Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 In 2000, Sam bought a beautiful timeshare in Puerto Rico for $20,000. By 2015, Sam was desperately trying to sell this same timeshare

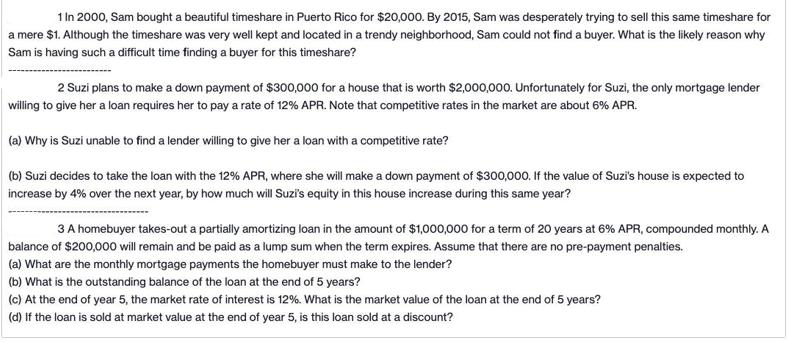

1 In 2000, Sam bought a beautiful timeshare in Puerto Rico for $20,000. By 2015, Sam was desperately trying to sell this same timeshare for a mere $1. Although the timeshare was very well kept and located in a trendy neighborhood. Sam could not find a buyer. What is the likely reason why Sam is having such a difficult time finding a buyer for this timeshare? 2 Suzi plans to make a down payment of $300,000 for a house that is worth $2,000,000. Unfortunately for Suzi, the only mortgage lender willing to give her a loan requires her to pay a rate of 12% APR. Note that competitive rates in the market are about 6% APR. (a) Why is Suzi unable to find a lender willing to give her a loan with a competitive rate? (b) Suzi decides to take the loan with the 12% APR, where she will make a down payment of $300,000. If the value of Suzi's house is expected to increase by 4% over the next year, by how much will Suzi's equity in this house increase during this same year? 3 A homebuyer takes-out a partially amortizing loan in the amount of $1,000,000 for a term of 20 years at 6% APR, compounded monthly. A balance of $200,000 will remain and be paid as a lump sum when the term expires. Assume that there are no pre-payment penalties. (a) What are the monthly mortgage payments the homebuyer must make to the lender? (b) What is the outstanding balance of the loan at the end of 5 years? (c) At the end of year 5, the market rate of interest is 12%. What is the market value of the loan at the end of 5 years? (d) If the loan is sold at market value at the end of year 5, is this loan sold at a discount? 1 In 2000, Sam bought a beautiful timeshare in Puerto Rico for $20,000. By 2015, Sam was desperately trying to sell this same timeshare for a mere $1. Although the timeshare was very well kept and located in a trendy neighborhood, Sam could not find a buyer. What is the likely reason why Sam is having such a difficult time finding a buyer for this timeshare? 2 Suzi plans to make a down payment of $300,000 for a house that is worth $2,000,000. Unfortunately for Suzi, the only mortgage lender willing to give her a loan requires her to pay a rate of 12% APR. Note that competitive rates in the market are about 6% APR. (a) Why is Suzi unable to find a lender willing to give her a loan with a competitive rate? (b) Suzi decides to take the loan with the 12% APR, where she will make a down payment of $300,000. If the value of Suzi's house is expected to increase by 4% over the next year, by how much will Suzi's equity in this house increase during this same year? 3 A homebuyer takes-out a partially amortizing loan in the amount of $1,000,000 for a term of 20 years at 6% APR, compounded monthly. A balance of $200,000 will remain and be paid as a lump sum when the term expires. Assume that there are no pre-payment penalties. (a) What are the monthly mortgage payments the homebuyer must make to the lender? (b) What is the outstanding balance of the loan at the end of 5 years? (c) At the end of year 5, the market rate of interest is 12%. What is the market value of the loan at the end of 5 years? (d) If the loan is sold at market value at the end of year 5, is this loan sold at a discount?

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 The likely reason why Sam is having such a difficult time finding a buyer for the timeshare is that the demand for timeshares in Puerto Rico has significantly decreased or the market for ti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started