Answered step by step

Verified Expert Solution

Question

1 Approved Answer

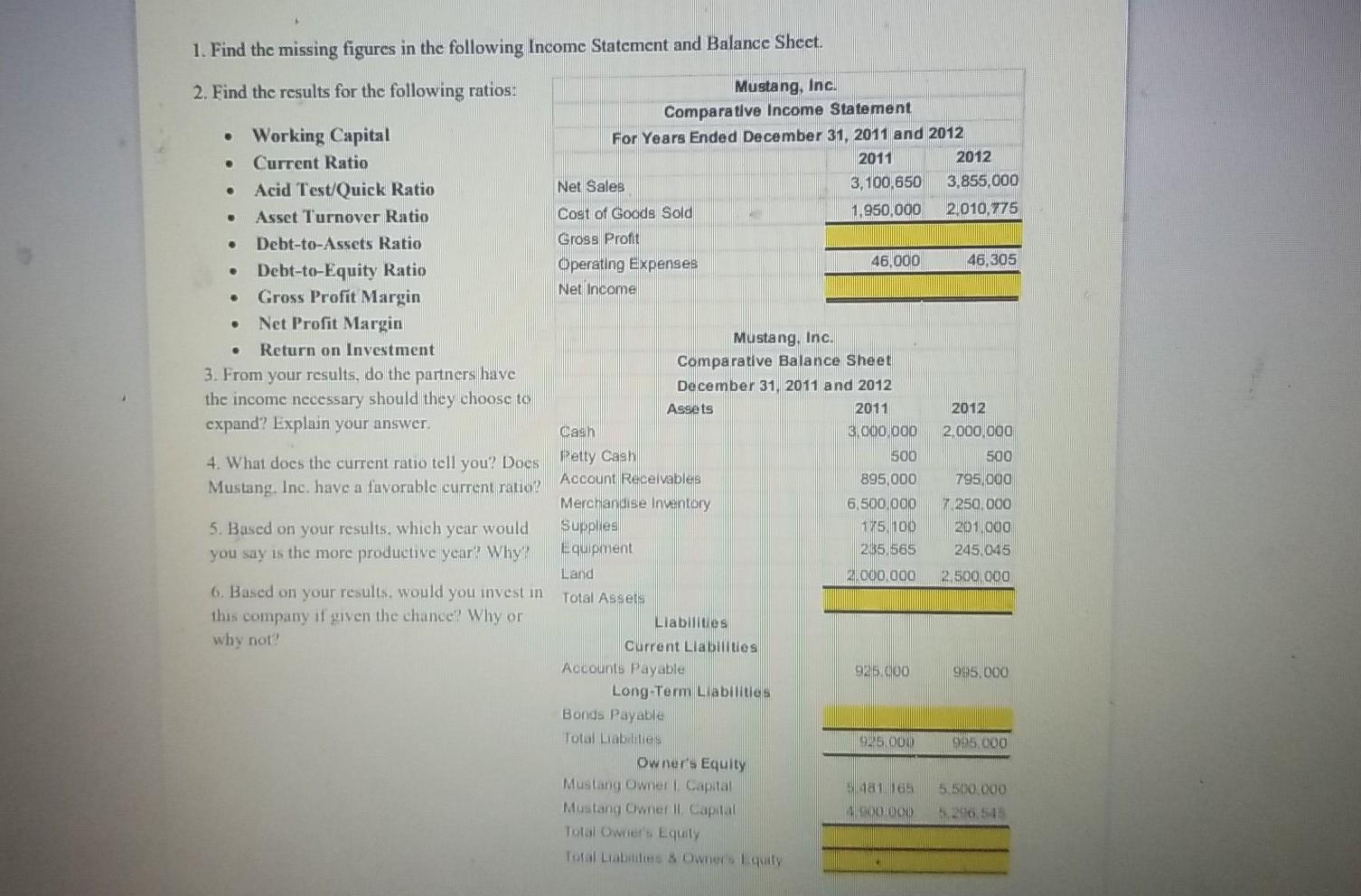

1. Find the missing figures in the following Income Statement and Balance Sheet. . . . . . 2. Find the results for the following

1. Find the missing figures in the following Income Statement and Balance Sheet. . . . . . 2. Find the results for the following ratios. Mustang, Inc. Comparative Income Statement Working Capital For Years Ended December 31, 2011 and 2012 Current Ratio 2011 2012 Acid Test/Quick Ratio Net Sales 3,100,650 3,855,000 Asset Turnover Ratio Cost of Goods Sold 1,950,000 2010,775 Debt-to-Assets Ratio Gross Profit 46,000 Operating Expenses 46,305 Debt-to-Equity Ratio Gross Profit Margin Net Income Net Profit Margin Mustang, Inc. Return on Investment Comparative Balance Sheet 3. From your results, do the partners have December 31, 2011 and 2012 the income necessary should they choose to Assets 2011 2012 expand? Explain your answer. cash 3.000.000 2,000,000 500 500 4. What does the current ratio tell you? Does Petty Cash 895,000 795,000 Mustang, Inc. have a favorable current ratio? Account Receivables Merchandise Inventory 6.500.000 7250.000 5. Based on your results, which year would Supplies 175 100 201000 you say is the more productive year? Why? Equipment 265 565 245.045 Land 000.000 2.500.000 6. Based on your results. would you invest in Total Assets this company if given the chance? Why or Liabilities why not? Current Liabilities Accounts Payable 945.000 995.000 Long-Term Liabilities Bonds Payable Total Liabilities 925.000 995,000 Owner's Equity Mustang Owner Capital 181 165 5.500.000 Mustang Owner Il Capital 9001000 5.296.545 Total Owner's Equity Total Labs & Owner quity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started