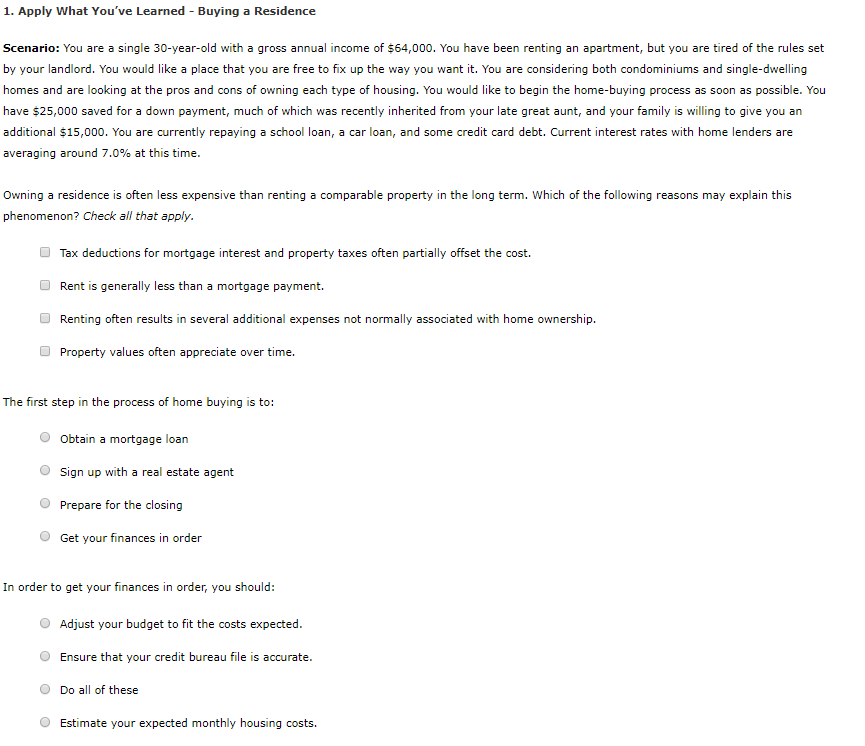

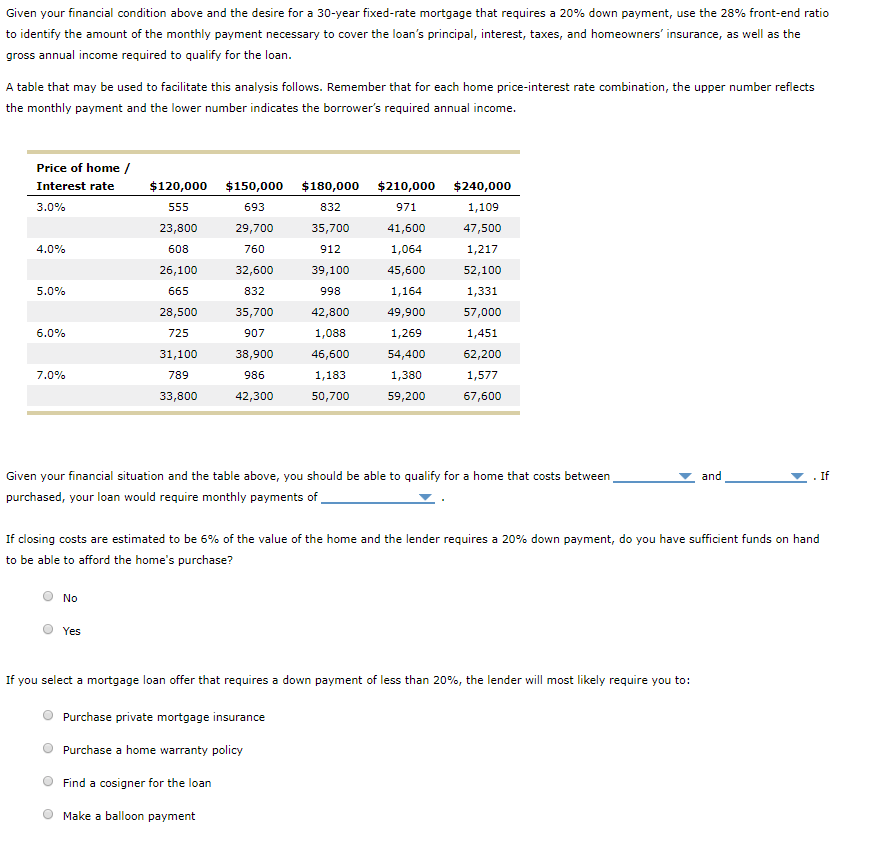

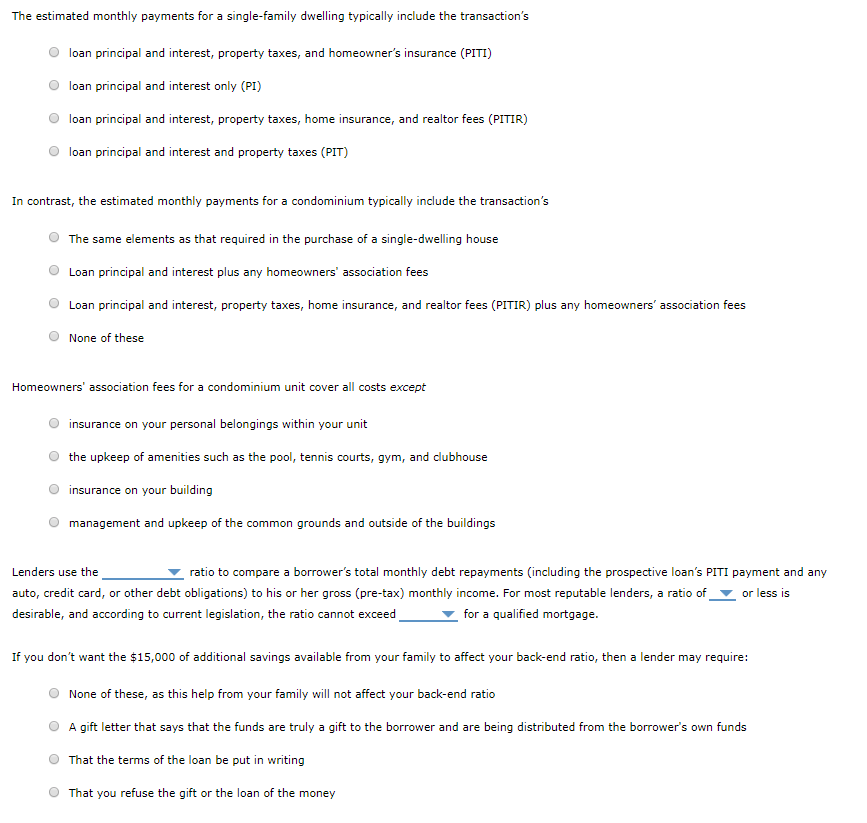

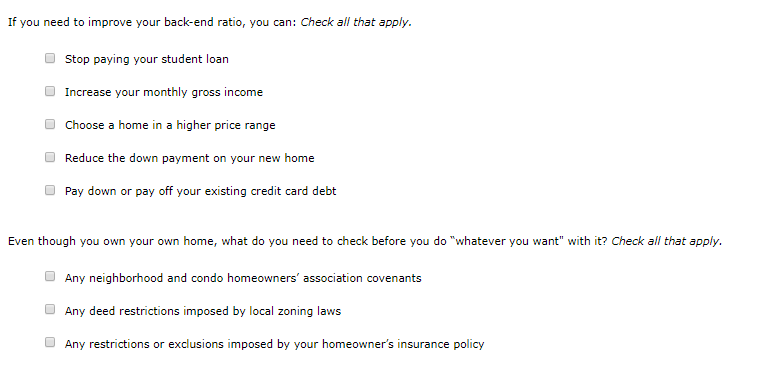

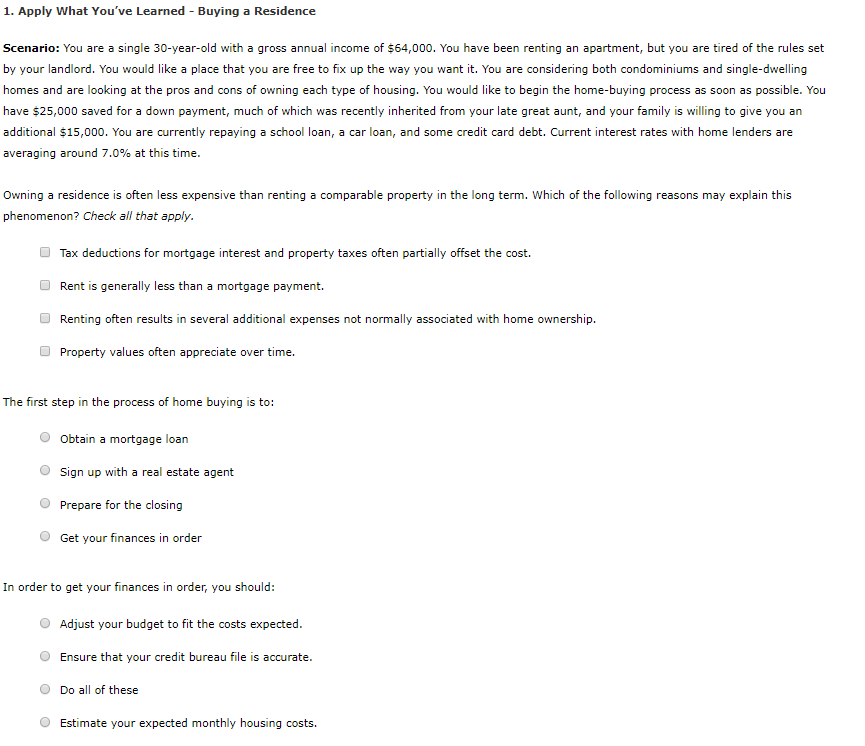

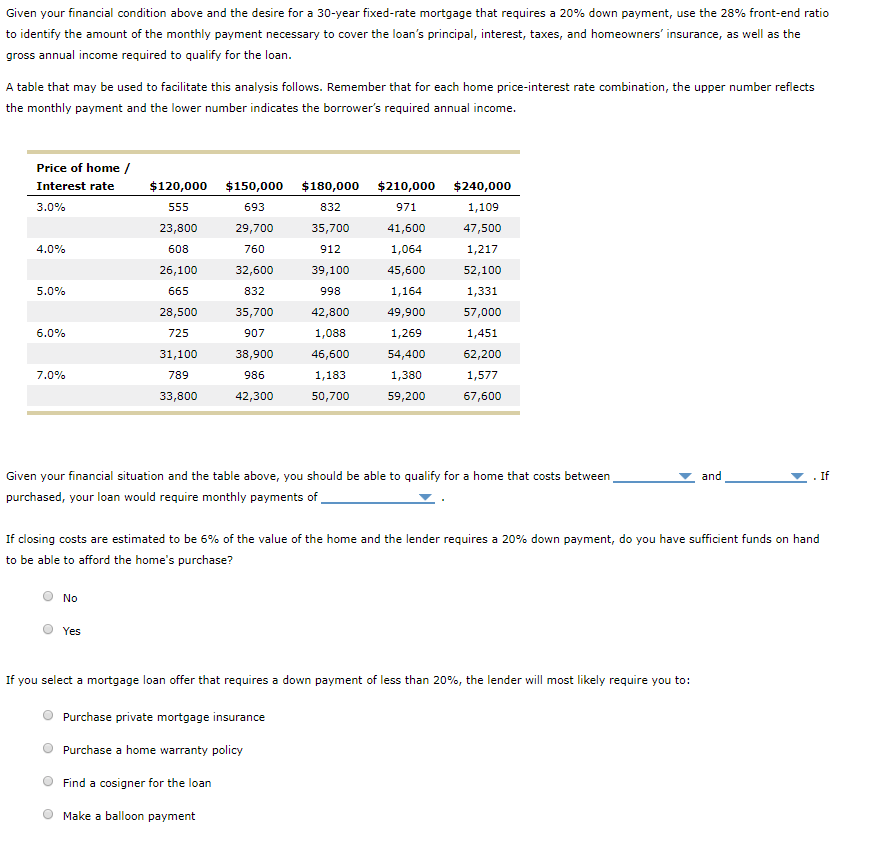

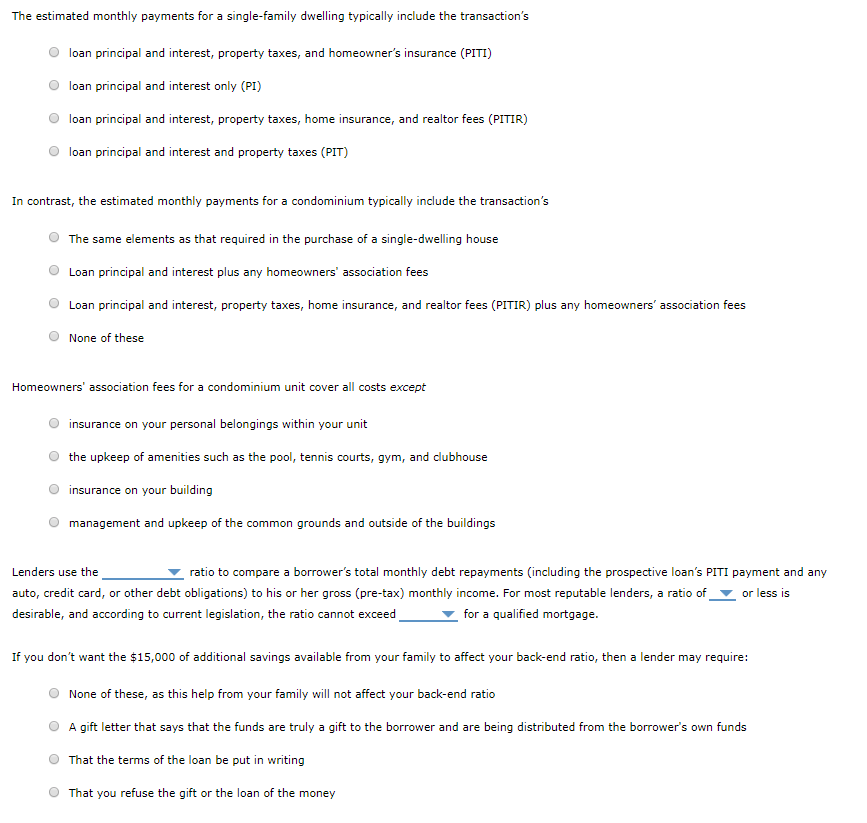

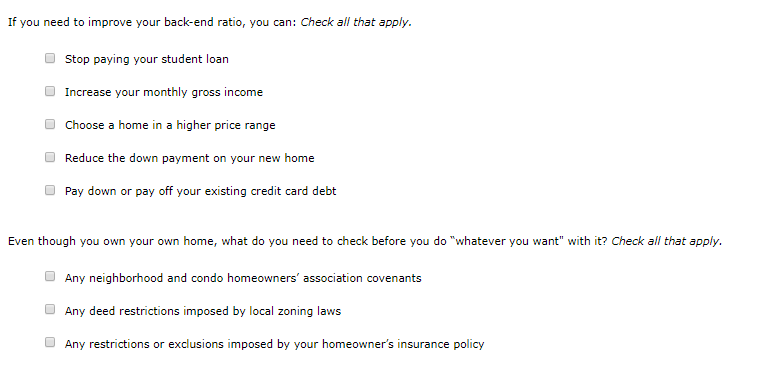

1. Apply What You've Learned - Buying a Residence Scenario: You are a single 30-year-old with a gross annual income of $64,000. You have been renting an apartment, but you are tired of the rules set by your landlord. You would like a place that you are free to fix up the way you want it. You are considering both condominiums and single-dwelling homes and are looking at the pros and cons of owning each type of housing. You would like to begin the home-buying process as soon as possible. You have $25,000 saved for a down payment, much of which was recently inherited from your late great aunt, and your family is willing to give you an additional $15,000. You are currently repaying a school loan, a car loan, and some credit card debt. Current interest rates with home lenders are averaging around 7.0% at this time. Owning a residence is often less expensive than renting a comparable property in the long term. Which of the following reasons may explain this phenomenon? Check all that apply. Tax deductions for mortgage interest and property taxes often partially offset the cost. Rent is generally less than a mortgage payment. Renting often results in several additional expenses not normally associated with home ownership. Property values often appreciate over time. The first step in the process of home buying is to: Obtain a mortgage loan Sign up with a real estate agent Prepare for the closing Get your finances in order In order to get your finances in order, you should: O Adjust your budget to fit the costs expected. Ensure that your credit bureau file is accurate. Do all of these Estimate your expected monthly housing costs. Given your financial condition above and the desire for a 30-year fixed-rate mortgage that requires a 20% down payment, use the 28% front-end ratio to identify the amount of the monthly payment necessary to cover the loan's principal, interest, taxes, and homeowners' insurance, as well as the gross annual income required to qualify for the loan. A table that may be used to facilitate this analysis follows. Remember that for each home price-interest rate combination, the upper number reflects the monthly payment and the lower number indicates the borrower's required annual income. Price of home/ Interest rate 3.0% 4.0% $120,000 555 23,800 608 26,100 665 28,500 725 31,100 789 33,800 $150,000 693 29,700 760 32,600 832 35,700 907 38,900 $180,000 832 35,700 912 39,100 998 42,800 1,088 46,600 5.0% $210,000 971 41,600 1,064 45,600 1,164 49,900 1,269 54,400 1,380 59,200 $240,000 1,109 47,500 1,217 52,100 1,331 57,000 1,451 62,200 1,577 67,600 6.0% 7.0% 986 42,300 1,105 50,700 and . If Given your financial situation and the table above, you should be able to qualify for a home that costs between purchased, your loan would require monthly payments of If closing costs are estimated to be 6% of the value of the home and the lender requires a 20% down payment, do you have sufficient funds on hand to be able to afford the home's purchase? No Yes If you select a mortgage loan offer that requires a down payment of less than 20%, the lender will most likely require you to: Purchase private mortgage insurance Purchase a home warranty policy Find a cosigner for the loan Make a balloon payment The estimated monthly payments for a single-family dwelling typically include the transaction's loan principal and interest, property taxes, and homeowner's insurance (PITI) O loan principal and interest only (PI) loan principal and interest, property taxes, home insurance, and realtor fees (PITIR) loan principal and interest and property taxes (PIT) In contrast, the estimated monthly payments for a condominium typically include the transaction's The same elements as that required in the purchase of a single-dwelling house Loan principal and interest plus any homeowners' association fees Loan principal and interest, property taxes, home insurance, and realtor fees (PITIR) plus any homeowners' association fees None of these Homeowners' association fees for a condominium unit cover all costs except insurance on your personal belongings within your unit the upkeep of amenities such as the pool, tennis courts, gym, and clubhouse insurance on your building management and upkeep of the common grounds and outside of the buildings Lenders use the ratio to compare a borrower's total monthly debt repayments (including the prospective loan's PITI payment and any auto, credit card, or other debt obligations) to his or her gross (pre-tax) monthly income. For most reputable lenders, a ratio of or less is desirable, and according to current legislation, the ratio cannot exceed for a qualified mortgage. If you don't want the $15,000 of additional savings available from your family to affect your back-end ratio, then a lender may require: None of these, as this help from your family will not affect your back-end ratio O A gift letter that says that the funds are truly a gift to the borrower and are being distributed from the borrower's own funds That the terms of the loan be put in writing That you refuse the gift or the loan of the money If you need to improve your back-end ratio, you can: Check all that apply. Stop paying your student loan Increase your monthly gross income Choose a home in a higher price range Reduce the down payment on your new home Pay down or pay off your existing credit card debt Even though you own your own home, what do you need to check before you do "whatever you want" with it? Check all that apply. Any neighborhood and condo homeowners' association covenants Any deed restrictions imposed by local zoning laws Any restrictions or exclusions imposed by your homeowner's insurance policy 1. Apply What You've Learned - Buying a Residence Scenario: You are a single 30-year-old with a gross annual income of $64,000. You have been renting an apartment, but you are tired of the rules set by your landlord. You would like a place that you are free to fix up the way you want it. You are considering both condominiums and single-dwelling homes and are looking at the pros and cons of owning each type of housing. You would like to begin the home-buying process as soon as possible. You have $25,000 saved for a down payment, much of which was recently inherited from your late great aunt, and your family is willing to give you an additional $15,000. You are currently repaying a school loan, a car loan, and some credit card debt. Current interest rates with home lenders are averaging around 7.0% at this time. Owning a residence is often less expensive than renting a comparable property in the long term. Which of the following reasons may explain this phenomenon? Check all that apply. Tax deductions for mortgage interest and property taxes often partially offset the cost. Rent is generally less than a mortgage payment. Renting often results in several additional expenses not normally associated with home ownership. Property values often appreciate over time. The first step in the process of home buying is to: Obtain a mortgage loan Sign up with a real estate agent Prepare for the closing Get your finances in order In order to get your finances in order, you should: O Adjust your budget to fit the costs expected. Ensure that your credit bureau file is accurate. Do all of these Estimate your expected monthly housing costs. Given your financial condition above and the desire for a 30-year fixed-rate mortgage that requires a 20% down payment, use the 28% front-end ratio to identify the amount of the monthly payment necessary to cover the loan's principal, interest, taxes, and homeowners' insurance, as well as the gross annual income required to qualify for the loan. A table that may be used to facilitate this analysis follows. Remember that for each home price-interest rate combination, the upper number reflects the monthly payment and the lower number indicates the borrower's required annual income. Price of home/ Interest rate 3.0% 4.0% $120,000 555 23,800 608 26,100 665 28,500 725 31,100 789 33,800 $150,000 693 29,700 760 32,600 832 35,700 907 38,900 $180,000 832 35,700 912 39,100 998 42,800 1,088 46,600 5.0% $210,000 971 41,600 1,064 45,600 1,164 49,900 1,269 54,400 1,380 59,200 $240,000 1,109 47,500 1,217 52,100 1,331 57,000 1,451 62,200 1,577 67,600 6.0% 7.0% 986 42,300 1,105 50,700 and . If Given your financial situation and the table above, you should be able to qualify for a home that costs between purchased, your loan would require monthly payments of If closing costs are estimated to be 6% of the value of the home and the lender requires a 20% down payment, do you have sufficient funds on hand to be able to afford the home's purchase? No Yes If you select a mortgage loan offer that requires a down payment of less than 20%, the lender will most likely require you to: Purchase private mortgage insurance Purchase a home warranty policy Find a cosigner for the loan Make a balloon payment The estimated monthly payments for a single-family dwelling typically include the transaction's loan principal and interest, property taxes, and homeowner's insurance (PITI) O loan principal and interest only (PI) loan principal and interest, property taxes, home insurance, and realtor fees (PITIR) loan principal and interest and property taxes (PIT) In contrast, the estimated monthly payments for a condominium typically include the transaction's The same elements as that required in the purchase of a single-dwelling house Loan principal and interest plus any homeowners' association fees Loan principal and interest, property taxes, home insurance, and realtor fees (PITIR) plus any homeowners' association fees None of these Homeowners' association fees for a condominium unit cover all costs except insurance on your personal belongings within your unit the upkeep of amenities such as the pool, tennis courts, gym, and clubhouse insurance on your building management and upkeep of the common grounds and outside of the buildings Lenders use the ratio to compare a borrower's total monthly debt repayments (including the prospective loan's PITI payment and any auto, credit card, or other debt obligations) to his or her gross (pre-tax) monthly income. For most reputable lenders, a ratio of or less is desirable, and according to current legislation, the ratio cannot exceed for a qualified mortgage. If you don't want the $15,000 of additional savings available from your family to affect your back-end ratio, then a lender may require: None of these, as this help from your family will not affect your back-end ratio O A gift letter that says that the funds are truly a gift to the borrower and are being distributed from the borrower's own funds That the terms of the loan be put in writing That you refuse the gift or the loan of the money If you need to improve your back-end ratio, you can: Check all that apply. Stop paying your student loan Increase your monthly gross income Choose a home in a higher price range Reduce the down payment on your new home Pay down or pay off your existing credit card debt Even though you own your own home, what do you need to check before you do "whatever you want" with it? Check all that apply. Any neighborhood and condo homeowners' association covenants Any deed restrictions imposed by local zoning laws Any restrictions or exclusions imposed by your homeowner's insurance policy