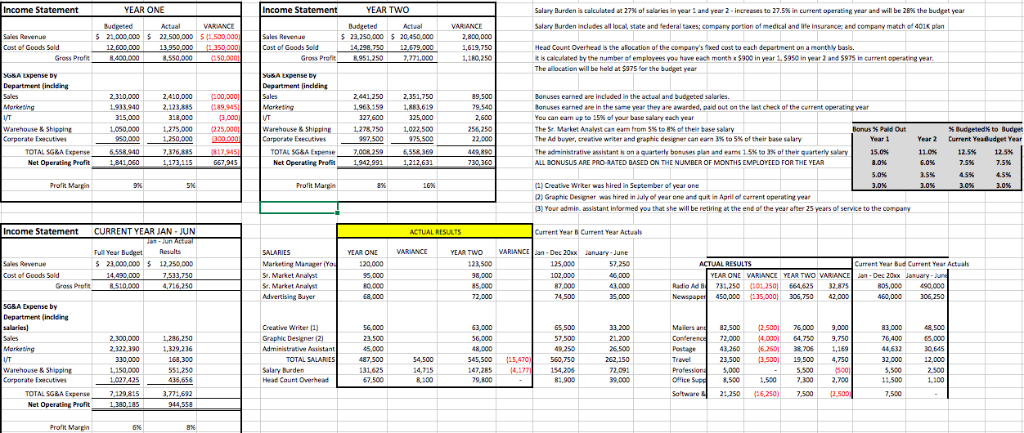

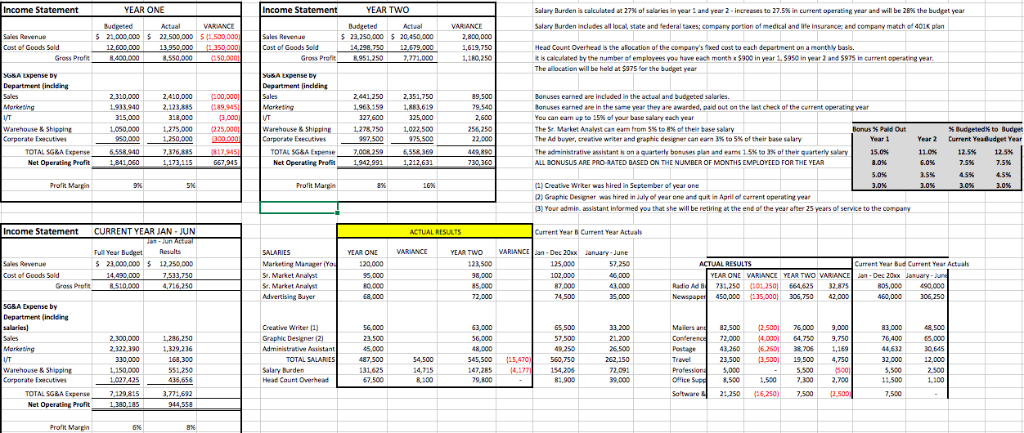

| 1.) In year one your department was approximately 10% over-budget. Justify why this occurred. |

| 2.) Your department was over budget two consecutive years in Software and Licensing, please provide an explanation. |

Income Statement YEAR ONE Income Statement YEAR TWO Salary Burden is calculated at 27% of salaries in year 1 and year 2-increases to 27,5% in current operating year and will be 2B% the budget year Salary Burden includes all local state and federal taxes; compeny portion of medical and life Insurance and company match of 401K plan $ 21,000,000 $ 22,500,000 $(1,500,000 23,150,00020,450,000 Cost o Goods Sold Cost of Goods Sold 1,619,750 1180,250 Head Count Overhead is the alocation of the copary's xedcost to each department on a monthly basis. t is calculated by the number o employees you have each month 5900 in year 1,5950 in year 2 and 5975 in current operating vear. The llocation will be held u $975 for the budget year Gross Proft Gross Profit obA Lxpense by Department linclding Department (inclding 2 310,0002,410,00 (00,000] 2.441 250 2,351,750 Bonuses earned are included in the actual and budgeted salaries. Sonuses earned are in the same year they are awarded, paid out on the last check of the current operating year You can earn up to 15% olyat base salary each year The Sr Market Analyst can eam from 5% to 8% of their base salary The Ad buyer, creative writer and graphic designer can earn 3% to 5% of their base salary The achinistrative assistant on acarterly bonuses plan and eams 1 5% to 3% of ther quarterly saan ALL BONUSUS 050.000 1,275.000 Warehouse& ShippinE 1278750 1.022.50 Carporate Executives Bonus % Paid Out Year 2 Cturrent YeaBudget Year 11.0% TOTAL SG&A Expee 6.558 TOTAL SG&A Expense 00R25 489,890 15.0% 12.5% 125% ARE PRO-RATED BASED ON THE NUMBER OF MONTHS EMPLOYEED FOR THE )Creative Writer was hired in September o year one 2) Graphic Designer w hired in Jdly of vear one and quit in April of current operating year 3 Your admin. assistant informed you that she will be retiring at the end o the year after 25 years o service to the company Income Statement CURRENT YEAR JAN-JUN Current Year B Current Year Actuals ARIANCEan Dec 20Mx anuary-June 125,000 102000 87,000 YEAR ONE VARIANCE YEAR TWO Marketing Manager (Yo S. Market Analys 20,000 23,500 57.250 Current Year Bud Current Year Actuals Cost o Goods Sold ONE VARIANCE Y EAR TWO Gross Proft MarketAa Advertising Buyer Radio Ad 8 731,250 64.62532,87 805,000 90000 460,000 306 250 50,0035,006,750 42,003 SG&A Expense by Department (inciding 56,000 63,000 65,50033200 2,500 2,500) 6,0009,000 72,000 400064,7509,750 33,7061.169 23,500 3500) 19,50 4,750 2.300,0001,286,250 7640030EA5 Graphic Designer (2 26,500 330,000168,300 32,000 147,285 7154,206 Salary Burden Head Count Overhead 425 436,656 81.900 . ~ 72091 500 500 .300 2,700 TOTAL SG&A Expense7,129815 Net Operating Profit