay all of the rent (or mortgage) and for absolutely everything else because your friend is a "writer" who does nothing by way of work other than on a supposed novel - which of course brings in absolutely zero income because it never seems to get finished, much less published... Since you're the sole breadwinner and it's your apartment (or house), can you file as "Head of household" instead of as "Single"? Explain in 2-3 sentences