Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.) I need to understand the steps on how to do this problem. the answer is already in picture just trying to understand how to

1.) I need to understand the steps on how to do this problem. the answer is already in picture just trying to understand how to get to that. thank you!!!

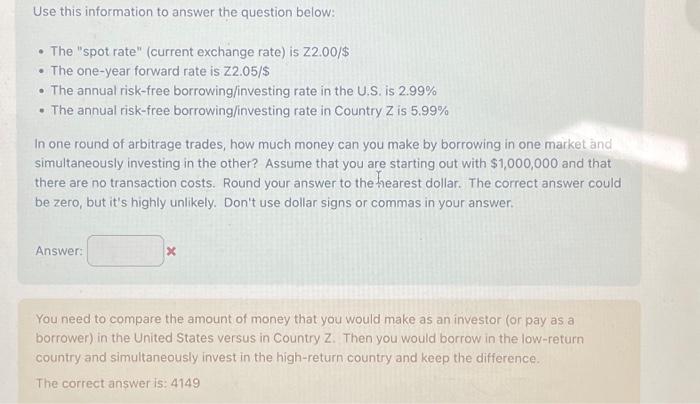

Use this information to answer the question below: - The "spot rate" (current exchange rate) is Z2.00/$ - The one-year forward rate is z2.05/$ - The annual risk-free borrowing/investing rate in the U.S. is 2.99% - The annual risk-free borrowing/investing rate in Country Z is 5.99% In one round of arbitrage trades, how much money can you make by borrowing in one market and simultaneously investing in the other? Assume that you are starting out with $1,000,000 and that there are no transaction costs. Round your answer to the hearest dollar. The correct answer could be zero, but it's highly unlikely. Don't use dollar signs or commas in your answer. Answer: You need to compare the amount of money that you would make as an investor (or pay as a borrower) in the United States versus in Country Z. Then you would borrow in the low-return country and simultaneously invest in the high-return country and keep the difference. The correct answer is: 4149

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started