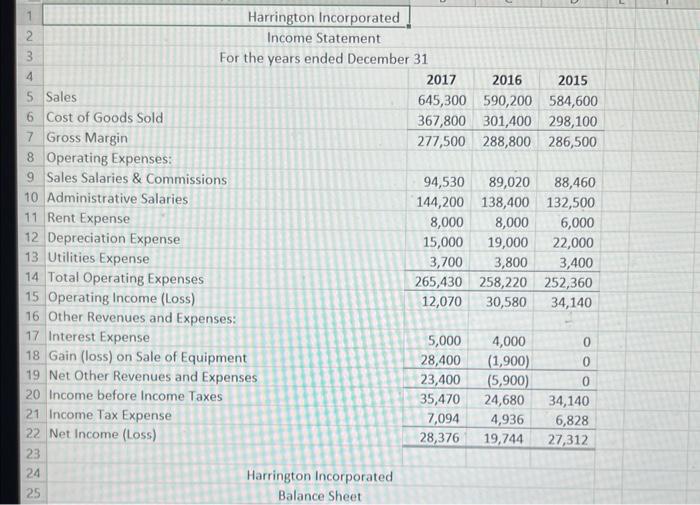

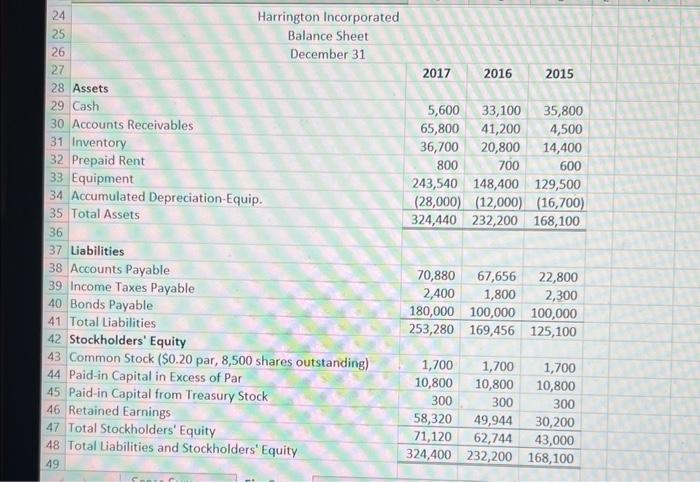

1 Harrington Incorporated Income Statement \begin{tabular}{|l|l|c|c|c|} \hline 3 & \multicolumn{5}{|l|}{ For the years ended December 31} & \\ \hline 4 & & 2017 & 2016 & 2015 \\ \hline 5 & Sales & 645,300 & 590,200 & 584,600 \\ \hline 6 & Cost of Goods Sold & 367,800 & 301,400 & 298,100 \\ \hline 7 & Gross Margin & 277,500 & 288,800 & 286,500 \\ \hline \end{tabular} 8 Operating Expenses: 9 Sales Salaries \& Commissions 10 Administrative Salaries 11 Rent Expense 12 Depreciation Expense 13 Utilities Expense 14 Total Operating Expenses 15 Operating Income (Loss) \begin{tabular}{|r|r|r|} \hline 94,530 & 89,020 & 88,460 \\ \hline 144,200 & 138,400 & 132,500 \\ \hline 8,000 & 8,000 & 6,000 \\ \hline 15,000 & 19,000 & 22,000 \\ \hline 3,700 & 3,800 & 3,400 \\ \hline 265,430 & 258,220 & 252,360 \\ \hline 12,070 & 30,580 & 34,140 \\ \hline \end{tabular} 16 Other Revenues and Expenses: 17 Interest Expense 18 Gain (loss) on Sale of Equipment 19 Net Other Revenues and Expenses 20 Income before Income Taxes 21 Income Tax Expense 22 Net Income (Loss) \begin{tabular}{|r|r|r|} \hline 5,000 & 4,000 & 0 \\ \hline 28,400 & (1,900) & 0 \\ \hline 23,400 & (5,900) & 0 \\ \hline 35,470 & 24,680 & 34,140 \\ \hline 7,094 & 4,936 & 6,828 \\ \hline 28,376 & 19,744 & 27,312 \\ \hline \end{tabular} 23 24 Harrington Incorporated 25 Balance Sheet 7 Liabilities 38 Accounts Payable 39 Income Taxes Payable 40 Bonds Payable 41 Total Liabilities 42 Stockholders' Equity \begin{tabular}{|r|r|r|} \hline 70,880 & 67,656 & 22,800 \\ \hline 2,400 & 1,800 & 2,300 \\ \hline 180,000 & 100,000 & 100,000 \\ \hline 253,280 & 169,456 & 125,100 \\ \hline \end{tabular} 43 Common Stock ( $0.20 par, 8,500 shares outstanding) 44 Paid-in Capital in Excess of Par 45 Paid-in Capital from Treasury Stock 46 Retained Earnings 47 Total Stockholders' Equity 48 Total Liabilities and Stockholders' Equity 49 \begin{tabular}{|r|r|r|} \hline 1,700 & 1,700 & 1,700 \\ \hline 10,800 & 10,800 & 10,800 \\ \hline 300 & 300 & 300 \\ \hline 58,320 & 49,944 & 30,200 \\ \hline 71,120 & 62,744 & 43,000 \\ \hline 324,400 & 232,200 & 168,100 \\ \hline \end{tabular} Farringten iecergerstel