Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Calculate the inventories if the current ratio of a company is 2.37 and quick ratio is 1.23 and current liabilities are 3850000 KZT.

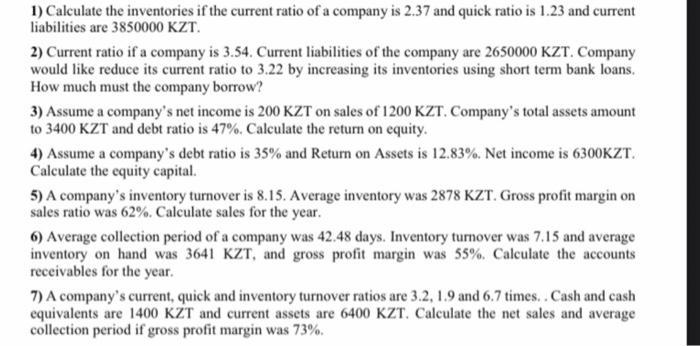

1) Calculate the inventories if the current ratio of a company is 2.37 and quick ratio is 1.23 and current liabilities are 3850000 KZT. 2) Current ratio if a company is 3.54. Current liabilities of the company are 2650000 KZT. Company would like reduce its current ratio to 3.22 by increasing its inventories using short term bank loans. How much must the company borrow? 3) Assume a company's net income is 200 KZT on sales of 1200 KZT. Company's total assets amount to 3400 KZT and debt ratio is 47%. Calculate the return on equity. 4) Assume a company's debt ratio is 35% and Return on Assets is 12.83%. Net income is 6300KZT. Calculate the equity capital. 5) A company's inventory turnover is 8.15. Average inventory was 2878 KZT. Gross profit margin on sales ratio was 62%. Calculate sales for the year. 6) Average collection period of a company was 42.48 days. Inventory turnover was 7.15 and average inventory on hand was 3641 KZT, and gross profit margin was 55%. Calculate the accounts receivables for the year. 7) A company's current, quick and inventory turnover ratios are 3.2, 1.9 and 6.7 times. . Cash and cash equivalents are 1400 KZT and current assets are 6400 KZT. Calculate the net sales and average collection period if gross profit margin was 73%.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started