Answered step by step

Verified Expert Solution

Question

1 Approved Answer

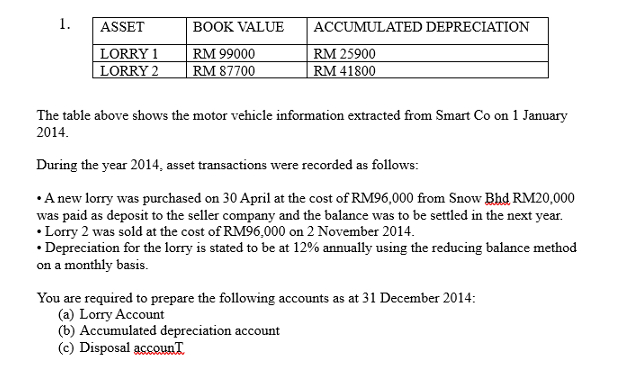

1. ASSET BOOK VALUE ACCUMULATED DEPRECIATION LORRY 1 LORRY 2 RM 99000 RM 25900 RM 87700 RM 41800 The table above shows the motor

1. ASSET BOOK VALUE ACCUMULATED DEPRECIATION LORRY 1 LORRY 2 RM 99000 RM 25900 RM 87700 RM 41800 The table above shows the motor vehicle information extracted from Smart Co on 1 January 2014. During the year 2014, asset transactions were recorded as follows: A new lorry was purchased on 30 April at the cost of RM96,000 from Snow Bhd RM20,000 was paid as deposit to the seller company and the balance was to be settled in the next year. Lorry 2 was sold at the cost of RM96,000 on 2 November 2014. Depreciation for the lorry is stated to be at 12% annually using the reducing balance method on a monthly basis. You are required to prepare the following accounts as at 31 December 2014: (a) Lorry Account (b) Accumulated depreciation account (c) Disposal account.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Lorry Account as at 31 December 2014 Debit Credit Opening Balance Purchase of New Lorry ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started