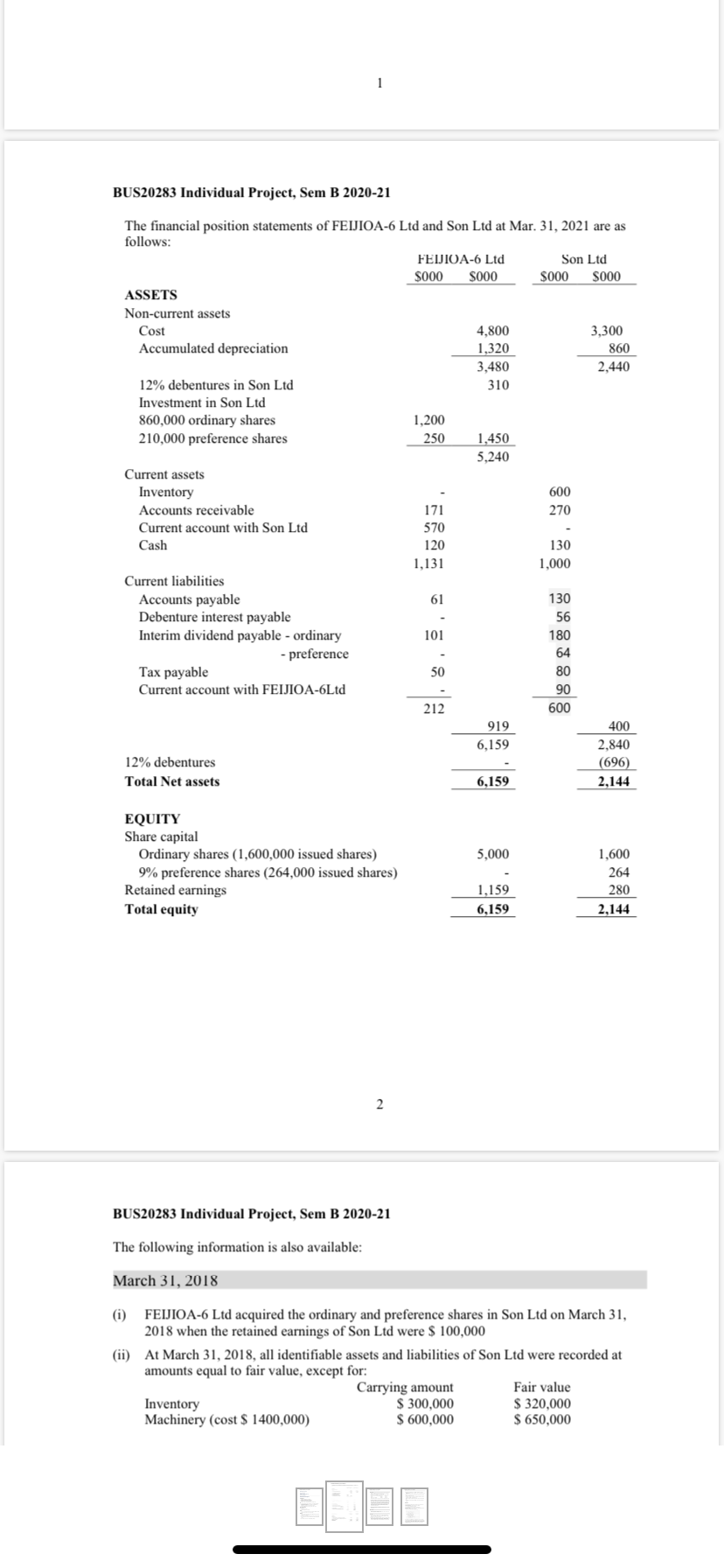

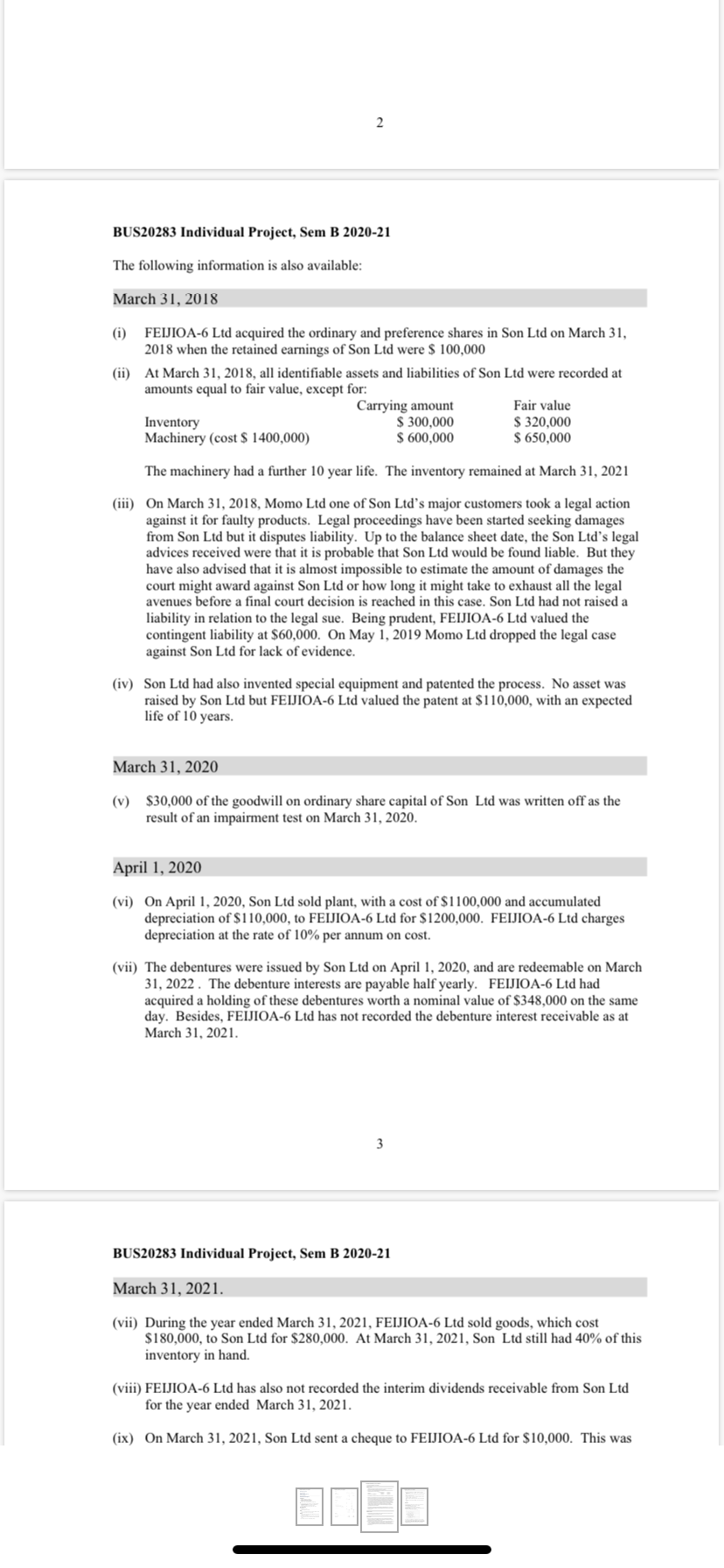

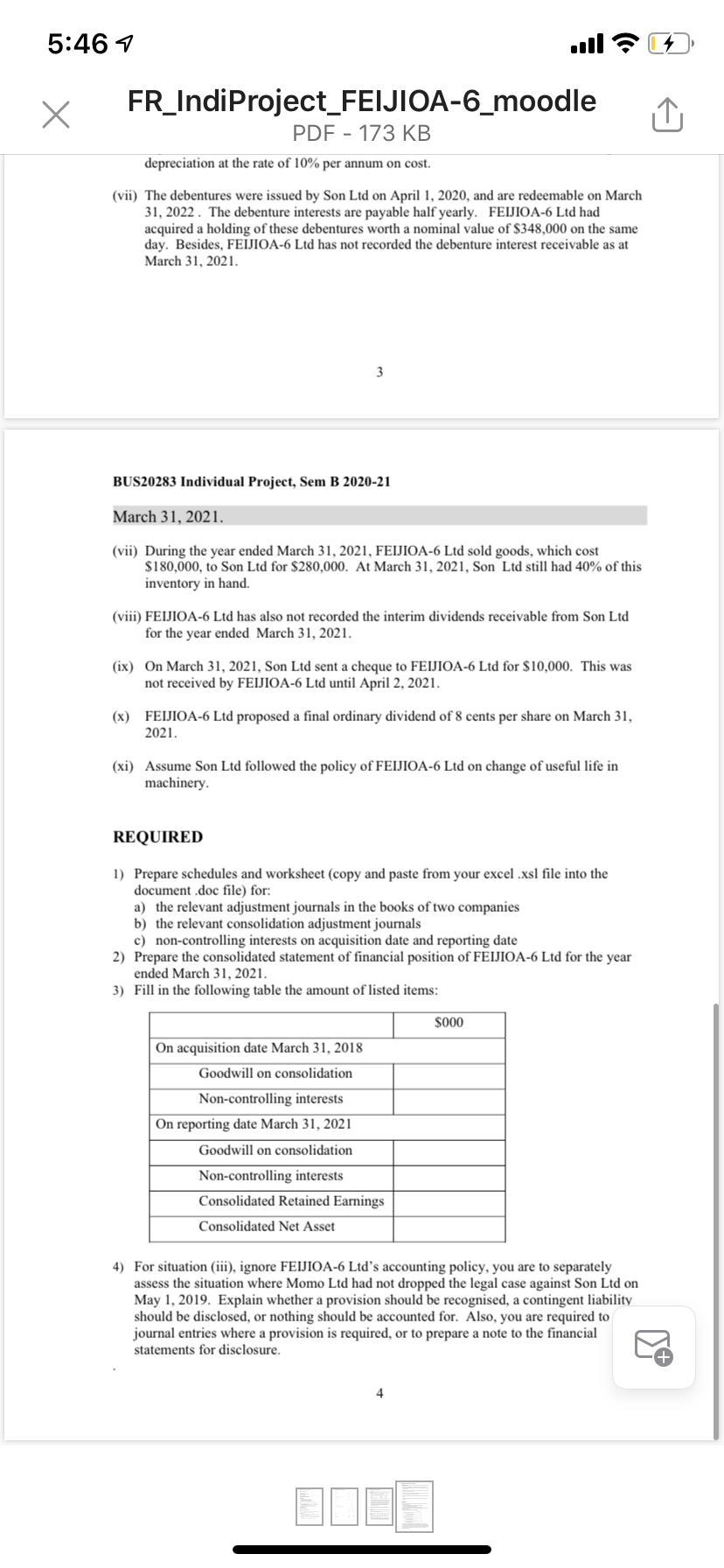

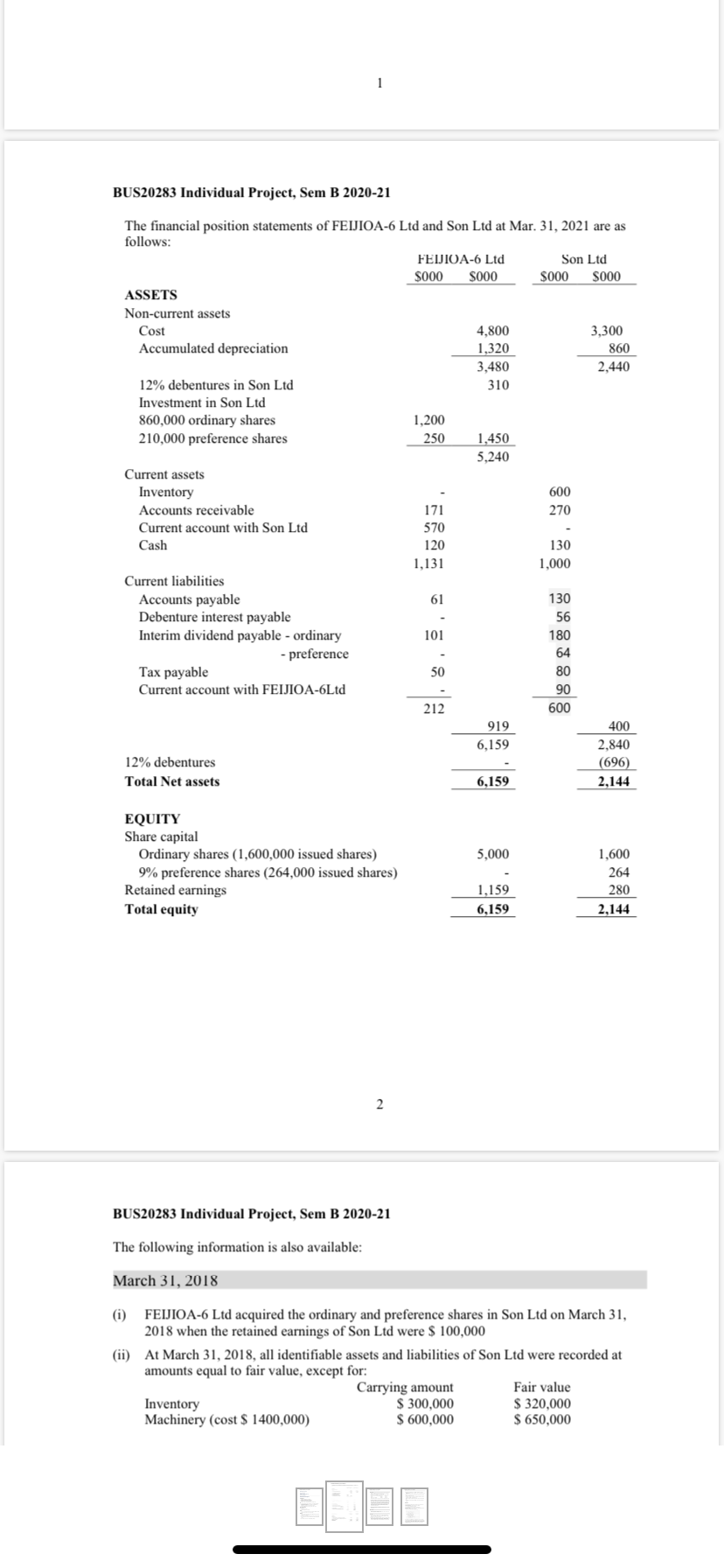

1 BUS20283 Individual Project, Sem B 2020-21 310 250 The financial position statements of FEIJIOA-6 Ltd and Son Ltd at Mar. 31, 2021 are as follows: FEIJIOA-6 Ltd Son Ltd S000 S000 $000 S000 ASSETS Non-current assets Cost 4.800 3,300 Accumulated depreciation 1.320 860 3,480 2,440 12% debentures in Son Ltd Investment in Son Ltd 860,000 ordinary shares 1,200 210,000 preference shares 1,450 5,240 Current assets Inventory 600 Accounts receivable 171 270 Current account with Son Ltd 570 Cash 120 130 1,131 Current liabilities Accounts payable 61 130 Debenture interest payable 56 Interim dividend payable - ordinary 101 180 - preference 64 Tax payable 50 80 Current account with FEIJIOA-6Ltd 90 212 600 919 400 6,159 2,840 12% debentures (696) Total Net assets 6,159 2,144 1,000 5.000 EQUITY Share capital Ordinary shares (1,600,000 issued shares) 9% preference shares (264,000 issued shares) Retained earnings Total equity 1,600 264 280 2,144 1.159 6,159 2 BUS20283 Individual Project, Sem B 2020-21 The following information is also available: March 31, 2018 (i) FEIJIOA-6 Ltd acquired the ordinary and preference shares in Son Ltd on March 31, 2018 when the retained earnings of Son Ltd were $ 100,000 (ii) At March 31, 2018, all identifiable assets and liabilities of Son Ltd were recorded at amounts equal to fair value, except for: Carrying amount Fair value Inventory $ 300,000 $ 320,000 Machinery (cost $ 1400,000) $ 600,000 $ 650,000 2 BUS20283 Individual Project, Sem B 2020-21 The following information is also available: March 31, 2018 (i) FEIJIOA-6 Ltd acquired the ordinary and preference shares in Son Ltd on March 31, 2018 when the retained earnings of Son Ltd were $ 100,000 (ii) At March 31, 2018, all identifiable assets and liabilities of Son Ltd were recorded at amounts equal to fair value, except for: Carrying amount Fair value Inventory $ 300,000 $ 320,000 Machinery (cost $ 1400,000) $ 600,000 $ 650,000 The machinery had a further 10 year life. The inventory remained at March 31, 2021 (iii) On March 31, 2018, Momo Ltd one of Son Ltd's major customers took a legal action against it for faulty products. Legal proceedings have been started seeking damages from Son Ltd but it disputes liability. Up to the balance sheet date, the Son Ltd's legal advices received were that it is probable that Son Ltd would be found liable. But they have also advised that it is almost impossible to estimate the amount of damages the court might award against Son Ltd or how long it might take to exhaust all the legal avenues before a final court decision is reached in this case. Son Ltd had not raised a liability in relation to the legal sue. Being prudent, FEIJIOA-6 Ltd valued the contingent liability at $60,000. On May 1, 2019 Momo Ltd dropped the legal case against Son Ltd for lack of evidence. (iv) Son Ltd had also invented special equipment and patented the process. No asset was raised by Son Ltd but FEIJIOA-6 Ltd valued the patent at $110,000, with an expected life of 10 years. March 31, 2020 (v) $30,000 of the goodwill on ordinary share capital of Son Ltd was written off as the result of an impairment test on March 31, 2020. April 1, 2020 (vi) On April 1, 2020, Son Ltd sold plant, with a cost of $1100,000 and accumulated depreciation of $110,000, to FEIJIOA-6 Ltd for $1200,000. FEIJIOA-6 Ltd charges depreciation at the rate of 10% per annum on cost. (vii) The debentures were issued by Son Ltd on April 1, 2020, and are redeemable on March 31, 2022. The debenture interests are payable half yearly. FEIJIOA-6 Ltd had acquired a holding of these debentures worth a nominal value of $348,000 on the same day. Besides, FEIJIOA-6 Ltd has not recorded the debenture interest receivable as at March 31, 2021. 3 BUS20283 Individual Project, Sem B 2020-21 March 31, 2021. (vii) During the year ended March 31, 2021, FEIJIOA-6 Ltd sold goods, which cost $180,000, to Son Ltd for $280,000. At March 31, 2021, Son Ltd still had 40% of this inventory in hand. (viii) FEIJIOA-6 Ltd has also not recorded the interim dividends receivable from Son Ltd for the year ended March 31, 2021. (ix) On March 31, 2021, Son Ltd sent a cheque to FEIJIOA-6 Ltd for $10,000. This was 5:46 7 X FR_IndiProject_FEIJIOA-6_moodle PDF - 173 KB depreciation at the rate of 10% per annum on cost. (vii) The debentures were issued by Son Ltd on April 1, 2020, and are redeemable on March 31, 2022. The debenture interests are payable half yearly. FEIJIOA-6 Ltd had acquired a holding of these debentures worth a nominal value of $348,000 on the same day. Besides, FEIJIOA-6 Ltd has not recorded the debenture interest receivable as at March 31, 2021. 3 BUS20283 Individual Project, Sem B 2020-21 March 31, 2021. (vii) During the year ended March 31, 2021, FEIJIOA-6 Ltd sold goods, which cost $180,000, to Son Ltd for $280,000. At March 31, 2021, Son Ltd still had 40% of this inventory in hand. (viii) FEIJIOA-6 Ltd has also not recorded the interim dividends receivable from Son Ltd for the year ended March 31, 2021. (ix) On March 31, 2021, Son Ltd sent a cheque to FEIJIOA-6 Ltd for $10,000. This was not received by FEIJIOA-6 Ltd until April 2, 2021. (x) FEIJIOA-6 Ltd proposed a final ordinary dividend of 8 cents per share on March 31, 2021. (xi) Assume Son Ltd followed the policy of FEIJIOA-6 Ltd on change of useful life in machinery. REQUIRED 1) Prepare schedules and worksheet (copy and paste from your excel .xsl file into the document.doc file) for: a) the relevant adjustment journals in the books of two companies b) the relevant consolidation adjustment journals c) non-controlling interests on acquisition date and reporting date 2) Prepare the consolidated statement of financial position of FEIJIOA-6 Ltd for the year ended March 31, 2021. 3) Fill in the following table the amount of listed items: $000 On acquisition date March 31, 2018 Goodwill on consolidation Non-controlling interests On reporting date March 31, 2021 Goodwill on consolidation Non-controlling interests Consolidated Retained Earnings Consolidated Net Asset 4) For situation (iii), ignore FEIJIOA-6 Ltd's accounting policy, you are to separately assess the situation where Momo Ltd had not dropped the legal case against Son Ltd on May 1, 2019. Explain whether a provision should be recognised, a contingent liability should be disclosed, or nothing should be accounted for. Also, you are required to journal entries where a provision is required, or to prepare a note to the financial statements for disclosure. 4 1 BUS20283 Individual Project, Sem B 2020-21 310 250 The financial position statements of FEIJIOA-6 Ltd and Son Ltd at Mar. 31, 2021 are as follows: FEIJIOA-6 Ltd Son Ltd S000 S000 $000 S000 ASSETS Non-current assets Cost 4.800 3,300 Accumulated depreciation 1.320 860 3,480 2,440 12% debentures in Son Ltd Investment in Son Ltd 860,000 ordinary shares 1,200 210,000 preference shares 1,450 5,240 Current assets Inventory 600 Accounts receivable 171 270 Current account with Son Ltd 570 Cash 120 130 1,131 Current liabilities Accounts payable 61 130 Debenture interest payable 56 Interim dividend payable - ordinary 101 180 - preference 64 Tax payable 50 80 Current account with FEIJIOA-6Ltd 90 212 600 919 400 6,159 2,840 12% debentures (696) Total Net assets 6,159 2,144 1,000 5.000 EQUITY Share capital Ordinary shares (1,600,000 issued shares) 9% preference shares (264,000 issued shares) Retained earnings Total equity 1,600 264 280 2,144 1.159 6,159 2 BUS20283 Individual Project, Sem B 2020-21 The following information is also available: March 31, 2018 (i) FEIJIOA-6 Ltd acquired the ordinary and preference shares in Son Ltd on March 31, 2018 when the retained earnings of Son Ltd were $ 100,000 (ii) At March 31, 2018, all identifiable assets and liabilities of Son Ltd were recorded at amounts equal to fair value, except for: Carrying amount Fair value Inventory $ 300,000 $ 320,000 Machinery (cost $ 1400,000) $ 600,000 $ 650,000 2 BUS20283 Individual Project, Sem B 2020-21 The following information is also available: March 31, 2018 (i) FEIJIOA-6 Ltd acquired the ordinary and preference shares in Son Ltd on March 31, 2018 when the retained earnings of Son Ltd were $ 100,000 (ii) At March 31, 2018, all identifiable assets and liabilities of Son Ltd were recorded at amounts equal to fair value, except for: Carrying amount Fair value Inventory $ 300,000 $ 320,000 Machinery (cost $ 1400,000) $ 600,000 $ 650,000 The machinery had a further 10 year life. The inventory remained at March 31, 2021 (iii) On March 31, 2018, Momo Ltd one of Son Ltd's major customers took a legal action against it for faulty products. Legal proceedings have been started seeking damages from Son Ltd but it disputes liability. Up to the balance sheet date, the Son Ltd's legal advices received were that it is probable that Son Ltd would be found liable. But they have also advised that it is almost impossible to estimate the amount of damages the court might award against Son Ltd or how long it might take to exhaust all the legal avenues before a final court decision is reached in this case. Son Ltd had not raised a liability in relation to the legal sue. Being prudent, FEIJIOA-6 Ltd valued the contingent liability at $60,000. On May 1, 2019 Momo Ltd dropped the legal case against Son Ltd for lack of evidence. (iv) Son Ltd had also invented special equipment and patented the process. No asset was raised by Son Ltd but FEIJIOA-6 Ltd valued the patent at $110,000, with an expected life of 10 years. March 31, 2020 (v) $30,000 of the goodwill on ordinary share capital of Son Ltd was written off as the result of an impairment test on March 31, 2020. April 1, 2020 (vi) On April 1, 2020, Son Ltd sold plant, with a cost of $1100,000 and accumulated depreciation of $110,000, to FEIJIOA-6 Ltd for $1200,000. FEIJIOA-6 Ltd charges depreciation at the rate of 10% per annum on cost. (vii) The debentures were issued by Son Ltd on April 1, 2020, and are redeemable on March 31, 2022. The debenture interests are payable half yearly. FEIJIOA-6 Ltd had acquired a holding of these debentures worth a nominal value of $348,000 on the same day. Besides, FEIJIOA-6 Ltd has not recorded the debenture interest receivable as at March 31, 2021. 3 BUS20283 Individual Project, Sem B 2020-21 March 31, 2021. (vii) During the year ended March 31, 2021, FEIJIOA-6 Ltd sold goods, which cost $180,000, to Son Ltd for $280,000. At March 31, 2021, Son Ltd still had 40% of this inventory in hand. (viii) FEIJIOA-6 Ltd has also not recorded the interim dividends receivable from Son Ltd for the year ended March 31, 2021. (ix) On March 31, 2021, Son Ltd sent a cheque to FEIJIOA-6 Ltd for $10,000. This was 5:46 7 X FR_IndiProject_FEIJIOA-6_moodle PDF - 173 KB depreciation at the rate of 10% per annum on cost. (vii) The debentures were issued by Son Ltd on April 1, 2020, and are redeemable on March 31, 2022. The debenture interests are payable half yearly. FEIJIOA-6 Ltd had acquired a holding of these debentures worth a nominal value of $348,000 on the same day. Besides, FEIJIOA-6 Ltd has not recorded the debenture interest receivable as at March 31, 2021. 3 BUS20283 Individual Project, Sem B 2020-21 March 31, 2021. (vii) During the year ended March 31, 2021, FEIJIOA-6 Ltd sold goods, which cost $180,000, to Son Ltd for $280,000. At March 31, 2021, Son Ltd still had 40% of this inventory in hand. (viii) FEIJIOA-6 Ltd has also not recorded the interim dividends receivable from Son Ltd for the year ended March 31, 2021. (ix) On March 31, 2021, Son Ltd sent a cheque to FEIJIOA-6 Ltd for $10,000. This was not received by FEIJIOA-6 Ltd until April 2, 2021. (x) FEIJIOA-6 Ltd proposed a final ordinary dividend of 8 cents per share on March 31, 2021. (xi) Assume Son Ltd followed the policy of FEIJIOA-6 Ltd on change of useful life in machinery. REQUIRED 1) Prepare schedules and worksheet (copy and paste from your excel .xsl file into the document.doc file) for: a) the relevant adjustment journals in the books of two companies b) the relevant consolidation adjustment journals c) non-controlling interests on acquisition date and reporting date 2) Prepare the consolidated statement of financial position of FEIJIOA-6 Ltd for the year ended March 31, 2021. 3) Fill in the following table the amount of listed items: $000 On acquisition date March 31, 2018 Goodwill on consolidation Non-controlling interests On reporting date March 31, 2021 Goodwill on consolidation Non-controlling interests Consolidated Retained Earnings Consolidated Net Asset 4) For situation (iii), ignore FEIJIOA-6 Ltd's accounting policy, you are to separately assess the situation where Momo Ltd had not dropped the legal case against Son Ltd on May 1, 2019. Explain whether a provision should be recognised, a contingent liability should be disclosed, or nothing should be accounted for. Also, you are required to journal entries where a provision is required, or to prepare a note to the financial statements for disclosure. 4