1. Conduct a financial analysis of the MLK Agency. Answer these questions in your memo using ratio analysis.

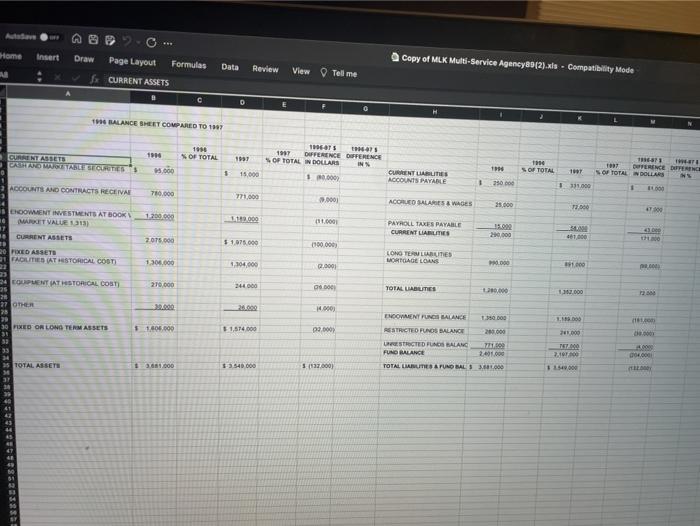

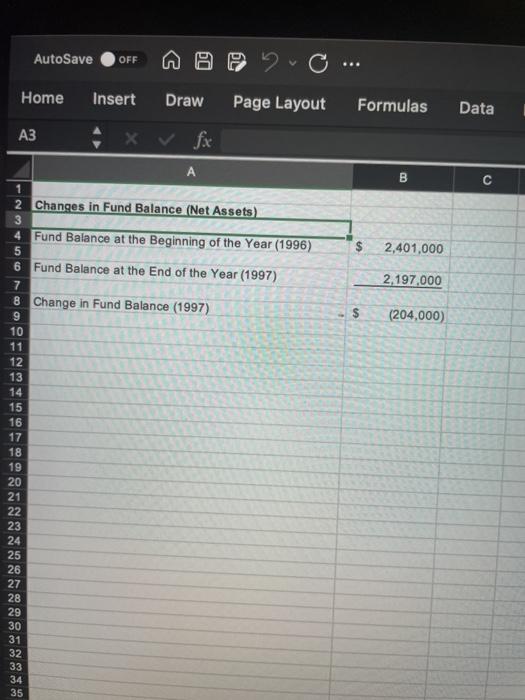

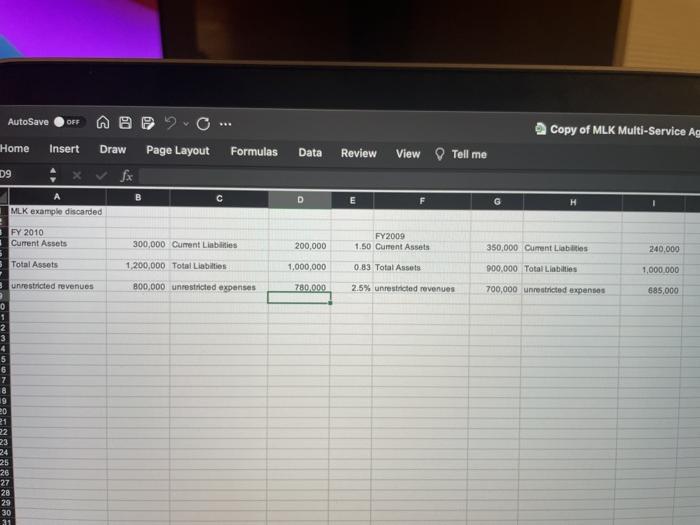

- How does the liquidity of MLK compare from year to year?

- How does the long term solvency compare from year to year?

- How does the efficiency compare from year to year?

- What is the profitability for each year and what are the implications?

- Are present resources sustainable?

- Are there any red flags that should be considered?

2. Write a memo to the executive director recommending a solution for the fiscal issues given your analysis.

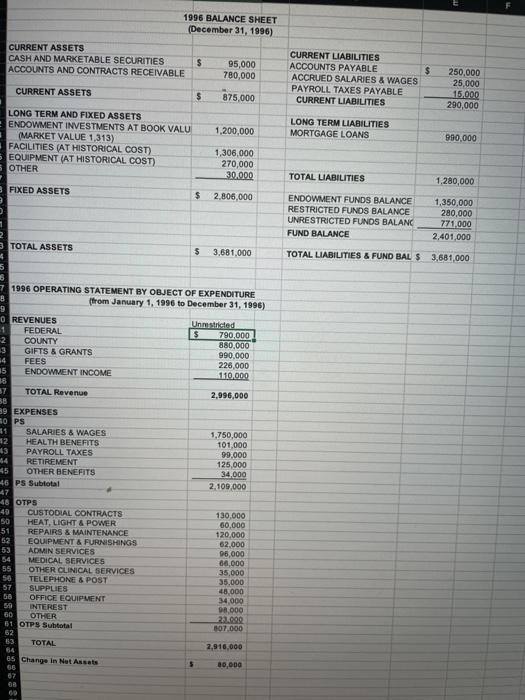

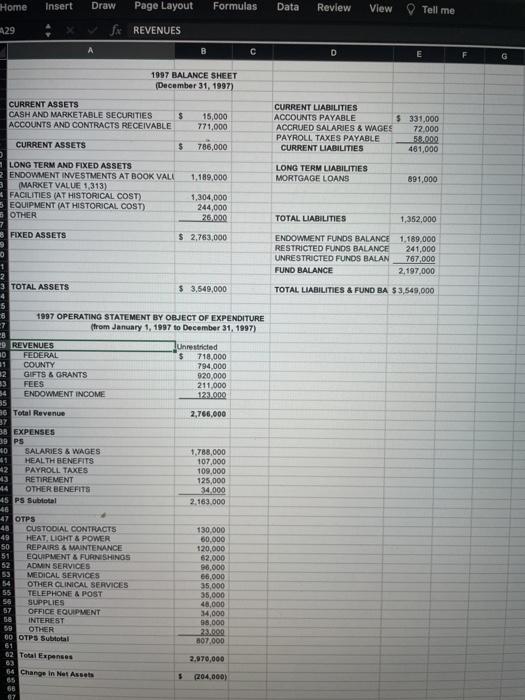

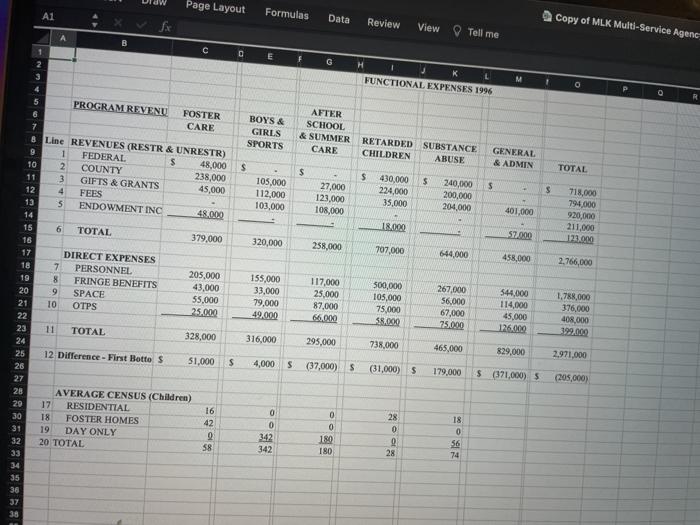

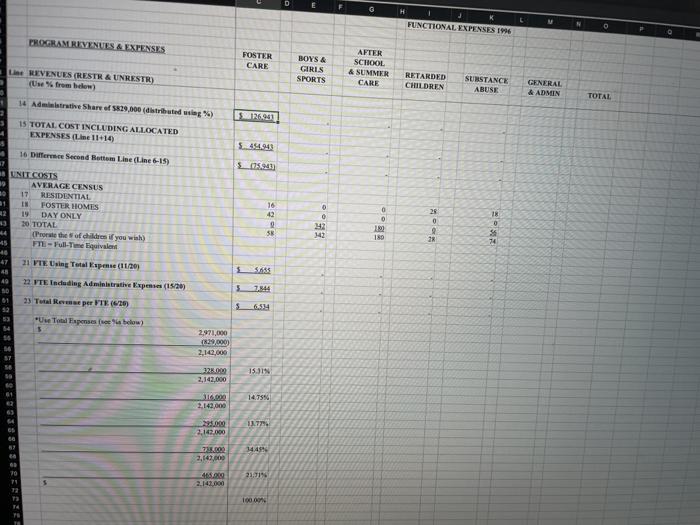

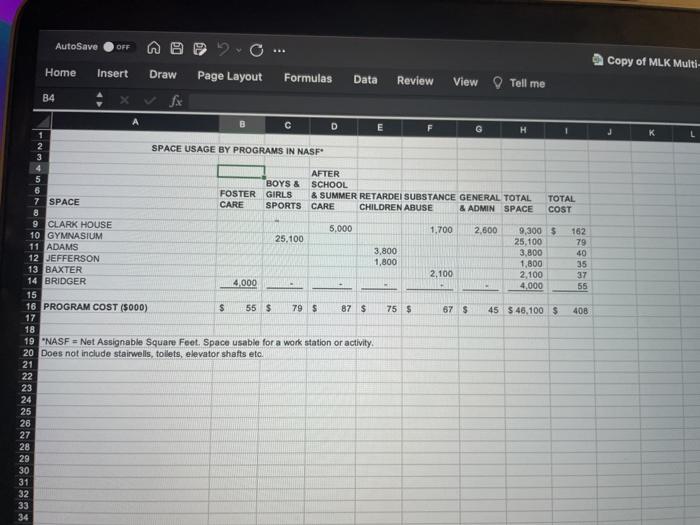

1996 BALANCE SHEET (December 31, 1996) CURRENT ASSETS CASH AND MARKETABLE SECURITIES ACCOUNTS AND CONTRACTS RECEIVABLE $ 95,000 780,000 $ CURRENT LIABILITIES ACCOUNTS PAYABLE ACCRUED SALARIES & WAGES PAYROLL TAXES PAYABLE CURRENT LIABILITIES CURRENT ASSETS 250,000 25.000 15.000 290,000 $ 875,000 1,200,000 LONG TERM LIABILITIES MORTGAGE LOANS LONG TERM AND FIXED ASSETS ENDOWMENT INVESTMENTS AT BOOK VALU (MARKET VALUE 1,313) FACILITIES (AT HISTORICAL COST) EQUIPMENT (AT HISTORICAL COST) OTHER 990.000 1,306,000 270,000 30.000 TOTAL LIABILITIES 1.280,000 FIXED ASSETS $ 2,800,000 ENDOWMENT FUNDS BALANCE RESTRICTED FUNDS BALANCE UNRESTRICTED FUNDS BALANC FUND BALANCE 1,350,000 280,000 771000 2,401,000 TOTAL ASSETS $ 3,681,000 TOTAL LIABILITIES & FUND BAL S 3.681,000 7 1996 OPERATING STATEMENT BY OBJECT OF EXPENDITURE B from January 1, 1996 to December 31, 1996) 9 0 REVENUES Unrestricted 1 FEDERAL $ 790,000 2 COUNTY 880,000 3 GIFTS & GRANTS 990.000 FEES 220,000 15 ENDOWMENT INCOME 110,000 18 TOTAL Revenue 2.996,000 BB 89 EXPENSES 30 PS 54 SALARIES & WAGES 1,750,000 12 HEALTH BENEFITS 101.000 13 PAYROLL TAXES 99.000 64 RETIREMENT 125,000 45 OTHER BENEFITS 34.000 46 PS Subtotal 2.109,000 47 48 OTPS 49 CUSTODIAL CONTRACTS 130.000 SO HEAT, LIGHT & POWER 60,000 51 REPAIRS & MAINTENANCE 120,000 52 EQUIPMENT & FURNISHINGS 62.000 ADMIN SERVICES 6,000 54 MEDICAL SERVICES 60,000 55 OTHER CLINICAL SERVICES 35,000 50 TELEPHONE & POST 35.000 57 SUPPLIES 45,000 58 OFFICE EQUIPMENT 34.000 50 INTEREST 8,000 60 OTHER 23.092 51 OTPU Subtotal 107.000 62 63 TOTAL 2.910.000 64 65 Change in Not Assets 5 80,000 67 O Home Insert Draw Page Layout Formulas Data Review View Tell me 429 fx REVENUES 0 E 1997 BALANCE SHEET (December 31, 1997) CURRENT ASSETS CASH AND MARKETABLE SECURITIES ACCOUNTS AND CONTRACTS RECEIVABLE $ 15,000 771,000 CURRENT LIABILITIES ACCOUNTS PAYABLE $ 331,000 ACCRUED SALARIES & WAGES 72.000 PAYROLL TAXES PAYABLE 58.002 CURRENT LIABILITIES 461,000 CURRENT ASSETS $ 786,000 1.189,000 LONG TERM LIABILITIES MORTGAGE LOANS 891,000 LONG TERM AND FIXED ASSETS 2 ENDOWMENT INVESTMENTS AT BOOK VALL MARKET VALUE 1,313) FACILITIES (AT HISTORICAL COST) 5 EQUIPMENT (AT HISTORICAL COST) OTHER 1,304,000 244,000 26.000 TOTAL LIABILITIES 1,352,000 FIXED ASSETS $ 2,763,000 ENDOWMENT FUNDS BALANCE RESTRICTED FUNDS BALANCE UNRESTRICTED FUNDS BALAN FUND BALANCE 1.189.000 241,000 767,000 2,197,000 TOTAL LIABILITIES & FUND BA $3,549,000 0 1 2 3 TOTAL ASSETS $ 3.549,000 4 5 8 1997 OPERATING STATEMENT BY OBJECT OF EXPENDITURE (from January 1, 1997 to December 31, 1997) 8 29 REVENUES Unrestricted 10 FEDERAL $ 718.000 31 COUNTY 794.000 32 GIFTS & GRANTS 920.000 FEES 211,000 54 ENDOWMENT INCOME 123.000 55 36 Total Revenue 2,766,000 37 38 EXPENSES 39 PS 0 SALARIES & WAGES 1.788,000 41 HEALTH BENEFITS 107.000 PAYROLL TAXES 109,000 3 RETIREMENT 125,000 OTHER BENEFITS 34.000 45 PS Subtotal 2. 163.000 46 47 OTPS 48 CUSTODIAL CONTRACTS 130.000 49 HEAT, LIGHT & POWER 60.000 SO REPAIRS & MAINTENANCE 120,000 51 EQUIPMENT & FURNISHINOS 62,000 52 ADMIN SERVICES 96,000 53 MEDICAL SERVICES 66.000 54 OTHER CLINICAL SERVICES 35,000 55 TELEPHONE & POST 35,000 56 SUPPLIES 48,000 57 OFFICE EQUIPMENT 34,000 INTEREST 98,000 59 OTHER 23.000 00 OTPS Subtotal 107.000 61 62 Total Expenses 2.970,000 5 204,000) 64 Change in Net Asset 65 66 07 Insert Draw Page Layout Formulas Copy of MLK Multi-Service Agency89(2).xls - Compatibility Mode Data Review View Telme CURRENT ASSETS D 19 BALANCE SHEET COMPARED TO 1997 S OF TOTAL CURRENTASSETS ROTALCOTIES 1931 1994 15.000 1997 DIFFERENCE DIFFERENCE OF TOTAL W DOLLARS IN TET 19 SOF TOTAL 13 TOD SOF TOTAL WOOLLARS 100T 3 CURRENT LAURES ACCOUNTS PAYABLE 15.000 17500 1111.000 ACCOUNTS AND CONTRACTS RECEIVAE 760.000 171.000 0.0001 ACORUCO BALADES & WAGES 25.000 3.000 47 12.000 ENDOWMENT INVESTMENTS AT BOOK MARKET VALUE 315) CURRENT ASSETS PAYROLL TAXES PAYABLE CURRENT LANTES 20.000 1000 2.075.000 5 1.075.000 1100.000) PIXED ASSETS FACILITIES AT STORICAL COST) LONO TE LARTE MORTGAGE LOANS 1.300.000 4.104.000 2.0001 000 100 24 COUPENT AT HISTORICAL COBT) 279.000 244000 . TOTAL LIABLITIES 120,000 0.000 2388 27 OTHER 30.000 ORD 14.00) 11.com 30 PIXED OR LONG TERM ASSETS 1.405.000 51,574.000 p2.000 2000 ENCOVIMENT FUNCHALANCE RESTRICTED PUNOS BALANCE 200.000 URESTRICTED FUNDS MALANG 7100 FUND BALANCE 240.000 TOTAL LABIES & PUNO BALS 3.811.000 4000 4. 2.100 1. TOTAL ASSETS 1381000 3540000 31177000) 50 31 AutoSave OFF A Home Insert Draw Page Layout Formulas Data B $ 2,401,000 2.197,000 $ (204,000) 1 2 Changes in Fund Balance (Net Assets) 3 4 Fund Balance at the Beginning of the Year (1996) 5 6 Fund Balance at the End of the Year (1997) 7 8 Change in Fund Balance (1997) 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Page Layout Formulas A1 Data Review Copy of MLK Multi-Service Agenc View Tell me A FUNCTIONAL EXPENSES 1996 BOYS & GIRLS SPORTS AFTER SCHOOL & SUMMER CARE RETARDED SUBSTANCE CHILDREN ABUSE GENERAL & ADMIN $ $ TOTAL $ $ 105,000 112,000 100.000 $ 430,000 224,000 35.000 27,000 123,000 108,000 240,000 200,000 204,000 $ 401,000 718,000 794,000 920,000 211.000 173.000 18.000 522.000 320,000 238,000 707,000 644,000 458,000 2.766,000 5 PROGRAM REVENU FOSTER 6 CARE 7 & Line REVENUES (RESTR & UNRESTR) 9 1 FEDERAL $ 48,000 10 2 COUNTY 238,000 11 3 GIFTS & GRANTS 45,000 12 4 FEES 13 5 ENDOWMENT INC 48.000 14 15 6 TOTAL 379.000 16 17 DIRECT EXPENSES 18 7 PERSONNEL 205,000 19 8 FRINGE BENEFITS 43,000 20 9 SPACE 55.000 21 10 OTPS 25.000 22 23 11 TOTAL 328.000 24 25 12 Difference - First Bottes 51,000 26 27 28 AVERAGE CENSUS (Children) 29 17 RESIDENTIAL 16 30 18 FOSTER HOMES 42 31 19 DAY ONLY 2 32 20 TOTAL 58 33 34 35 36 37 38 155,000 33,000 79,000 49.000 117,000 25,000 87,000 66.000 300,000 105,000 75,000 $8.00 267.000 56,000 67,000 775.000 544.000 114,000 45,000 126.000 1,788,000 376.000 408 000 399.000 316,000 295,000 738,000 465,000 829,000 2.971.000 s 4,000 $ (37,000) S (31,000) 5 179,000 $ (371,000) 5 (205,000) 0 0 342 342 28 0 0 0 180 180 18 0 56 74 28 D FUNCTIONAL EXPENSES 1996 PROGRAM RIVENUES A EXPENSES FOSTER CARE LE REVENUES CRESTR & UNRESTR) (Une from below) BOYS & GIRIS SPORTS AFTER SCHOOL & SUMMER CARE RETARDED CHILDREN SUBSTANCE ABUSE GENERAL & ADMIN TOTAL 14 Artie Share of 829,00 (distributed using %) 15 TOTAL COST INCLUDING ALLOCATED EXPENSES (Line 11+14) 5.494.943 16 Difference Second Rett Line (Line 6-15) 505941 UNIT COSTS 19 AVERAGE CENSUS 10 17 RESIDENTIAL 21 IN FOSTER HOMES 19 DAY ONLY 30 TOTAL Prose the of children if you wish) 15 FIL-Full-Time liquet 0 16 42 2 58 242 141 0 0 1190 180 28 0 2 28 0 55 74 47 21 VIE Using Total Expense (11/20 5 22 VTE Induding Administrative Expenses (1/20) 40 SO 61 3 7.844 23 Total Remase per VTE (620) 6,544 53 Total Fapenses below) 5 2.971.000 8:29.000 2.142.000 30 15:319 32.000 2,142,000 14.7556 116.000 2.142,000 13.77 2,149.000 60 149 7.000 2,143,600 21:19 HO 2.141,000 10000 AutoSave OFF Copy of MLK Multi- Home Insert Draw Page Layout Formulas Data Review View Tell me B4 D E H 1 1 2 SPACE USAGE BY PROGRAMS IN NASF 3 4 AFTER 5 BOYS & SCHOOL 6 FOSTER GIRLS & SUMMER RETARDEI SUBSTANCE GENERAL TOTAL TOTAL 7 SPACE CARE SPORTS CARE CHILDREN ABUSE & ADMIN SPACE COST 8 9 CLARK HOUSE 5.000 1,700 2,600 9,300 162 10 GYMNASIUM 25.100 25.100 79 11 ADAMS 3,800 3,800 40 12 JEFFERSON 1,800 1,800 35 13 BAXTER 2,100 2,100 37 14 BRIDGER 4,000 4,000 55 15 16 PROGRAM COST (5000) $ 55 $ 79 $ 87 $ 75 $ 67 S 45 $ 40,100 $ 408 17 18 19 "NASF = Net Assignable Square Feet. Space usable for a workstation or activity 20 Does not include stairwells, toilets, elevator shafts etc. 21 22 23 24 25 28 27 28 29 30 31 32 33 OFF AutoSave Home Insert Copy of MLK Multi-Service Aa Draw Page Layout Formulas Data Review View Tell me 09 fx B C D H MLK example discarded FY 2010 Current Assets 300,000 Current Liabilities FY2009 1.50 Current Assets 200,000 350,000 Current Liabilities 240,000 Total Assets 1,200,000 Total Liabilities 1,000,000 0.83 Total Assets 900.000 Total Liabities 1.000.000 unrestricted revenues 800,000 unrestricted expenses 780,000 2.5% unrestricted revenues 700,000 unrestricted expenses 685,000 0 1 2 3 4 5 6 7 8 19 20 4 22 23 24 25 26 27 28 29 30 31 1996 BALANCE SHEET (December 31, 1996) CURRENT ASSETS CASH AND MARKETABLE SECURITIES ACCOUNTS AND CONTRACTS RECEIVABLE $ 95,000 780,000 $ CURRENT LIABILITIES ACCOUNTS PAYABLE ACCRUED SALARIES & WAGES PAYROLL TAXES PAYABLE CURRENT LIABILITIES CURRENT ASSETS 250,000 25.000 15.000 290,000 $ 875,000 1,200,000 LONG TERM LIABILITIES MORTGAGE LOANS LONG TERM AND FIXED ASSETS ENDOWMENT INVESTMENTS AT BOOK VALU (MARKET VALUE 1,313) FACILITIES (AT HISTORICAL COST) EQUIPMENT (AT HISTORICAL COST) OTHER 990.000 1,306,000 270,000 30.000 TOTAL LIABILITIES 1.280,000 FIXED ASSETS $ 2,800,000 ENDOWMENT FUNDS BALANCE RESTRICTED FUNDS BALANCE UNRESTRICTED FUNDS BALANC FUND BALANCE 1,350,000 280,000 771000 2,401,000 TOTAL ASSETS $ 3,681,000 TOTAL LIABILITIES & FUND BAL S 3.681,000 7 1996 OPERATING STATEMENT BY OBJECT OF EXPENDITURE B from January 1, 1996 to December 31, 1996) 9 0 REVENUES Unrestricted 1 FEDERAL $ 790,000 2 COUNTY 880,000 3 GIFTS & GRANTS 990.000 FEES 220,000 15 ENDOWMENT INCOME 110,000 18 TOTAL Revenue 2.996,000 BB 89 EXPENSES 30 PS 54 SALARIES & WAGES 1,750,000 12 HEALTH BENEFITS 101.000 13 PAYROLL TAXES 99.000 64 RETIREMENT 125,000 45 OTHER BENEFITS 34.000 46 PS Subtotal 2.109,000 47 48 OTPS 49 CUSTODIAL CONTRACTS 130.000 SO HEAT, LIGHT & POWER 60,000 51 REPAIRS & MAINTENANCE 120,000 52 EQUIPMENT & FURNISHINGS 62.000 ADMIN SERVICES 6,000 54 MEDICAL SERVICES 60,000 55 OTHER CLINICAL SERVICES 35,000 50 TELEPHONE & POST 35.000 57 SUPPLIES 45,000 58 OFFICE EQUIPMENT 34.000 50 INTEREST 8,000 60 OTHER 23.092 51 OTPU Subtotal 107.000 62 63 TOTAL 2.910.000 64 65 Change in Not Assets 5 80,000 67 O Home Insert Draw Page Layout Formulas Data Review View Tell me 429 fx REVENUES 0 E 1997 BALANCE SHEET (December 31, 1997) CURRENT ASSETS CASH AND MARKETABLE SECURITIES ACCOUNTS AND CONTRACTS RECEIVABLE $ 15,000 771,000 CURRENT LIABILITIES ACCOUNTS PAYABLE $ 331,000 ACCRUED SALARIES & WAGES 72.000 PAYROLL TAXES PAYABLE 58.002 CURRENT LIABILITIES 461,000 CURRENT ASSETS $ 786,000 1.189,000 LONG TERM LIABILITIES MORTGAGE LOANS 891,000 LONG TERM AND FIXED ASSETS 2 ENDOWMENT INVESTMENTS AT BOOK VALL MARKET VALUE 1,313) FACILITIES (AT HISTORICAL COST) 5 EQUIPMENT (AT HISTORICAL COST) OTHER 1,304,000 244,000 26.000 TOTAL LIABILITIES 1,352,000 FIXED ASSETS $ 2,763,000 ENDOWMENT FUNDS BALANCE RESTRICTED FUNDS BALANCE UNRESTRICTED FUNDS BALAN FUND BALANCE 1.189.000 241,000 767,000 2,197,000 TOTAL LIABILITIES & FUND BA $3,549,000 0 1 2 3 TOTAL ASSETS $ 3.549,000 4 5 8 1997 OPERATING STATEMENT BY OBJECT OF EXPENDITURE (from January 1, 1997 to December 31, 1997) 8 29 REVENUES Unrestricted 10 FEDERAL $ 718.000 31 COUNTY 794.000 32 GIFTS & GRANTS 920.000 FEES 211,000 54 ENDOWMENT INCOME 123.000 55 36 Total Revenue 2,766,000 37 38 EXPENSES 39 PS 0 SALARIES & WAGES 1.788,000 41 HEALTH BENEFITS 107.000 PAYROLL TAXES 109,000 3 RETIREMENT 125,000 OTHER BENEFITS 34.000 45 PS Subtotal 2. 163.000 46 47 OTPS 48 CUSTODIAL CONTRACTS 130.000 49 HEAT, LIGHT & POWER 60.000 SO REPAIRS & MAINTENANCE 120,000 51 EQUIPMENT & FURNISHINOS 62,000 52 ADMIN SERVICES 96,000 53 MEDICAL SERVICES 66.000 54 OTHER CLINICAL SERVICES 35,000 55 TELEPHONE & POST 35,000 56 SUPPLIES 48,000 57 OFFICE EQUIPMENT 34,000 INTEREST 98,000 59 OTHER 23.000 00 OTPS Subtotal 107.000 61 62 Total Expenses 2.970,000 5 204,000) 64 Change in Net Asset 65 66 07 Insert Draw Page Layout Formulas Copy of MLK Multi-Service Agency89(2).xls - Compatibility Mode Data Review View Telme CURRENT ASSETS D 19 BALANCE SHEET COMPARED TO 1997 S OF TOTAL CURRENTASSETS ROTALCOTIES 1931 1994 15.000 1997 DIFFERENCE DIFFERENCE OF TOTAL W DOLLARS IN TET 19 SOF TOTAL 13 TOD SOF TOTAL WOOLLARS 100T 3 CURRENT LAURES ACCOUNTS PAYABLE 15.000 17500 1111.000 ACCOUNTS AND CONTRACTS RECEIVAE 760.000 171.000 0.0001 ACORUCO BALADES & WAGES 25.000 3.000 47 12.000 ENDOWMENT INVESTMENTS AT BOOK MARKET VALUE 315) CURRENT ASSETS PAYROLL TAXES PAYABLE CURRENT LANTES 20.000 1000 2.075.000 5 1.075.000 1100.000) PIXED ASSETS FACILITIES AT STORICAL COST) LONO TE LARTE MORTGAGE LOANS 1.300.000 4.104.000 2.0001 000 100 24 COUPENT AT HISTORICAL COBT) 279.000 244000 . TOTAL LIABLITIES 120,000 0.000 2388 27 OTHER 30.000 ORD 14.00) 11.com 30 PIXED OR LONG TERM ASSETS 1.405.000 51,574.000 p2.000 2000 ENCOVIMENT FUNCHALANCE RESTRICTED PUNOS BALANCE 200.000 URESTRICTED FUNDS MALANG 7100 FUND BALANCE 240.000 TOTAL LABIES & PUNO BALS 3.811.000 4000 4. 2.100 1. TOTAL ASSETS 1381000 3540000 31177000) 50 31 AutoSave OFF A Home Insert Draw Page Layout Formulas Data B $ 2,401,000 2.197,000 $ (204,000) 1 2 Changes in Fund Balance (Net Assets) 3 4 Fund Balance at the Beginning of the Year (1996) 5 6 Fund Balance at the End of the Year (1997) 7 8 Change in Fund Balance (1997) 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Page Layout Formulas A1 Data Review Copy of MLK Multi-Service Agenc View Tell me A FUNCTIONAL EXPENSES 1996 BOYS & GIRLS SPORTS AFTER SCHOOL & SUMMER CARE RETARDED SUBSTANCE CHILDREN ABUSE GENERAL & ADMIN $ $ TOTAL $ $ 105,000 112,000 100.000 $ 430,000 224,000 35.000 27,000 123,000 108,000 240,000 200,000 204,000 $ 401,000 718,000 794,000 920,000 211.000 173.000 18.000 522.000 320,000 238,000 707,000 644,000 458,000 2.766,000 5 PROGRAM REVENU FOSTER 6 CARE 7 & Line REVENUES (RESTR & UNRESTR) 9 1 FEDERAL $ 48,000 10 2 COUNTY 238,000 11 3 GIFTS & GRANTS 45,000 12 4 FEES 13 5 ENDOWMENT INC 48.000 14 15 6 TOTAL 379.000 16 17 DIRECT EXPENSES 18 7 PERSONNEL 205,000 19 8 FRINGE BENEFITS 43,000 20 9 SPACE 55.000 21 10 OTPS 25.000 22 23 11 TOTAL 328.000 24 25 12 Difference - First Bottes 51,000 26 27 28 AVERAGE CENSUS (Children) 29 17 RESIDENTIAL 16 30 18 FOSTER HOMES 42 31 19 DAY ONLY 2 32 20 TOTAL 58 33 34 35 36 37 38 155,000 33,000 79,000 49.000 117,000 25,000 87,000 66.000 300,000 105,000 75,000 $8.00 267.000 56,000 67,000 775.000 544.000 114,000 45,000 126.000 1,788,000 376.000 408 000 399.000 316,000 295,000 738,000 465,000 829,000 2.971.000 s 4,000 $ (37,000) S (31,000) 5 179,000 $ (371,000) 5 (205,000) 0 0 342 342 28 0 0 0 180 180 18 0 56 74 28 D FUNCTIONAL EXPENSES 1996 PROGRAM RIVENUES A EXPENSES FOSTER CARE LE REVENUES CRESTR & UNRESTR) (Une from below) BOYS & GIRIS SPORTS AFTER SCHOOL & SUMMER CARE RETARDED CHILDREN SUBSTANCE ABUSE GENERAL & ADMIN TOTAL 14 Artie Share of 829,00 (distributed using %) 15 TOTAL COST INCLUDING ALLOCATED EXPENSES (Line 11+14) 5.494.943 16 Difference Second Rett Line (Line 6-15) 505941 UNIT COSTS 19 AVERAGE CENSUS 10 17 RESIDENTIAL 21 IN FOSTER HOMES 19 DAY ONLY 30 TOTAL Prose the of children if you wish) 15 FIL-Full-Time liquet 0 16 42 2 58 242 141 0 0 1190 180 28 0 2 28 0 55 74 47 21 VIE Using Total Expense (11/20 5 22 VTE Induding Administrative Expenses (1/20) 40 SO 61 3 7.844 23 Total Remase per VTE (620) 6,544 53 Total Fapenses below) 5 2.971.000 8:29.000 2.142.000 30 15:319 32.000 2,142,000 14.7556 116.000 2.142,000 13.77 2,149.000 60 149 7.000 2,143,600 21:19 HO 2.141,000 10000 AutoSave OFF Copy of MLK Multi- Home Insert Draw Page Layout Formulas Data Review View Tell me B4 D E H 1 1 2 SPACE USAGE BY PROGRAMS IN NASF 3 4 AFTER 5 BOYS & SCHOOL 6 FOSTER GIRLS & SUMMER RETARDEI SUBSTANCE GENERAL TOTAL TOTAL 7 SPACE CARE SPORTS CARE CHILDREN ABUSE & ADMIN SPACE COST 8 9 CLARK HOUSE 5.000 1,700 2,600 9,300 162 10 GYMNASIUM 25.100 25.100 79 11 ADAMS 3,800 3,800 40 12 JEFFERSON 1,800 1,800 35 13 BAXTER 2,100 2,100 37 14 BRIDGER 4,000 4,000 55 15 16 PROGRAM COST (5000) $ 55 $ 79 $ 87 $ 75 $ 67 S 45 $ 40,100 $ 408 17 18 19 "NASF = Net Assignable Square Feet. Space usable for a workstation or activity 20 Does not include stairwells, toilets, elevator shafts etc. 21 22 23 24 25 28 27 28 29 30 31 32 33 OFF AutoSave Home Insert Copy of MLK Multi-Service Aa Draw Page Layout Formulas Data Review View Tell me 09 fx B C D H MLK example discarded FY 2010 Current Assets 300,000 Current Liabilities FY2009 1.50 Current Assets 200,000 350,000 Current Liabilities 240,000 Total Assets 1,200,000 Total Liabilities 1,000,000 0.83 Total Assets 900.000 Total Liabities 1.000.000 unrestricted revenues 800,000 unrestricted expenses 780,000 2.5% unrestricted revenues 700,000 unrestricted expenses 685,000 0 1 2 3 4 5 6 7 8 19 20 4 22 23 24 25 26 27 28 29 30 31