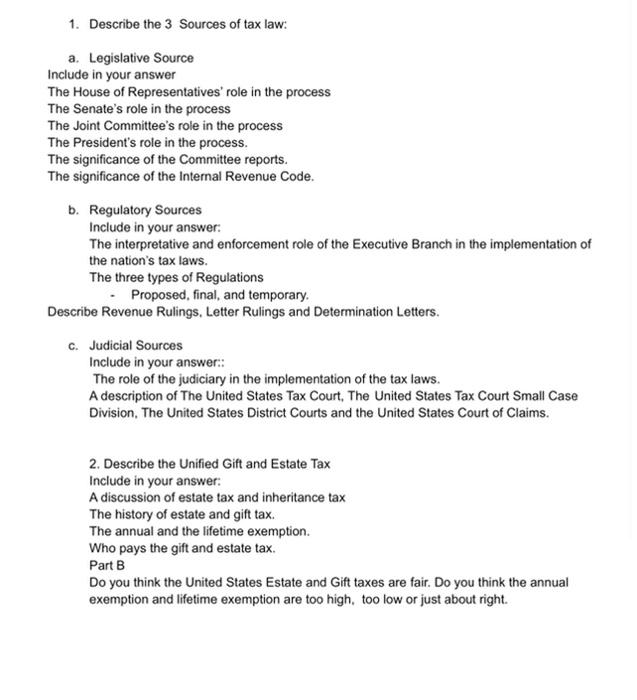

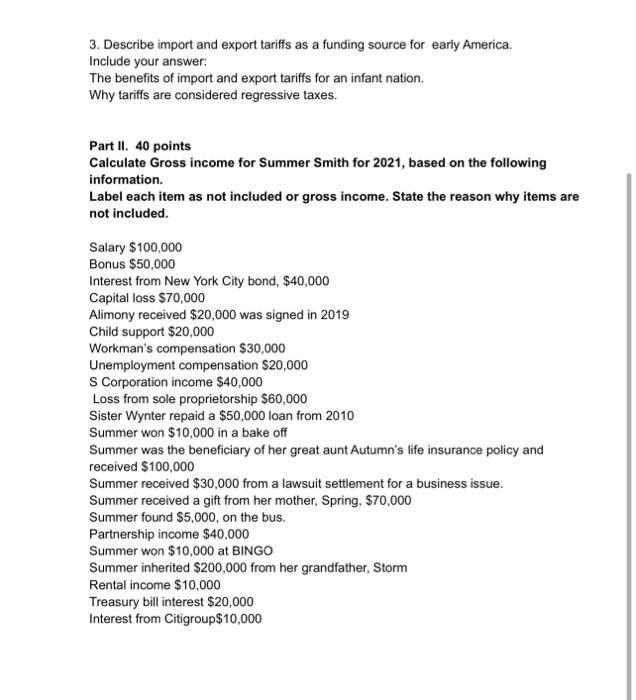

1. Describe the 3 Sources of tax law: a. Legislative Source Include in your answer The House of Representatives' role in the process The Senate's role in the process The Joint Committee's role in the process The President's role in the process. The significance of the Committee reports. The significance of the Internal Revenue Code. b. Regulatory Sources Include in your answer: The interpretative and enforcement role of the Executive Branch in the implementation of the nation's tax laws. The three types of Regulations Proposed, final, and temporary Describe Revenue Rulings, Letter Rulings and Determination Letters. c. Judicial Sources Include in your answer: The role of the judiciary in the implementation of the tax laws. A description of The United States Tax Court, The United States Tax Court Small Case Division, The United States District Courts and the United States Court of Claims. 2. Describe the Unified Gift and Estate Tax Include in your answer: A discussion of estate tax and inheritance tax The history of estate and gift tax. The annual and the lifetime exemption. Who pays the gift and estate tax. Part B Do you think the United States Estate and Gift taxes are fair. Do you think the annual exemption and lifetime exemption are too high, too low or just about right. 3. Describe import and export tariffs as a funding source for early America. Include your answer: The benefits of import and export tariffs for an infant nation. Why tariffs are considered regressive taxes. Part II. 40 points Calculate Gross income for Summer Smith for 2021, based on the following information. Label each item as not included or gross income. State the reason why items are not included. Salary $100,000 Bonus $50,000 Interest from New York City bond, $40,000 Capital loss $70,000 Alimony received $20,000 was signed in 2019 Child support $20,000 Workman's compensation $30,000 Unemployment compensation $20,000 S Corporation income $40,000 Loss from sole proprietorship $60,000 Sister Wynter repaid a $50,000 loan from 2010 Summer won $10,000 in a bake off Summer was the beneficiary of her great aunt Autumn's life insurance policy and received $100,000 Summer received $30,000 from a lawsuit settlement for a business issue. Summer received a gift from her mother, Spring, $70,000 Summer found $5,000, on the bus. Partnership income $40,000 Summer won $10,000 at BINGO Summer inherited $200,000 from her grandfather, Storm Rental income $10,000 Treasury bill interest $20,000 Interest from Citigroup$10,000