Answered step by step

Verified Expert Solution

Question

1 Approved Answer

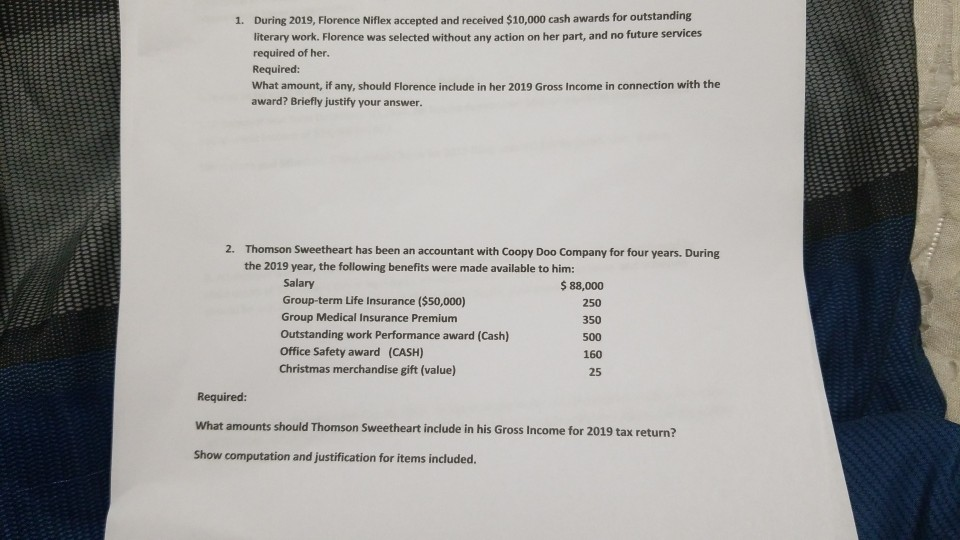

1. During 2019, Florence Niflex accepted and received $10,000 cash awards for outstanding literary work. Florence was selected without any action on her part, and

1. During 2019, Florence Niflex accepted and received $10,000 cash awards for outstanding literary work. Florence was selected without any action on her part, and no future services required of her. Required: What amount, if any, should Florence include in her 2019 Gross Income in connection with the award? Briefly justify your answer. 2. Thomson Sweetheart has been an accountant with Coopy Doo Company for four years. During the 2019 year, the following benefits were made available to him: Salary $ 88,000 Group-term Life Insurance ($50,000) 250 350 Outstanding work Performance award (Cash) 500 Office Safety award (CASH) Christmas merchandise gift (value) Required: What amounts should Thomson Sweetheart include in his Gross Income for 2019 tax return? Show computation and justification for items included

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started