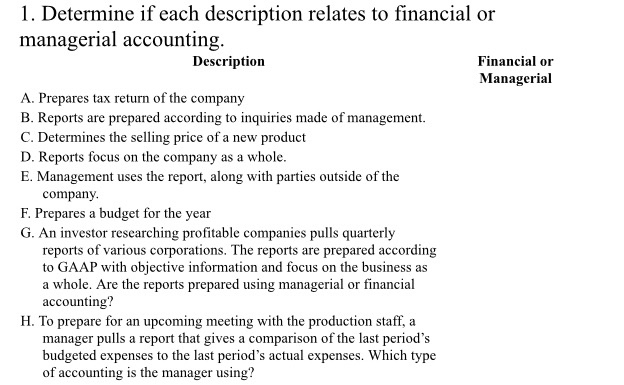

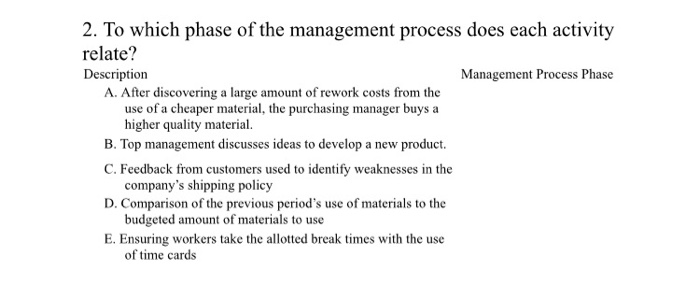

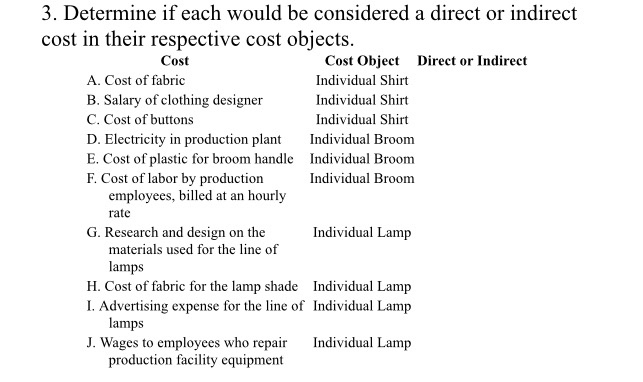

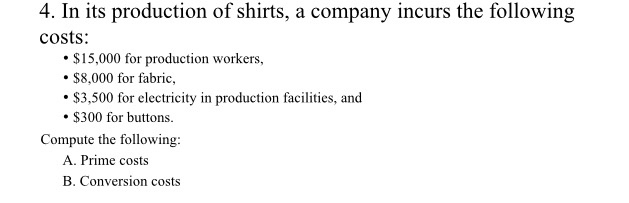

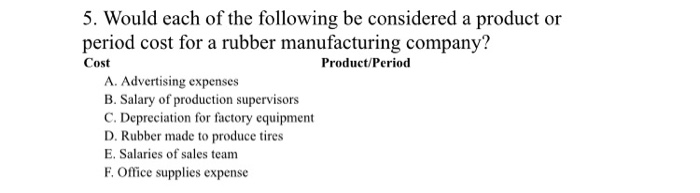

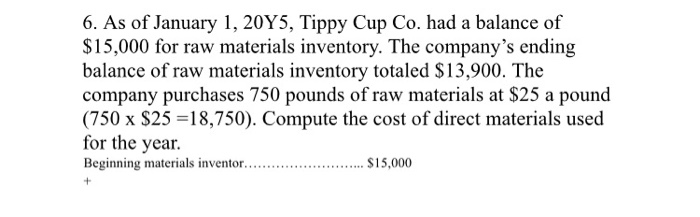

1. Determine if each description relates to financial or managerial accounting. Description Financial or Managerial A. Prepares tax return of the company B. Reports are prepared according to inquiries made of management. C. Determines the selling price of a new product D. Reports focus on the company as a whole. E. Management uses the report, along with parties outside of the company F. Prepares a budget for the year G. An investor researching profitable companies pulls quarterly reports of various corporations. The reports are prepared according to GAAP with objective information and focus on the business as a whole. Are the reports prepared using managerial or financial accounting? H. To prepare for an upcoming meeting with the production staff, a manager pulls a report that gives a comparison of the last period's budgeted expenses to the last period's actual expenses. Which type of accounting is the manager using? 2. To which phase of the management process does each activity relate? Description Management Process Phase A. After discovering a large amount of rework costs from the use of a cheaper material, the purchasing manager buys a higher quality material. B. Top management discusses ideas to develop a new product. C. Feedback from customers used to identify weaknesses in the company's shipping policy D. Comparison of the previous period's use of materials to the budgeted amount of materials to use E. Ensuring workers take the allotted break times with the use of time cards 3. Determine if each would be considered a direct or indirect cost in their respective cost objects. Cost Cost Object Direct or Indirect A. Cost of fabric Individual Shirt B. Salary of clothing designer Individual Shirt C. Cost of buttons Individual Shirt D. Electricity in production plant Individual Broom E. Cost of plastic for broom handle Individual Broom F. Cost of labor by production Individual Broom employees, billed at an hourly rate G. Research and design on the Individual Lamp materials used for the line of lamps H. Cost of fabric for the lamp shade Individual Lamp 1. Advertising expense for the line of Individual Lamp lamps J. Wages to employees who repair Individual Lamp production facility equipment 4. In its production of shirts, a company incurs the following costs: $15,000 for production workers, $8,000 for fabric, $3,500 for electricity in production facilities, and $300 for buttons. Compute the following: A. Prime costs B. Conversion costs 5. Would each of the following be considered a product or period cost for a rubber manufacturing company? Cost Product/Period A. Advertising expenses B. Salary of production supervisors C. Depreciation for factory equipment D. Rubber made to produce tires E. Salaries of sales team F. Office supplies expense 6. As of January 1, 2045, Tippy Cup Co. had a balance of $15,000 for raw materials inventory. The company's ending balance of raw materials inventory totaled $13,900. The company purchases 750 pounds of raw materials at $25 a pound (750 x $25 =18,750). Compute the cost of direct materials used for the year. Beginning materials inventor.. $15,000 +