Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. An investor is looking to finance the acquisition of a $31M property using both a firstlien mortgage and mezzanine financing. The stabilized underwritten NOI

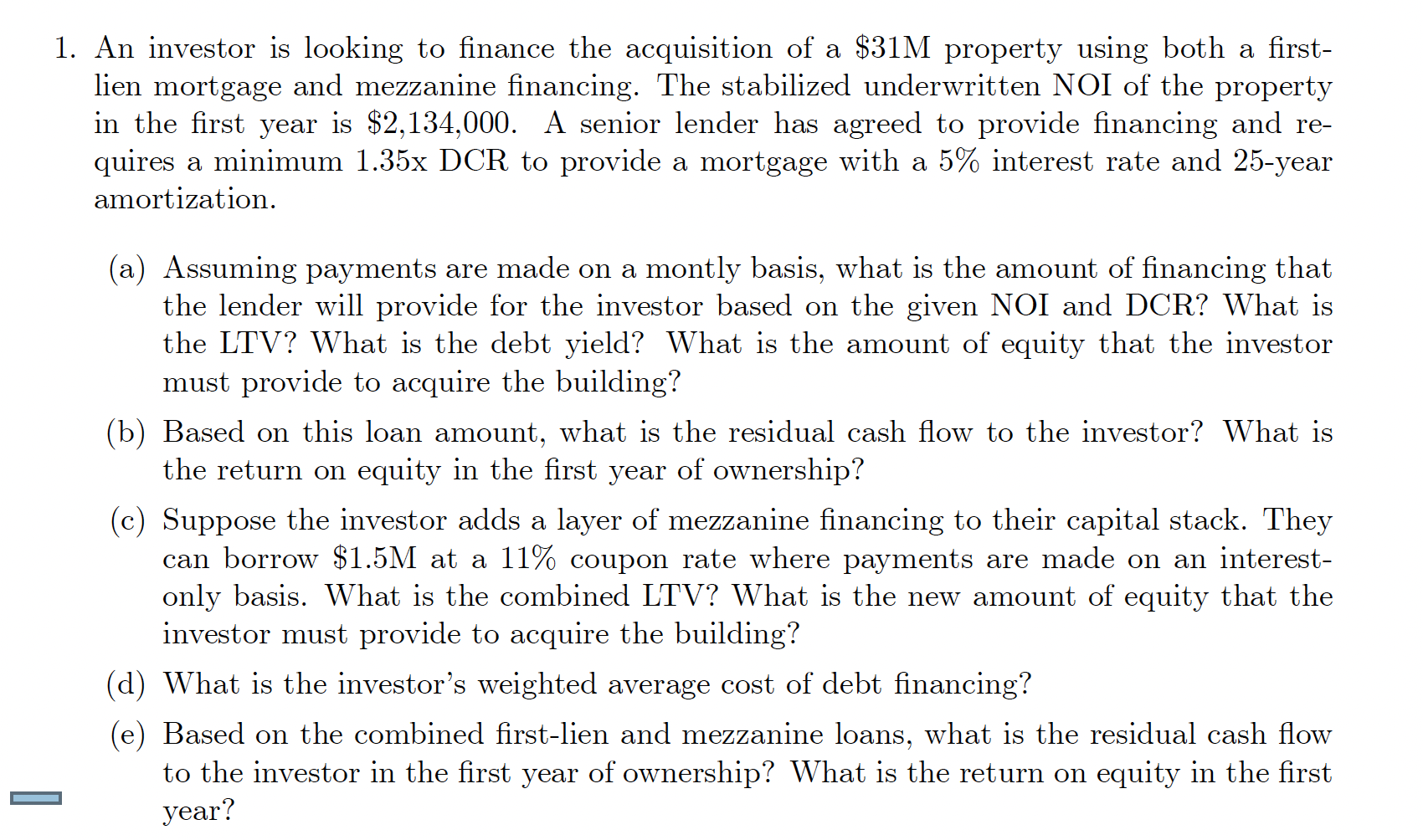

1. An investor is looking to finance the acquisition of a $31M property using both a firstlien mortgage and mezzanine financing. The stabilized underwritten NOI of the property in the first year is $2,134,000. A senior lender has agreed to provide financing and requires a minimum 1.35x DCR to provide a mortgage with a 5% interest rate and 25 -year amortization. (a) Assuming payments are made on a montly basis, what is the amount of financing that the lender will provide for the investor based on the given NOI and DCR? What is the LTV? What is the debt yield? What is the amount of equity that the investor must provide to acquire the building? (b) Based on this loan amount, what is the residual cash flow to the investor? What is the return on equity in the first year of ownership? (c) Suppose the investor adds a layer of mezzanine financing to their capital stack. They can borrow $1.5M at a 11% coupon rate where payments are made on an interestonly basis. What is the combined LTV? What is the new amount of equity that the investor must provide to acquire the building? (d) What is the investor's weighted average cost of debt financing? (e) Based on the combined first-lien and mezzanine loans, what is the residual cash flow to the investor in the first year of ownership? What is the return on equity in the first

1. An investor is looking to finance the acquisition of a $31M property using both a firstlien mortgage and mezzanine financing. The stabilized underwritten NOI of the property in the first year is $2,134,000. A senior lender has agreed to provide financing and requires a minimum 1.35x DCR to provide a mortgage with a 5% interest rate and 25 -year amortization. (a) Assuming payments are made on a montly basis, what is the amount of financing that the lender will provide for the investor based on the given NOI and DCR? What is the LTV? What is the debt yield? What is the amount of equity that the investor must provide to acquire the building? (b) Based on this loan amount, what is the residual cash flow to the investor? What is the return on equity in the first year of ownership? (c) Suppose the investor adds a layer of mezzanine financing to their capital stack. They can borrow $1.5M at a 11% coupon rate where payments are made on an interestonly basis. What is the combined LTV? What is the new amount of equity that the investor must provide to acquire the building? (d) What is the investor's weighted average cost of debt financing? (e) Based on the combined first-lien and mezzanine loans, what is the residual cash flow to the investor in the first year of ownership? What is the return on equity in the first Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started