Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. do journal entries 2. ledger 3. Trial balance 4. Adjusting entries 5. Adjusting Trial balance 6. Income Statement If you do the correct order

1. do journal entries

2. ledger

3. Trial balance

4. Adjusting entries

5. Adjusting Trial balance

6. Income Statement

If you do the correct order i will up vote

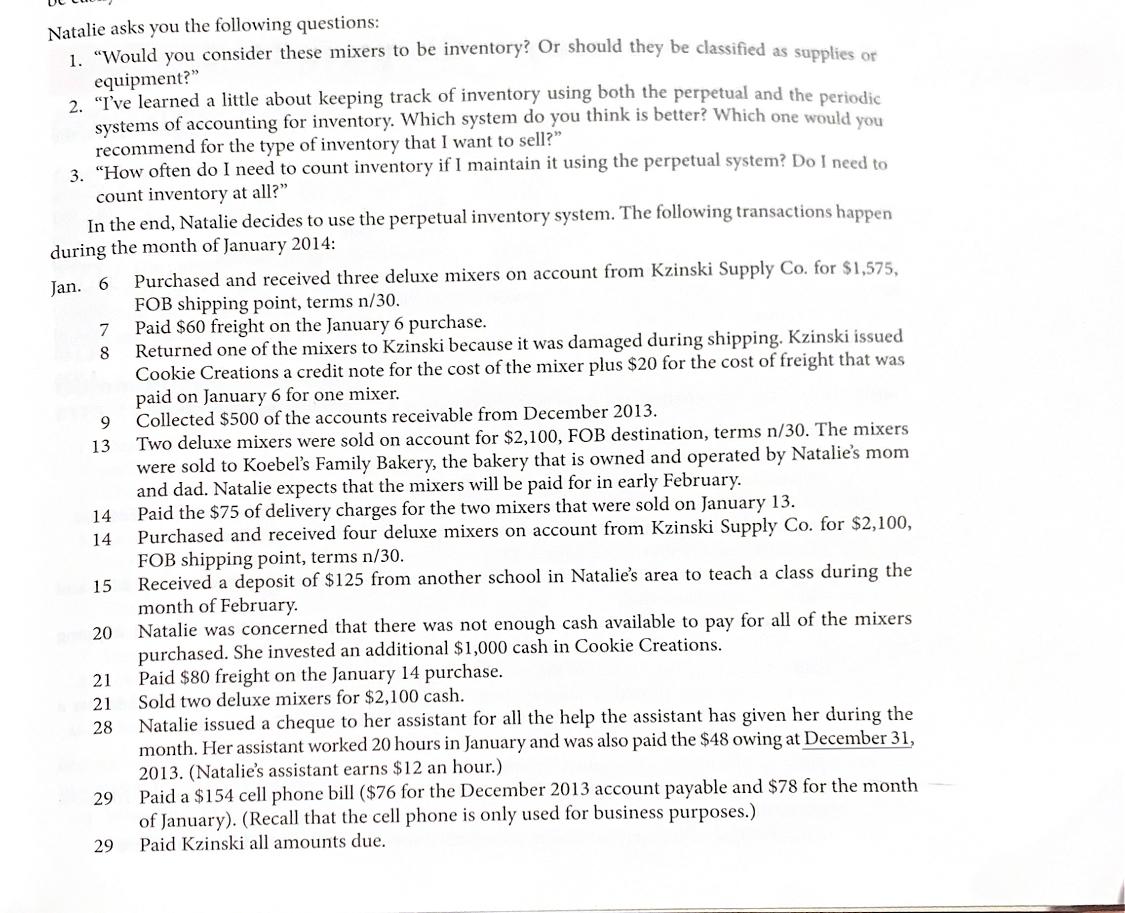

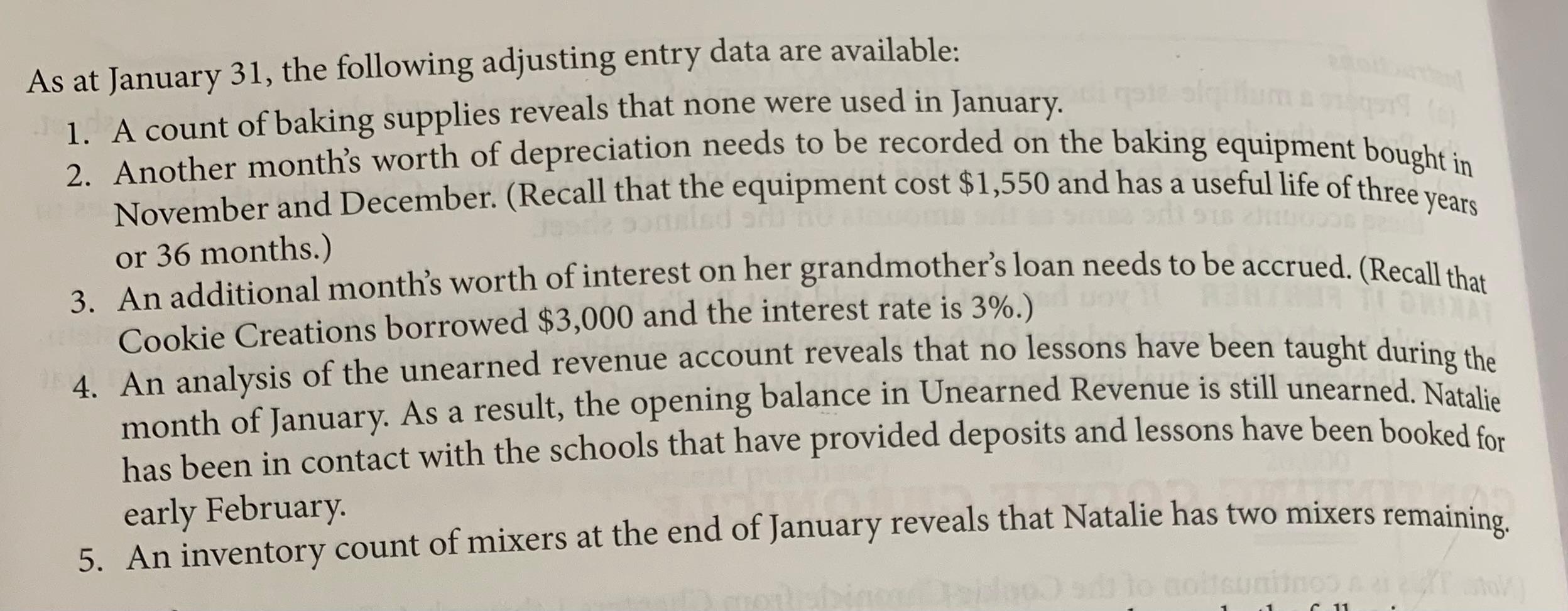

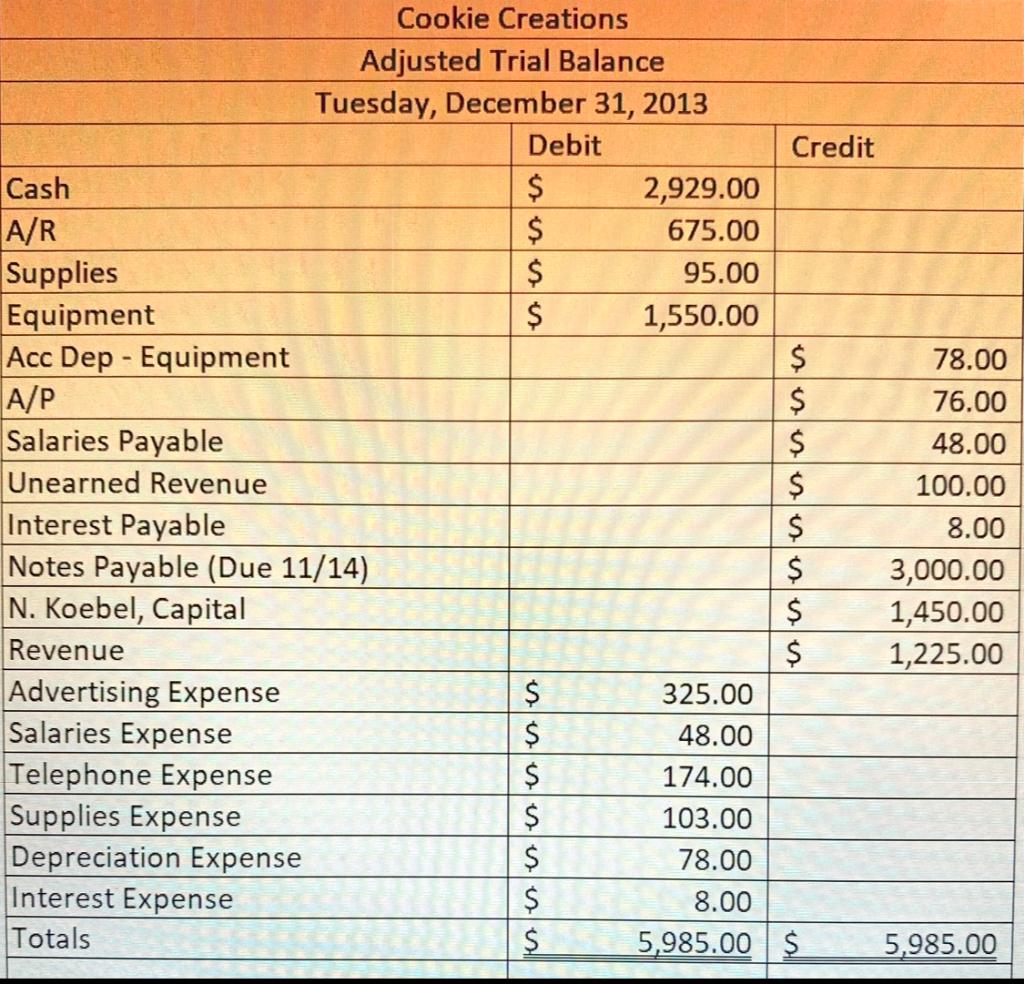

Jan. 6 Natalie asks you the following questions: 1. "Would you consider these mixers to be inventory? Or should they be classified as supplies or equipment?" 2. "Tve learned a little about keeping track of inventory using both the perpetual and the periodic systems of accounting for inventory. Which system do you think is better? Which one would you recommend for the type of inventory that I want to sell?" 3. "How often do I need to count inventory if I maintain it using the perpetual system? Do I need to count inventory at all?" In the end, Natalie decides to use the perpetual inventory system. The following transactions happen during the month of January 2014: Purchased and received three deluxe mixers on account from Kzinski Supply Co. for $1,575, FOB shipping point, terms n/30. 7 Paid $60 freight on the January 6 purchase. 8 Returned one of the mixers to Kzinski because it was damaged during shipping. Kzinski issued Cookie Creations a credit note for the cost of the mixer plus $20 for the cost of freight that was paid on January 6 for one mixer. 9 Collected $500 of the accounts receivable from December 2013. Two deluxe mixers were sold on account for $2,100, FOB destination, terms n/30. The mixers were sold to Koebel's Family Bakery, the bakery that is owned and operated by Natalie's mom and dad. Natalie expects that the mixers will be paid for in early February. 14 Paid the $75 of delivery charges for the two mixers that were sold on January 13. 14 Purchased and received four deluxe mixers on account from Kzinski Supply Co. for $2,100, FOB shipping point, terms n/30. 15 Received a deposit of $125 from another school in Natalie's area to teach a class during the month of February. 20 Natalie was concerned that there was not enough cash available to pay for all of the mixers purchased. She invested an additional $1,000 cash in Cookie Creations. Paid $80 freight on the January 14 purchase. Sold two deluxe mixers for $2,100 cash. 28 Natalie issued a cheque to her assistant for all the help the assistant has given her during the month. Her assistant worked 20 hours in January and was also paid the $48 owing at December 31, 2013. (Natalie's assistant earns $12 an hour.) 29 Paid a $154 cell phone bill ($76 for the December 2013 account payable and $78 for the month of January). (Recall that the cell phone is only used for business purposes.) 29 Paid Kzinski all amounts due. 13 13 21 21 As at January 31, the following adjusting entry data are available: 1. A count of baking supplies reveals that none were used in January. 2. Another month's worth of depreciation needs to be recorded on the baking equipment bought in November and December. (Recall that the equipment cost $1,550 and has a useful life of three years or 36 months.) 3. An additional month's worth of interest on her grandmother's loan needs to be accrued. (Recall that Cookie Creations borrowed $3,000 and the interest rate is 3%.) 4. An analysis of the unearned revenue account reveals that no lessons have been taught during the month of January. As a result, the opening balance in Unearned Revenue is still unearned. Natalie has been in contact with the schools that have provided deposits and lessons have been booked for early February 5. An inventory count of mixers at the end of January reveals that Natalie has two mixers remaining . 11 Cookie Creations Adjusted Trial Balance Tuesday, December 31, 2013 Debit Credit Cash $ 2,929.00 A/R $ 675.00 Supplies $ 95.00 Equipment $ 1,550.00 Acc Dep - Equipment $ 78.00 A/P $ 76.00 Salaries Payable $ 48.00 Unearned Revenue $ 100.00 Interest Payable $ 8.00 Notes Payable (Due 11/14) $ 3,000.00 N. Koebel, Capital $ 1,450.00 Revenue $ 1,225.00 Advertising Expense $ 325.00 Salaries Expense $ 48.00 Telephone Expense $ 174.00 Supplies Expense $ 103.00 Depreciation Expense $ 78.00 Interest Expense $ 8.00 Totals $ 5,985.00 $ 5,985.00 linnunununStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started