Question

1) According to Acosta's Classified Balance Sheet you prepared, what is the total current assets? Amount can be entered with or without commas. DO NOT

1) According to Acosta's Classified Balance Sheet you prepared, what is the total current assets? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

2) According to Acosta's Classified Balance Sheet you prepared, what is the total plant assets? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

3) According to Acosta's Classified Balance Sheet you prepared, what is the book value of the building? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

4) According to Acosta's Classified Balance Sheet you prepared, what is the total current liabilities? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

5) According to Acosta's Classified Balance Sheet you prepared, what is the total equity? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

6) According to Acosta's Classified Balance Sheet you prepared, what is the total liabilities and equity? Amount can be entered with or without commas. DO NOT include dollar signs or decimals.

7) How should the date in the header of this Classified Balance Sheet read?

A) Dec 31, 20xx

B) For the month ended Dec 31, 20xx

C) For the year ended Dec 31, 20xx

D) There is not enough information given the problem to determine this

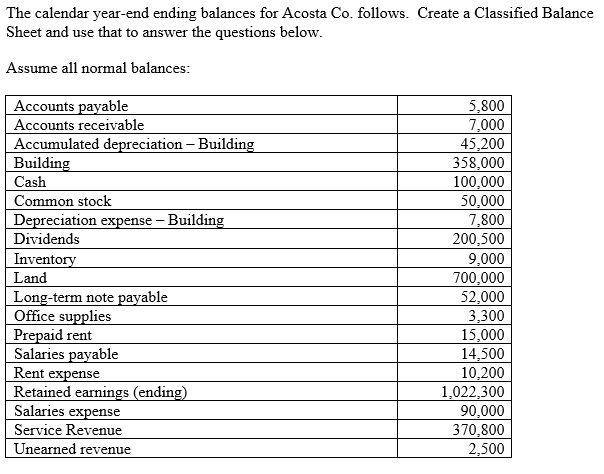

The calendar year-end ending balances for Acosta Co. follows. Create a Classified Balance Sheet and use that to answer the questions below. Assume all normal balances: Accounts payable Accounts receivable Accumulated depreciation - Building Building Cash Common stock Depreciation expense Building Dividends Inventory Land Long-term note payable Office supplies Prepaid rent Salaries payable Rent expense Retained earnings (ending) Salaries expense Service Revenue Unearned revenue 5,800 7,000 45,200 358,000 100,000 50,000 7,800 200,500 9,000 700,000 52,000 3,300 15,000 14,500 10,200 1,022,300 90,000 370,800 2,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started