Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me with this. I need it by Sunday, March 14, 2021. It would be greatly appreciated. Xtral 16-1 APPLICATION PROBLEM Journalizing

Can someone please help me with this. I need it by Sunday, March 14, 2021. It would be greatly appreciated.

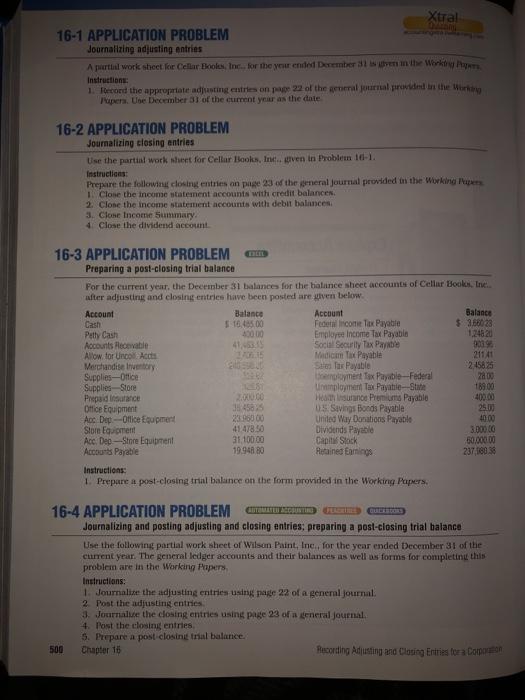

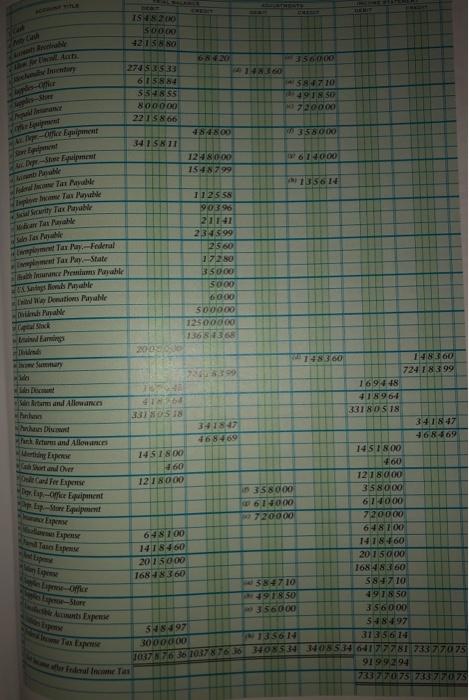

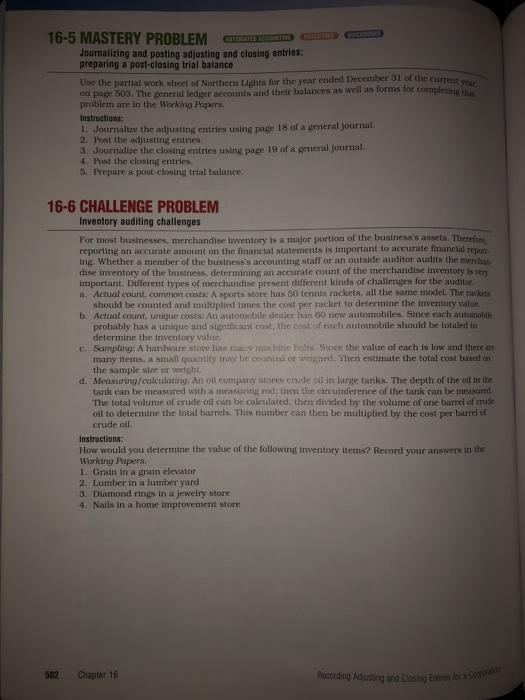

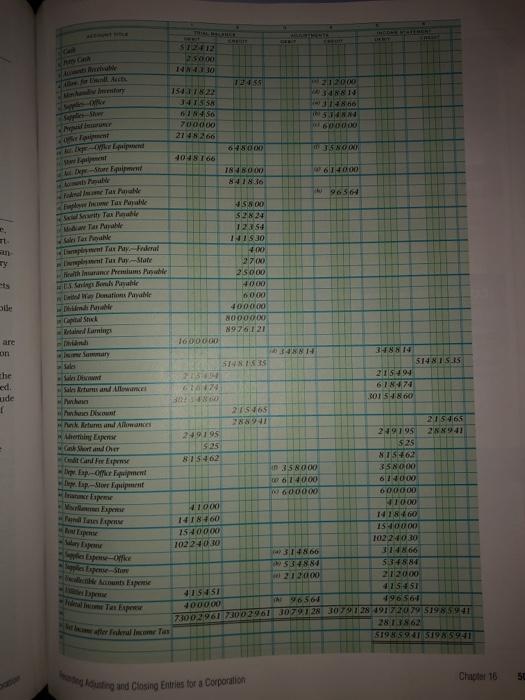

Xtral 16-1 APPLICATION PROBLEM Journalizing adjusting entries Apuertal work sheet fer Cellar Books, Inc.. for the your ended December 31 w when the Work Instructions: 1 loecond the appropriate adjusting entries on pe 22 of the real journal provided in the Working fupera. Une December 31 of the current year as the date 16-2 APPLICATION PROBLEM Journalizing closing entries Use the partial work sheet for Cellar Books, Instven in Problem 1-1. Instructions Prepare the following closing entries on page 23 of the general journal provided in the Working Papers Close the income statement accounts with credit balance 2. Clone the income statement accounts with debut balances 3. Clone Income Summary 4 Close the dividend account 16-3 APPLICATION PROBLEM Preparing a post-closing trial balance For the current year, the December 31 balances for the balance sheet accounts of Cellar Books, ne after adjusting and closing entries have been posted are uiven below. Account Balance Account Balance Cash 10.4500 Fri come Tax Payable $ 3.68028 Petly Cash 40000 Employee Income Tax Payable 1.24820 Accounts lovable Social Security Tax Payne 9019 Allow for Uncos Acct 17 Medicin Tax Payable 21141 Merchandise ventory Sales Tax Payable 2 15875 Supplies-Office nament Tax Payable - Federal 2000 Supplies Store Uployment Tax Payatie-Stile 189.00 Prepaid sace Hamsun Premiums Payable 400.00 Office Equipment 38458 US Savings Bonds Payable 25.00 Ane De-Office Equipment 2396000 United Way Donations Payable 40.00 Slom Egent 41 478.54 Dividends Payable 3.000.00 Ace Dep-Store Equipment 31 100.00 Capit Stock 60.000.00 Accounts Payable 19.94889 Retained Earnings 237160 Instructions: 1. Prepare a post-closing trial balance on the form provided in the Working Papers, 16-4 APPLICATION PROBLEM Journalizing and posting adjusting and closing entries, preparing a post-closing trial balance Use the following partial work sheet of Wilson Paint, Inc., for the year ended December 31 of the current year. The general ledger accounts and their balances as well as forms for completing this problem are in the Working Papers Instructions: 1. Journalise the adjusting entries using page 22 of a general Journal 2 Post the adjusting entries 3. Journalve the closing entries using page 23 of a general Journal 4. Post the closing entries 5. Prepare a post closing trial balance 500 Chapter 16 Recording Adjusting and Closing Entries toza Coron ISHS210 500.00 4213880 w www Dey-Stella Lim Pow Tax Route als Tas Federal Tarp-State Channel is mahl Destions Payable Dabar trwarming 09 ESEL DA 20 350.000 274 5533 615884 584710 554855 150 800000 790000 2215866 484800 35800 34 15811 1248000 6 14000 15487.99 13561 TI 25 58 90396 21141 234599 2560 17280 3 5000 500D 6000 500000 12500000 136836 00 148360 724 18 399 1694 48 189644 3310518 331 80 518 341847 341847 168769 468-469 1451 800 1451 800 60 460 1278000 1218000 358000 358000 614000 674000 2720000 720000 648100 64800 141 84.60 147860 20 15000 20 1 5 000 168483 60 16878360 3847 10 38 710 918.50 49 1850 356000 356 000 548797 548497 135614 3135614 3000 000 7037763810378763834080534 WHITE 81 73377075 9199294 733 70 75 783 77075 Wide San Raman Ali Hilanhan Panik mand Allonne kup-office Equipment to tapetes Tape Arts Expo del was 16-5 MASTERY PROBLEM Journalizing and posting adjusting and closing entries: preparing a post-closing trial balance Use the partial work sheet of Northern Lights for the year ended December 31 of the current you on pode 503. The general ledger accounts and their balances as well as forms for completing the problem are in the Working Papers Instructions: 1. Journalize the adjusting entries using page 18 of a general Journal 2. Post the adjusting entries 3. Journalize the closing entries using page 19 of a general Journal 4. Post the closing entries 5. Prepare a post-closing trial balance. 16-6 CHALLENGE PROBLEM Inventory auditing challenges For most businesses, merchandise inventory is a major portion of the business's assets. Therefore reporting an accurate amount on the financial statement is important to accurate financial repen Ing. Whether a member of the business's accounting staff or an outside auditor audits the merchas dise Inventory of the business, determining an accurate count of the merchandise inventory is en important. Different types of merchandise present different kinds of challenges for the auditor . Actual count, common costs: A sports store has 50 tennis rackets, all the same model. The tackets should be counted and multiplied times the cost per racket to determine the inventory value b. Actual count unique costs: An automobile dealer han 60 new automobiles. Since each automobile probably has a unique and staticant cost, the cost of each automobile should be totaled to determine the inventory value C. Sampling: A hardware store has noche bolts. Since the value of each is low and there are many items, a small quantity trhy bit counted or ext. Then estimate the total cost based on the sample size or watchi d. Measuring/calculating: An oil company toeschide olin large tanks. The depth of the all the tank can be measured with a measuring col then the circumference of the tank can be measured The total volume of crude oil can be calculated, the divided by the volume of one barrel of crude oll to determine the total barrels. This number can then be multplied by the cost per barrel of crude oil Instructions How would you determine the value of the following inventory items? Record your answers in the Working Papers. 1. Grain in a grain elevator 2. Lumber in a lumber yard 3. Diamond rings in a Jewelry Store 4. Nails in a home Improvement store 502 Chapter 16 51212 500 NNHO NG SSFET 15417822 1558 IN 50 700000 214266 DOO 34 48 ANN WOWO 648.000 NON 4048 766 614000 BOON 8418:36 H9596 HEIC are on FREE SENS the ed PER uide r +5800 52824 Ma Tarmak 12:51 INI930 Wap Tau-deral KO Tax-State 27 (NO hinnamomums Powe 25000 +000 We Donation 60.00 4000.00 1000000 and Laming 8976121 1600000 37814 514815.15 DE 21594 61 874 201 5800 hudo De 21565 hak ruman Al 2889 215465 Meny 29195 249195 2941 Sul Cher 525 525 815462 81562 lap- opere in 35 8000 Dep. Lap-Strippen 674000 W 600 000 1000 1000 1418160 1418760 1540000 2540000 102 24030 10224030 314866 31466 534884 5:37814 2120 21 2000 415451 15451 400000 Th6564 19656 7300.2961730029613079728 307972819172079 51983941 281862 be the finderal Income Tus 519858451985441 000NSE 00019 000009 an wspom Chapter 16 50 out and Closing Entries for a Corporation Xtral 16-1 APPLICATION PROBLEM Journalizing adjusting entries Apuertal work sheet fer Cellar Books, Inc.. for the your ended December 31 w when the Work Instructions: 1 loecond the appropriate adjusting entries on pe 22 of the real journal provided in the Working fupera. Une December 31 of the current year as the date 16-2 APPLICATION PROBLEM Journalizing closing entries Use the partial work sheet for Cellar Books, Instven in Problem 1-1. Instructions Prepare the following closing entries on page 23 of the general journal provided in the Working Papers Close the income statement accounts with credit balance 2. Clone the income statement accounts with debut balances 3. Clone Income Summary 4 Close the dividend account 16-3 APPLICATION PROBLEM Preparing a post-closing trial balance For the current year, the December 31 balances for the balance sheet accounts of Cellar Books, ne after adjusting and closing entries have been posted are uiven below. Account Balance Account Balance Cash 10.4500 Fri come Tax Payable $ 3.68028 Petly Cash 40000 Employee Income Tax Payable 1.24820 Accounts lovable Social Security Tax Payne 9019 Allow for Uncos Acct 17 Medicin Tax Payable 21141 Merchandise ventory Sales Tax Payable 2 15875 Supplies-Office nament Tax Payable - Federal 2000 Supplies Store Uployment Tax Payatie-Stile 189.00 Prepaid sace Hamsun Premiums Payable 400.00 Office Equipment 38458 US Savings Bonds Payable 25.00 Ane De-Office Equipment 2396000 United Way Donations Payable 40.00 Slom Egent 41 478.54 Dividends Payable 3.000.00 Ace Dep-Store Equipment 31 100.00 Capit Stock 60.000.00 Accounts Payable 19.94889 Retained Earnings 237160 Instructions: 1. Prepare a post-closing trial balance on the form provided in the Working Papers, 16-4 APPLICATION PROBLEM Journalizing and posting adjusting and closing entries, preparing a post-closing trial balance Use the following partial work sheet of Wilson Paint, Inc., for the year ended December 31 of the current year. The general ledger accounts and their balances as well as forms for completing this problem are in the Working Papers Instructions: 1. Journalise the adjusting entries using page 22 of a general Journal 2 Post the adjusting entries 3. Journalve the closing entries using page 23 of a general Journal 4. Post the closing entries 5. Prepare a post closing trial balance 500 Chapter 16 Recording Adjusting and Closing Entries toza Coron ISHS210 500.00 4213880 w www Dey-Stella Lim Pow Tax Route als Tas Federal Tarp-State Channel is mahl Destions Payable Dabar trwarming 09 ESEL DA 20 350.000 274 5533 615884 584710 554855 150 800000 790000 2215866 484800 35800 34 15811 1248000 6 14000 15487.99 13561 TI 25 58 90396 21141 234599 2560 17280 3 5000 500D 6000 500000 12500000 136836 00 148360 724 18 399 1694 48 189644 3310518 331 80 518 341847 341847 168769 468-469 1451 800 1451 800 60 460 1278000 1218000 358000 358000 614000 674000 2720000 720000 648100 64800 141 84.60 147860 20 15000 20 1 5 000 168483 60 16878360 3847 10 38 710 918.50 49 1850 356000 356 000 548797 548497 135614 3135614 3000 000 7037763810378763834080534 WHITE 81 73377075 9199294 733 70 75 783 77075 Wide San Raman Ali Hilanhan Panik mand Allonne kup-office Equipment to tapetes Tape Arts Expo del was 16-5 MASTERY PROBLEM Journalizing and posting adjusting and closing entries: preparing a post-closing trial balance Use the partial work sheet of Northern Lights for the year ended December 31 of the current you on pode 503. The general ledger accounts and their balances as well as forms for completing the problem are in the Working Papers Instructions: 1. Journalize the adjusting entries using page 18 of a general Journal 2. Post the adjusting entries 3. Journalize the closing entries using page 19 of a general Journal 4. Post the closing entries 5. Prepare a post-closing trial balance. 16-6 CHALLENGE PROBLEM Inventory auditing challenges For most businesses, merchandise inventory is a major portion of the business's assets. Therefore reporting an accurate amount on the financial statement is important to accurate financial repen Ing. Whether a member of the business's accounting staff or an outside auditor audits the merchas dise Inventory of the business, determining an accurate count of the merchandise inventory is en important. Different types of merchandise present different kinds of challenges for the auditor . Actual count, common costs: A sports store has 50 tennis rackets, all the same model. The tackets should be counted and multiplied times the cost per racket to determine the inventory value b. Actual count unique costs: An automobile dealer han 60 new automobiles. Since each automobile probably has a unique and staticant cost, the cost of each automobile should be totaled to determine the inventory value C. Sampling: A hardware store has noche bolts. Since the value of each is low and there are many items, a small quantity trhy bit counted or ext. Then estimate the total cost based on the sample size or watchi d. Measuring/calculating: An oil company toeschide olin large tanks. The depth of the all the tank can be measured with a measuring col then the circumference of the tank can be measured The total volume of crude oil can be calculated, the divided by the volume of one barrel of crude oll to determine the total barrels. This number can then be multplied by the cost per barrel of crude oil Instructions How would you determine the value of the following inventory items? Record your answers in the Working Papers. 1. Grain in a grain elevator 2. Lumber in a lumber yard 3. Diamond rings in a Jewelry Store 4. Nails in a home Improvement store 502 Chapter 16 51212 500 NNHO NG SSFET 15417822 1558 IN 50 700000 214266 DOO 34 48 ANN WOWO 648.000 NON 4048 766 614000 BOON 8418:36 H9596 HEIC are on FREE SENS the ed PER uide r +5800 52824 Ma Tarmak 12:51 INI930 Wap Tau-deral KO Tax-State 27 (NO hinnamomums Powe 25000 +000 We Donation 60.00 4000.00 1000000 and Laming 8976121 1600000 37814 514815.15 DE 21594 61 874 201 5800 hudo De 21565 hak ruman Al 2889 215465 Meny 29195 249195 2941 Sul Cher 525 525 815462 81562 lap- opere in 35 8000 Dep. Lap-Strippen 674000 W 600 000 1000 1000 1418160 1418760 1540000 2540000 102 24030 10224030 314866 31466 534884 5:37814 2120 21 2000 415451 15451 400000 Th6564 19656 7300.2961730029613079728 307972819172079 51983941 281862 be the finderal Income Tus 519858451985441 000NSE 00019 000009 an wspom Chapter 16 50 out and Closing Entries for a Corporation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started