Answered step by step

Verified Expert Solution

Question

1 Approved Answer

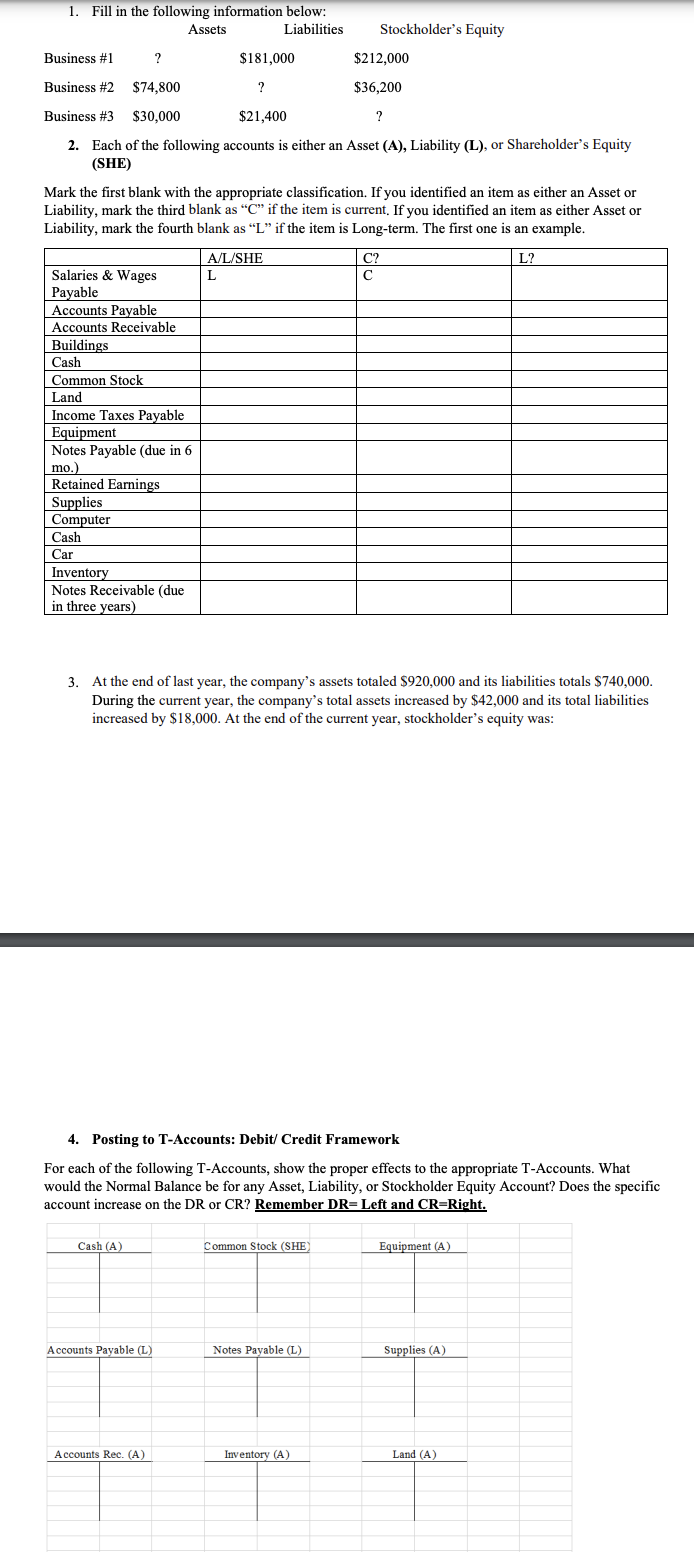

1. Fill in the following information below: Assets Liabilities Stockholder's Equity Business #1 ? $181,000 $212,000 Business #2 $74,800 ? $36,200 Business # 3

1. Fill in the following information below: Assets Liabilities Stockholder's Equity Business #1 ? $181,000 $212,000 Business #2 $74,800 ? $36,200 Business # 3 $30,000 $21,400 ? 2. Each of the following accounts is either an Asset (A), Liability (L), or Shareholder's Equity (SHE) Mark the first blank with the appropriate classification. If you identified an item as either an Asset or Liability, mark the third blank as "C" if the item is current. If you identified an item as either Asset or Liability, mark the fourth blank as "L" if the item is Long-term. The first one is an example. Salaries & Wages A/L/SHE L Payable Accounts Payable Accounts Receivable Buildings Cash Common Stock Land Income Taxes Payable Equipment Notes Payable (due in 6 mo.) Retained Earnings Supplies Computer Cash Car Inventory Notes Receivable (due in three years) C? L? 3. At the end of last year, the company's assets totaled $920,000 and its liabilities totals $740,000. During the current year, the company's total assets increased by $42,000 and its total liabilities increased by $18,000. At the end of the current year, stockholder's equity was: 4. Posting to T-Accounts: Debit/Credit Framework For each of the following T-Accounts, show the proper effects to the appropriate T-Accounts. What would the Normal Balance be for any Asset, Liability, or Stockholder Equity Account? Does the specific account increase on the DR or CR? Remember DR= Left and CR=Right. Cash (A) Common Stock (SHE) Equipment (A) Accounts Payable (L) Notes Payable (L) Supplies (A) Accounts Rec. (A) Inventory (A) Land (A)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started