Question

Data concerning Marchman Corporation's single product appear below. The company is currently selling 4,000 units per month. Fixed expenses are $166,000 per month. The marketing

Data concerning Marchman Corporation's single product appear below. The company is currently selling 4,000 units per month. Fixed expenses are $166,000 per month. The marketing manager believes that a $6,000 increase in the monthly advertising budget would result in a 130 unit increase in monthly sales. What effect will this increase have on the overall company's monthly net operating income?

A. Increase of $240

B. Decrease of $6,240

C. Increase of $6,000

D. Decrease of $240

What would be the revised net operating income per month if the sales volume increases by 90 units?

A. $61,950 B. $57,360 C. $61.950 D. $60,240

| Cash Sales | Credit Sales | |

| January | $80,000 | $350,000 |

| February | $60,000 | $200,000 |

| March | $50,000 | $145,000 |

Richards Corporation has the following budgeted sales for the first quarter of the next year: The company is in the process of preparing a cash budget and must determine the expected cash collections by month. Because Richards Corporation historically has very few uncollectable accounts, all credit sales are expected to be fully collected by the end of the second month following the sale. Based on the historical information, the following information has been assembled. Collection on credit sales: 60% in month of sale 30% in month following sale 10% in second month following sale Richards Corporation's credit sales were $150,000 in December and $100,000 in November. The total cash collected in January would be: O $270,000 O $345.000 O $420.000 O $360.000

Poriss Corporation is in the process of preparing its annual cash budget. Various department managers have submitted the following disbursements as items that should be included in the cash budget. Advertising $42,000 Office equipment depreciation $210,000 Executive salaries $198.000 Equipment purchases $110,000 What is the total of these amounts that should be included in the cash budget? O $560,000 O $240,000 O $450,000 O $350,000

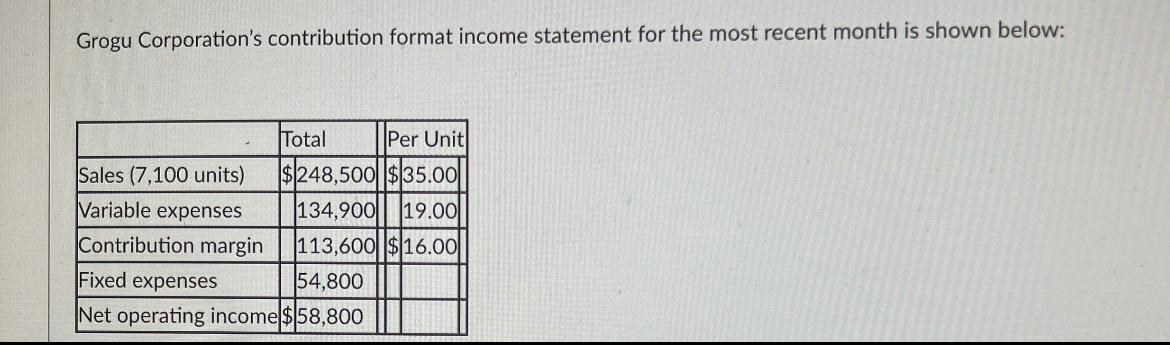

Grogu Corporation's contribution format income statement for the most recent month is shown below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started