Answered step by step

Verified Expert Solution

Question

1 Approved Answer

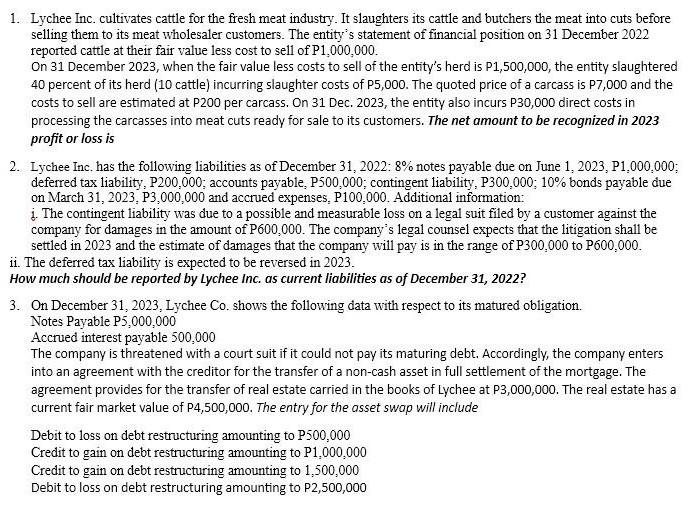

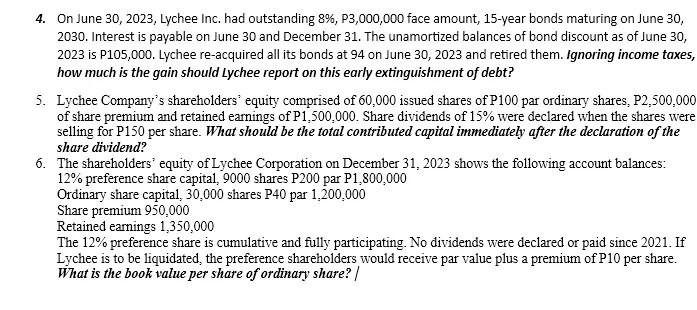

1. Lychee Inc. cultivates cattle for the fresh meat industry. It slaughters its cattle and butchers the meat into cuts before selling them to its

1. Lychee Inc. cultivates cattle for the fresh meat industry. It slaughters its cattle and butchers the meat into cuts before selling them to its meat wholesaler customers. The entity's statement of financial position on 31 December 2022 reported cattle at their fair value less cost to sell of P1,000,000. On 31 December 2023, when the fair value less costs to sell of the entity's herd is P1,500,000, the entity slaughtered 40 percent of its herd ( 10 cattle) incurring slaughter costs of P5,000. The quoted price of a carcass is P7,000 and the costs to sell are estimated at P200 per carcass. On 31 Dec. 2023, the entity also incurs P30,000 direct costs in processing the carcasses into meat cuts ready for sale to its customers. The net amount to be recognized in 2023 profit or loss is 2. Lychee Inc, has the following liabilities as of December 31,2022:8% notes payable due on June 1,2023,P1,000,000; deferred tax liability, P200,000; accounts payable, P500,000; contingent liability, P300,000; 10% bonds payable due on March 31,2023, P3,000,000 and accrued expenses, P100,000. Additional information: i. The contingent liability was due to a possible and measurable loss on a legal suit filed by a customer against the company for damages in the amount of P600,000. The company's legal counsel expects that the litigation shall be settled in 2023 and the estimate of damages that the company will pay is in the range of P300,000 to P600,000. ii. The deferred tax liability is expected to be reversed in 2023. How much should be reported by Lychee Inc. as current liabilities as of December 31, 2022? 3. On December 31,2023, Lychee Co. shows the following data with respect to its matured obligation. Notes Payable P5,000,000 Accrued interest payable 500,000 The company is threatened with a court suit if it could not pay its maturing debt. Accordingly, the company enters into an agreement with the creditor for the transfer of a non-cash asset in full settlement of the mortgage. The agreement provides for the transfer of real estate carried in the books of Lychee at P3,000,000. The real estate has a current fair market value of P4,500,000. The entry for the asset swap will include Debit to loss on debt restructuring amounting to P500,000 Credit to gain on debt restructuring amounting to P1,000,000 Credit to gain on debt restructuring amounting to 1,500,000 Debit to loss on debt restructuring amounting to P2,500,000 4. On June 30,2023 , Lychee Inc. had outstanding 8%,P3,000,000 face amount, 15 -year bonds maturing on June 30 , 2030. Interest is payable on June 30 and December 31 . The unamortized balances of bond discount as of June 30 , 2023 is P105,000. Lychee re-acquired all its bonds at 94 on June 30, 2023 and retired them. Ignoring income taxes, how much is the gain should Lychee report on this early extinguishment of debt? 5. Lychee Company's shareholders' equity comprised of 60,000 issued shares of P100 par ordinary shares, P2,500,000 of share premium and retained earnings of P1,500,000. Share dividends of 15% were declared when the shares were selling for P150 per share. What should be the total contributed capital immediately after the declaration of the share dividend? 6. The shareholders' equity of Lychee Corporation on December 31,2023 shows the following account balances: 12% preference share capital, 9000 shares P200 par P1,800,000 Ordinary share capital, 30,000 shares P40 par 1,200,000 Share premium 950,000 Retained earnings 1,350,000 The 12% preference share is cumulative and fully participating. No dividends were declared or paid since 2021 . If Lychee is to be liquidated, the preference shareholders would receive par value plus a premium of P10 per share. What is the book value per share of ordinary share? /

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started