Question

1. Assume that Cane expects to produce and sell 100,000 Alphas during the current year. One of Cane's sales representatives has found a new customer

1. Assume that Cane expects to produce and sell 100,000 Alphas during the current year. One of Cane's sales representatives has found a new customer who is willing to buy 30,000 additional Alphas for a price of $160 per unit. What is the financial advantage (disadvantage) of accepting the new customer's order?

2. Assume that Cane expects to produce and sell 110,000 Betas during the current year. One of Canes sales representatives has found a new customer who is willing to buy 2,000 additional Betas for a price of $83 per unit. What is the financial advantage (disadvantage) of accepting the new customer's order?

3. Assume that Cane normally produces and sells 60,000 Betas per year. What is the financial advantage (disadvantage) of discontinuing the Beta product line?

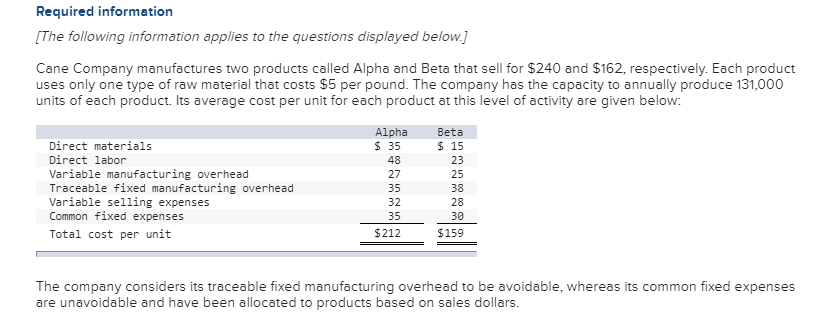

Required information The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $240 and $162, respectively. Each product uses only one type of raw material that costs $5 per pound. The company has the capacity to annually produce 131,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Beta $ 15 23 25 Alpha $ 35 48 27 35 32 35 $212 Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit 28 30 $159 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollarsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started