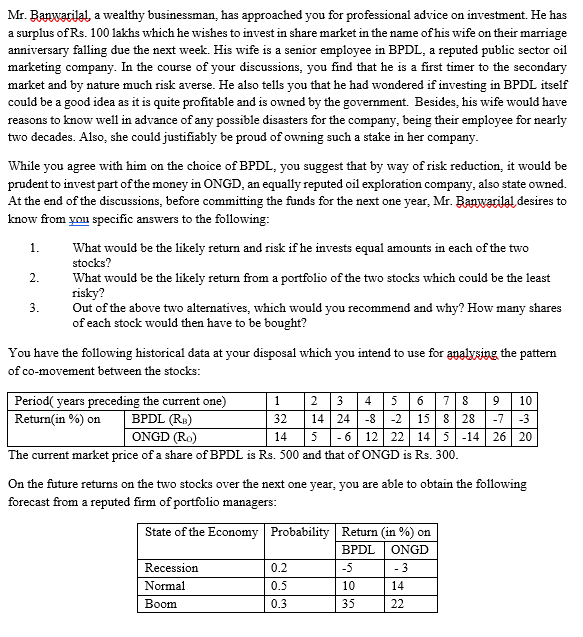

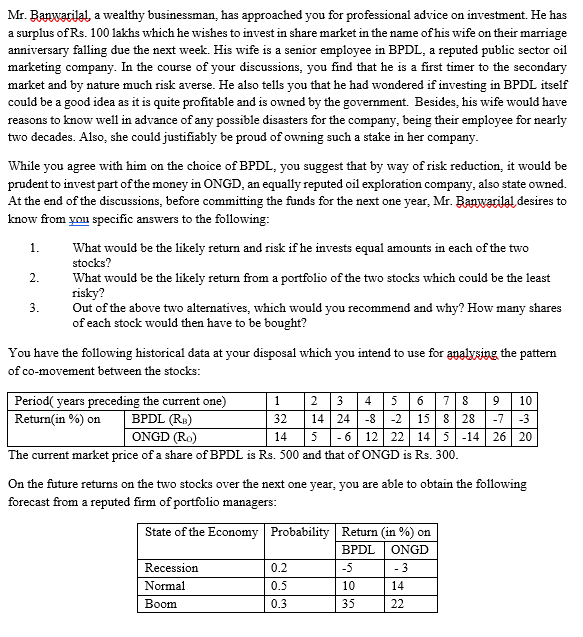

1. Mr. Banwarilal, a wealthy businessman, has approached you for professional advice on investment. He has a surplus of Rs. 100 lakhs which he wishes to invest in share market in the name of his wife on their marriage anniversary falling due the next week. His wife is a senior employee in BPDL, a reputed public sector oil marketing company. In the course of your discussions, you find that he is a first timer to the secondary market and by nature much risk averse. He also tells you that he had wondered if investing in BPDL itself could be a good idea as it is quite profitable and is owned by the government. Besides, his wife would have reasons to know well in advance of any possible disasters for the company, being their employee for nearly two decades. Also, she could justifiably be proud of owning such a stake in her company. While you agree with him on the choice of BPDL, you suggest that by way of risk reduction, it would be prudent to invest part of the money in ONGD, an equally reputed oil exploration company, also state owned. At the end of the discussions, before committing the funds for the next one year, Mr. Banwarilal desires to know from you specific answers to the following: What would be the likely return and risk if he invests equal amounts in each of the two stocks? 2. What would be the likely return from a portfolio of the two stocks which could be the least risky? Out of the above two alternatives, which would you recommend and why? How many shares of each stock would then have to be bought? You have the following historical data at your disposal which you intend to use for analysing the pattern of co-movement between the stocks: Period( years preceding the current one) 5 9 Return(in %) on BPDL (R) 15 -3 ONGD (RO) 12 | 22 The current market price of a share of BPDL is Rs. 500 and that of ONGD is Rs. 300. On the future returns on the two stocks over the next one year, you are able to obtain the following forecast from a reputed firm of portfolio managers: State of the Economy Probability Return (in %) on BPDL ONGD Recession -3 Normal 10 3. 1 32 2 14 5 3 24 4 -8 -2 6 78 828 145 -14 10 -7 26 20 14 - 6 -5 0.2 0.5 0.3 14 22 Boom 35 1. Mr. Banwarilal, a wealthy businessman, has approached you for professional advice on investment. He has a surplus of Rs. 100 lakhs which he wishes to invest in share market in the name of his wife on their marriage anniversary falling due the next week. His wife is a senior employee in BPDL, a reputed public sector oil marketing company. In the course of your discussions, you find that he is a first timer to the secondary market and by nature much risk averse. He also tells you that he had wondered if investing in BPDL itself could be a good idea as it is quite profitable and is owned by the government. Besides, his wife would have reasons to know well in advance of any possible disasters for the company, being their employee for nearly two decades. Also, she could justifiably be proud of owning such a stake in her company. While you agree with him on the choice of BPDL, you suggest that by way of risk reduction, it would be prudent to invest part of the money in ONGD, an equally reputed oil exploration company, also state owned. At the end of the discussions, before committing the funds for the next one year, Mr. Banwarilal desires to know from you specific answers to the following: What would be the likely return and risk if he invests equal amounts in each of the two stocks? 2. What would be the likely return from a portfolio of the two stocks which could be the least risky? Out of the above two alternatives, which would you recommend and why? How many shares of each stock would then have to be bought? You have the following historical data at your disposal which you intend to use for analysing the pattern of co-movement between the stocks: Period( years preceding the current one) 5 9 Return(in %) on BPDL (R) 15 -3 ONGD (RO) 12 | 22 The current market price of a share of BPDL is Rs. 500 and that of ONGD is Rs. 300. On the future returns on the two stocks over the next one year, you are able to obtain the following forecast from a reputed firm of portfolio managers: State of the Economy Probability Return (in %) on BPDL ONGD Recession -3 Normal 10 3. 1 32 2 14 5 3 24 4 -8 -2 6 78 828 145 -14 10 -7 26 20 14 - 6 -5 0.2 0.5 0.3 14 22 Boom 35