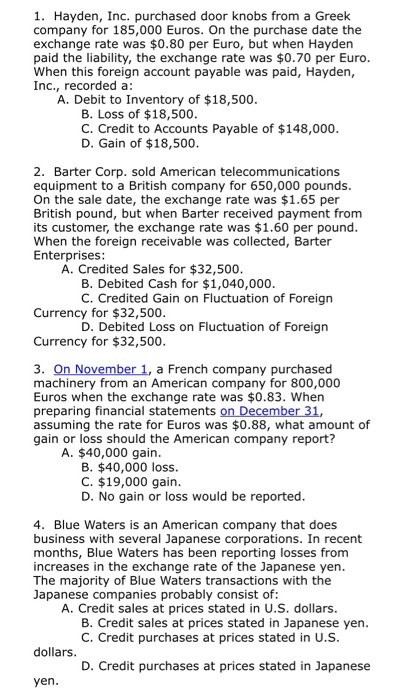

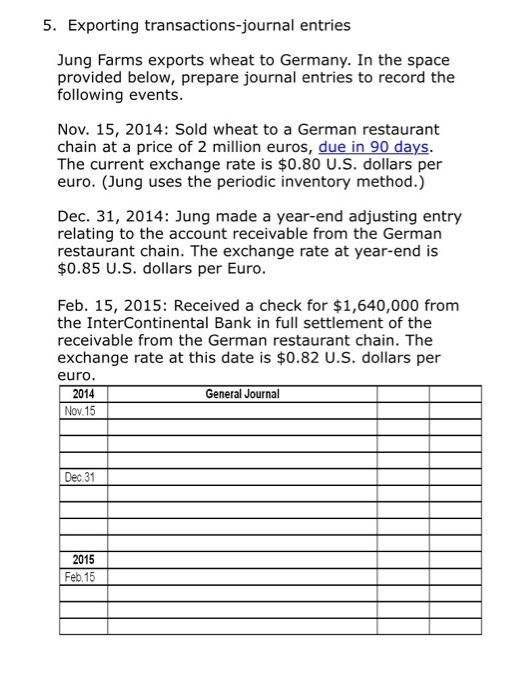

1. Hayden, Inc. purchased door knobs from a Greek company for 185,000 Euros. On the purchase date the exchange rate was $0.80 per Euro, but when Hayden paid the liability, the exchange rate was $0.70 per Euro When this foreign account payable was paid, Hayden, Inc., recorded a A. Debit to Inventory of $18,500 B. Loss of $18,500 C. Credit to Accounts Payable of $148,000 D. Gain of $18,500 2. Barter Corp. sold American telecommunications equipment to a British company for 650,000 pounds On the sale date, the exchange rate was $1.65 per British pound, but when Barter received payment fromm its customer, the exchange rate was $1.60 per pound When the foreign receivable was collected, Barter Enterprises A. Credited Sales for $32,500 B. Debited Cash for $1,040,000 C. Credited Gain on Fluctuation of Foreign Currency for $32,500 D. Debited Loss on Fluctuation of Foreign Currency for $32,500 a French company purchased machinery from an American company for 800,000 Euros when the exchange rate was $0.83. When preparing financial statements assuming the rate for Euros was $0.88, what amount of gain or loss should the American company report? A. $40,000 gain B. $40,000 loss. C. $19,000 gain D. No gain or loss would be reported 4. Blue Waters is an American company that does business with several Japanese corporations. In recent months, Blue Waters has been reporting losses from increases in the exchange rate of the Japanese yen The majority of Blue Waters transactions with the Japanese companies probably consist of A. Credit sales at prices stated in U.S. dollars. B. Credit sales at prices stated in Japanese yen. C. Credit purchases at prices stated in U.S dollars D. Credit purchases at prices stated in Japanese yen 5. Exporting transactions-journal entries Jung Farms exports wheat to Germany. In the space provided below, prepare journal entries to record the following events Nov. 15, 2014: Sold wheat to a German restaurant chain at a price of 2 million euros, due in 90 days The current exchange rate is $0.80 U.S. dollars per euro. (Jung uses the periodic inventory method.) Dec. 31, 2014: Jung made a year-end adjusting entry relating to the account receivable from the German restaurant chain. The exchange rate at year-end is $0.85 U.S. dollars per Euro Feb. 15, 2015: Received a check for $1,640,000 from the InterContinental Bank in full settlement of the receivable from the German restaurant chain. The exchange rate at this date is $0.82 U.S. dollars per euro 2014 Nov.15 General Journal Dec 31 2015 Feb.15